Why Dividend Investors are Outperforming the Market Today

While the market presents uncertainty, one thing is clear: dividend investors are faring much better than average stockholders.

Consider the investors in “America’s ticker”—the SPDR S&P 500 ETF Trust (SPY). This fund is widely owned, and many individuals have it lurking somewhere in their portfolios. Unfortunately, these investors have suffered significantly during the recent market downturn, seeing returns that amount to a meager 1.4%.

The Advantage of High, Reliable Dividends

In contrast, contrarian dividend investors understand the importance of receiving high, secure payouts. These dividends help cover expenses during turbulent market periods. No investor wants to be compelled to sell assets at a loss just to access cash.

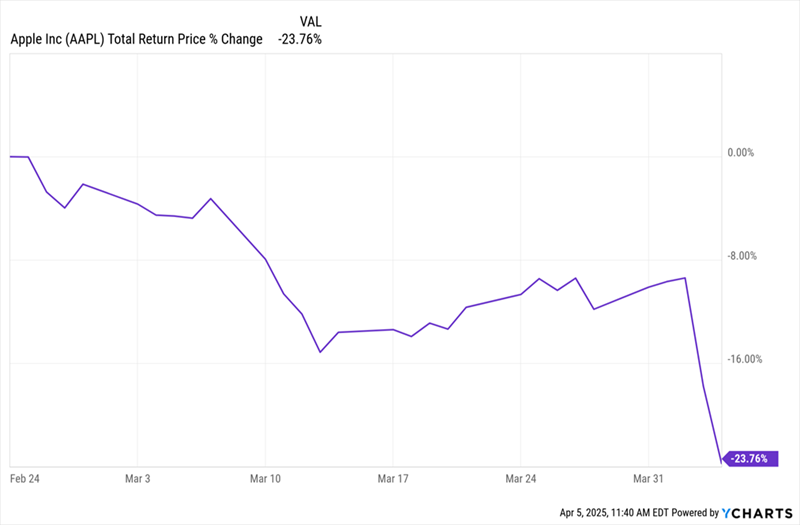

Take Apple (AAPL), for instance. While its dividend remains decent, the stock’s price has plummeted. Tim Cook’s company has lost approximately 20% of its value since late February.

A Potential Nightmare for Retirees

Being forced to sell shares during a decline to meet cash needs can be detrimental to retirement savings.

Collecting regular, substantial dividends also allows investors to reinvest, enhancing their income and growth potential. Using a dividend reinvestment plan (DRIP) can be particularly beneficial, as it automatically reinvests dividends back into the investment at regular intervals. This approach allows investors to “buy cheap” during downturns and purchase fewer shares when prices are high.

The importance of dividends cannot be overstated, especially when considering the challenge of tracking them accurately.

Many investors still rely on traditional spreadsheets to monitor which dividends are deposited each month into their accounts.

Although some brokerages offer built-in dividend trackers, these tools often cater only to investments held within that specific brokerage.

This limitation poses a challenge for those managing multiple accounts or considering investments they haven’t yet made.

Brokerage-operated apps can often be cumbersome, while alternative apps may require manual input of tickers or a steep learning curve—neither of which is appealing.

Introducing Income Calendar: Simplifying Dividend Tracking

At Contrarian Outlook, we have tried numerous tools for projecting dividends but found none that met our expectations. Therefore, we developed our own tool, Income Calendar, to help ensure your dividends are deposited ahead of bill due dates.

Let’s explore this tool using a ticker familiar to subscribers of my Contrarian Income report: the Reaves Utility Income Fund (UTG). Since its addition to our portfolio in June 2023, UTG has provided an impressive return of 38%.

UTG focuses on U.S. utility stocks, including Entergy Corp. (ETR), Xcel Energy (XEL), and CenterPoint Energy (CNP), as well as firms resembling utility structures like Enterprise Products Partners (EPD).

Currently yielding 7%, UTG is favored by many as a “bond proxy,” aligning with the inverse relationship utility stocks often have with the yield on the 10-year Treasury.

This investment makes sense now, especially considering Treasury Secretary Scott Bessent’s intention to lower 10-year yields, which typically influences interest rates on mortgages and loans.

Returning to UTG, this fund distributes its returns to investors in the form of a consistent 7% monthly dividend, which has been trending upwards over time and may include special dividends.

Take a look at this chart created with Income Calendar:

A Rare 7% Dividend That Grows

Source: Income Calendar

Now, let’s utilize Income Calendar by entering UTG along with other holdings from my Contrarian Income report that pay out quarterly, namely Ares Capital (ARCC), which has a yield of 8.9%, and Alerian MLP ETF (AMLP), a pipeline fund offering an 8% payout.

Assuming a $100,000 investment in each, Income Calendar will immediately outline expected monthly dividends from this three-stock “mini-portfolio.”

Our projections indicate that dividends could range from $593.75 to $2,954.39 monthly, totaling $18,432.36 annually with just a $300,000 investment. That equates to a robust 7.9% yield. This estimate remains conservative, as we do not assume additional dividend growth, meaning actual payouts could be even higher.

You can access detailed breakdowns by stock, along with a month-by-month calendar that highlights earnings dates, ex-dividend dates, and other important metrics for all of your investments. Instantly!

Explore the tool today.

Projected Dividend Pay Dates for Our Top Stocks in June 2025

Here‘s what our three-stock portfolio indicates for one of our highest-paying months, June 2025:

Understanding Payment and Earnings Reports

Our graphic illustrates the projected pay dates, ex-dividend dates (the dates before which an investor must own shares to qualify for the upcoming dividend), as well as relevant market holidays. These dates are critical for investors looking to maximize their dividend income.

Additionally, we will receive notifications about when our stocks are due to report earnings. In June, however, there are no earnings announcements scheduled for our selected trio. This is not surprising, considering one of our picks is an ETF, while the other is a closed-end fund.

Tools for Tracking Investments

The benefits don’t stop there. We offer real-time email alerts for declared dividends, a “week-ahead” summary that clearly details our expected payments, and a useful tool that calculates our “yield on cost.” This way, investors can see the actual yield based on their initial purchase timing.

As dividends play a crucial role in investment strategy, now is an ideal moment to explore the Income Calendar tool for your financial planning.

Click here for more information about this valuable dividend planner and to take advantage of a trial period. You may find it beneficial.

Additional Resources

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.