Investors Seek Stability with Low-Beta Stocks Amid Market Turmoil

Recent weeks have seen significant market volatility, primarily driven by ongoing tariff negotiations that have unsettled investors and negatively impacted many leading stocks. During these turbulent times, there is an opportunity for investors to stabilize their portfolios by considering low-beta stocks, which tend to perform better during sharp market fluctuations.

Notably, two companies stand out as ‘defensive’ additions to a conservative investment strategy: The Progressive Corp. (PGR) and American Water Works (AWK). Both stocks are currently well-rated according to Zacks Ranks, indicating favorable earnings per share (EPS) revisions and analyst sentiment.

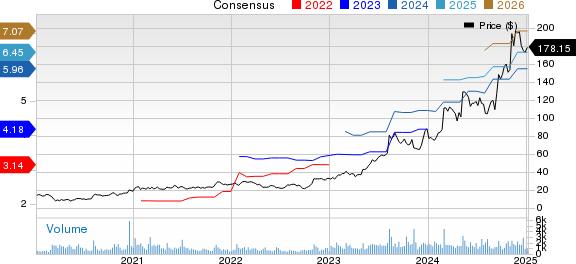

Progressive Corp. (PGR) Shows Strong Performance

So far in 2025, PGR has been an exceptional performer, with stock prices rising over 20%, significantly outperforming the S&P 500 index. This positive movement has been bolstered by strong quarterly results, with the next earnings report anticipated shortly.

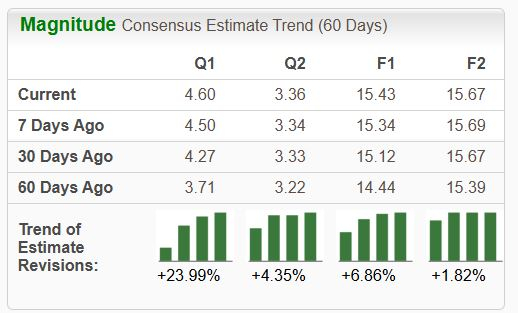

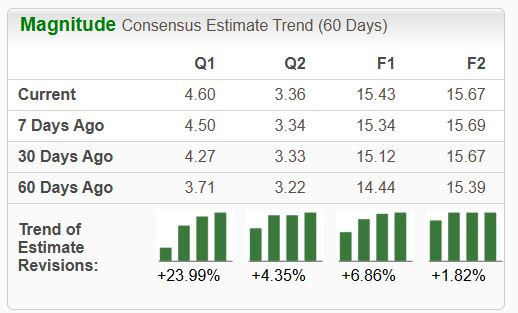

PGR’s recent earnings reports have been impressively above expectations, beating the Zacks Consensus EPS estimate by an average of 18.5% over the last four quarters. The stock currently holds a Zacks Rank #2 (Buy), with positive earnings expectations trending upward.

Image Source: Zacks Investment Research

Additionally, PGR offers limited income potential through its stock dividend, yielding approximately 0.2% annually. While not a primary target for income investors, the stock’s robust performance helps mitigate that factor.

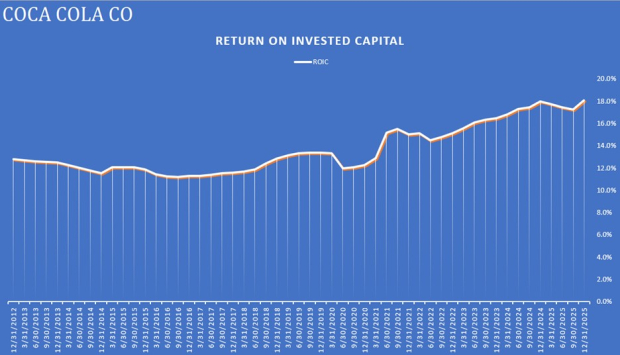

American Water Works (AWK) Exhibits Stability

AWK has also demonstrated strong relative performance in 2025, realizing a 14% gain even as the S&P 500 declined by 14%. Its latest quarterly release in mid-February exceeded both EPS and sales expectations, leading to a notable rise in stock prices.

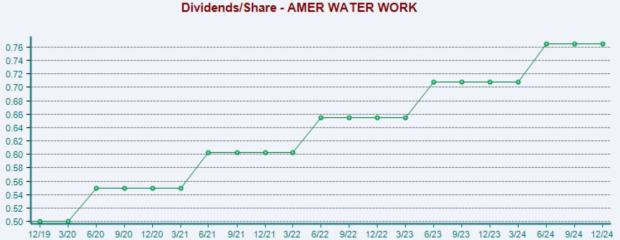

The company reaffirmed its guidance, which contributed to the positive sentiment surrounding the stock. AWK stands out as a better income play, offering a 2.2% annual yield that surpasses that of the S&P 500. Over the past five years, AWK has increased its dividend payout five times, resulting in an impressive 8.8% annualized dividend growth rate.

Below is a chart illustrating the company’s dividend payouts per share.

Image Source: Zacks Investment Research

Conclusion on Low-Beta Stocks

In times of market instability, low-beta stocks like The Progressive Corp. and American Water Works provide an essential defensive strategy, enhancing a more balanced risk profile. In recent months, both companies experienced positive earnings estimate revisions, securing higher Zacks Ranks.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering them 30-day access to all our picks for just $1. There’s no obligation to spend another cent.

Many have seized this opportunity, while others hesitated. Our goal is simple: we want you to get to know our portfolio services, which include Surprise Trader, Stocks Under $10, Technology Innovators, and more. In 2024 alone, these services closed 256 positions, many yielding double- and triple-digit gains.

The Progressive Corporation (PGR): Free Stock Analysis Report

American Water Works Company, Inc. (AWK): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.