Unexpected Turbulence Strikes Disc Medicine Stock

In a cruel twist of fate, the stock of clinical-stage biopharmaceutical company Disc Medicine, Inc. IRON has taken a sharp nosedive by 45%. The reason behind this precipitous fall? Mixed results from the phase II AURORA study testing bitopertin in patients struggling with erythropoietic protoporphyria (EPP).

The Tale of the AURORA Study

The AURORA study was crafted as a randomized, double-blind, placebo-controlled phase II examination that involved 75 adult subjects battling EPP. These participants were divided in a 1:1:1 ratio to receive either 20 mg of bitopertin, 60 mg of bitopertin, or a placebo once daily over a span of 17 weeks.

A Roller Coaster of Outcomes

Initial glimpses of hope emerged as treatment with bitopertin led to statistically notable reductions in toxic metabolite protoporphyrin IX (PPIX), the primary focal point of the study, alongside marked improvements in the rate of phototoxic reactions with pain and the Patient Global Impression of Change (PGIC).

The 60 mg dose exhibited statistical superiority compared to the placebo. The 20mg cohort reported a moderate 21.6% drop in whole blood PPIX levels, while the 60mg dose showcased an impressive 40.7% reduction in whole blood PPIX levels. In contrast, the placebo group saw an unwelcome mean increase of 8.0%.

Yet, the study lost its way when it couldn’t reach the critical secondary endpoint of cumulative time in sunlight on days devoid of pain. Surprisingly, subjects treated with biopterin registered a mean of 175.1 hours at 20 mg and 153.1 hours at 60 mg, against the placebo’s 133.9 hours of cumulative total time in sunlight between 10 am and 6 pm on pain-free days over the four-month treatment duration.

Post-Storm Reflections

Despite the storm, bitopertin was generally well-received in both dose groups, with no serious adverse events reported and hemoglobin levels remaining stable. In light of these findings, Disc Medicine is set to sift through its final data set and engage with investigators, regulators, and patient advocacy groups to carve out the most fitting registrational endpoints for their upcoming journey.

Riding the Waves of Hope

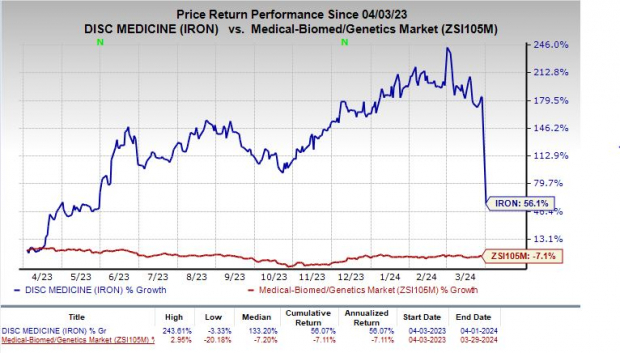

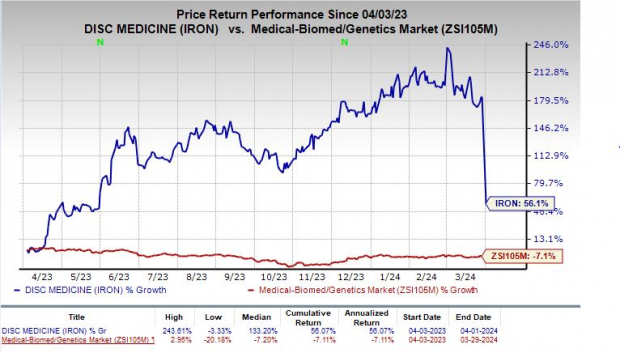

Embarking on a path laden with uncertainty, Disc Medicine’s shares have seen a positive rally of 56.1% in the past year, defying the industry’s descent of 7.1%. These turn of events could be likened to a sailboat navigating rough sea winds with a tenacity that refuses to be crushed.

Image Source: Zacks Investment Research

Disc Medicine’s treasure trove of prospects includes bitopertin for EPP and X-linked protoporphyria (XLP), along with Diamond-Blackfan anemia. DISC-0974 stands ready to take on anemia of myelofibrosis and anemia of chronic kidney disease, while DISC-3405 (formerly MWTX-003) holds promises for polycythemia vera and a spectrum of other hematologic disorders.

The Light Beyond the Storm Clouds

Despite the shadows cast by the results of the AURORA study, the potential success of any of these endeavors could act as a shining beacon for the company, casting light on their future trajectory.

Bitopertin has previously braved the treacherous waters of scrutiny under Roche’s comprehensive clinical program involving more than 4,000 individuals in various indications. The trials demonstrated the potent activity of bitopertin as a glycine transporter 1, alongside its impact on heme biosynthesis.

EPP and XLP stand as rare, debilitating maladies that can potentially threaten lives. These conditions stem from mutations impacting heme biosynthesis, which result in the accumulation of the dangerous, light-reactive intermediate named PPIX.

While a cure for EPP remains elusive, there exists only a solitary FDA-approved therapy – Scenesse (afamelanotide), a synthetic hormone implanted surgically to encourage melanin production.

Guiding the Ship Ahead

With a current Zacks Rank #3 (Hold), IRON finds itself at a pivotal juncture, contemplating its next course of action as it weathers the storm that the AURORA study has brought.

Top Picks on the Horizon

Within the biotech realm, a few stars twinkle brighter than others – namely ADMA Biologics, Inc. ADMA, Galapagos GLPG, and ANI Pharmaceuticals, Inc. ANIP, each proudly flaunting a Zacks Rank #1 (Strong Buy) badge. An illustrious trove of potential that beckons like undiscovered treasures buried beneath the vast expanse of the market.

The last 60 days have seen estimates for ADMA Biologics’ 2024 earnings per share (EPS) surge from 22 to 30 cents, with ADMA shares skyrocketing by an impressive 97% over the past year.

Moreover, the ebb and flow of the past 60 days have witnessed a narrowing of estimates for GLPG’s loss from $1.68 per share to a mere 40 cents, while the star of ANI Pharmaceuticals has risen, with estimates for their 2024 EPS escalating from $4.06 to $4.43, and shares enjoying an 81% surge over the last year.

ANI Pharmaceuticals’ stellar performance in beating estimates in every quarter of the last year, delivering an average surprise of 74.8%, serves as a shining example of what lies beyond the horizon.

Seeking the Shores of Prosperity

Zacks Names “Single Best Pick to Double”

From a multitude of options, 5 Zacks experts have each chosen their prized pick expected to soar over 100% in the months to come. Among these selections, Director of Research Sheraz Mian hand-picked a singular entity showcasing the most explosive potential.

This hidden gem is a niche chemical enterprise that has galloped ahead by 65% in the past year, yet remains a bargain. With a demand that refuses to be quelled, a steep rise in 2022 earnings estimates, and a $1.5 billion repurchasing scheme, retail investors have the chance to dive in and ride the wave of success at any given moment.

This entity has the potential to match or even surpass other noteworthy predecessors like Boston Beer Company, which surged by an astonishing +143.0% in just over 9 months, and NVIDIA, which reigned supreme with a meteoric +175.9% ascent in the span of a year.

The opinions and insights expressed here are those of the writer and might not align with the views held by Nasdaq, Inc.