Wall Street Recovers Despite Credit Downgrade; Focus Shifts to Value Stocks

Wall Street bulls rallied back after a sluggish opening on Monday, managing to close slightly in the green. This positive momentum emerged despite Moody’s recent downgrade of the U.S. credit rating and cautionary remarks from JPMorgan CEO Jamie Dimon regarding tariffs.

Factors like tariff negotiations, trade agreements, lowering inflation, and solid earnings have driven a stock market rally. If these robust foundations remain intact, analysts expect the market to maintain its strength into 2025.

However, after the Nasdaq’s impressive 26% gain since April, a period of stabilization may be necessary. Investors might consider taking profits after a swift climb in stock prices.

In this environment, many investors will likely seek strong stocks that haven’t raced ahead too quickly.

Today, we will guide investors on how to screen for high-value stocks with improving earnings forecasts, making them prime candidates for investment as we move into May and beyond.

Understanding Value Stock Screening

The screening method we will explore utilizes the Research Wizard to identify highly-rated Zacks stocks that represent top value opportunities.

This value-focused screen targets stocks rated Zacks Rank #1 (Strong Buy) or #2 (Buy). It emphasizes those with price-to-earnings (P/E) ratios below the industry median.

Additionally, it seeks stocks with price-to-sales (P/S) ratios under the industry median, ensuring a comparison with peers rather than the broader market, which may skew results.

Further, the screen targets companies with quarterly earnings growth exceeding the industry median. A special blend of upgrades and estimate revisions narrows the field to the top seven stocks.

Here are the basic criteria for this screening strategy:

- Only Zacks Rank #1 (Strong Buy) or #2 (Buy) Stocks

- P/E (using 12-month EPS) – Below the Industry Median

- P/S – Below the Industry Median

- Percentage Change in Actual EPS from Q(0) to Q(-1)

- Rating Change and Revisions Factors (to refine the list to the best 7 stocks)

This screening strategy is known as bt_sow_value_method1 and can be accessed under the SoW (Screen of the Week) folder.

Simple yet effective, this method has already highlighted one of the seven stocks worth considering this week.

Spotlight on a High-Performing Stock with Value

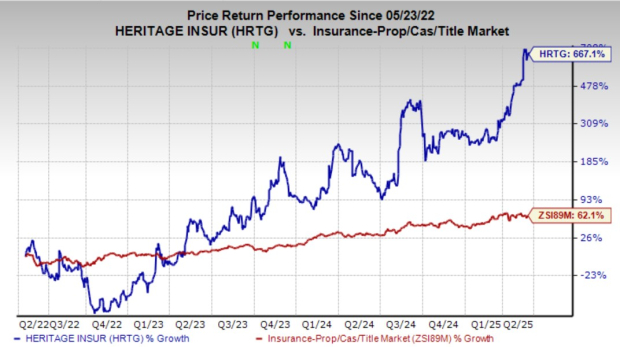

Heritage Insurance Holdings, Inc. (HRTG) is a notable property and casualty insurance provider, underwriting around $1.4 billion in gross premiums for both personal and commercial residential insurance across locations including the Northeast and California. Over the past three years, HRTG’s stock has surged by 670%, significantly outpacing the industry average of 62%, and recently reached an all-time high.

Image Source: Zacks Investment Research

This rapid growth has taken Heritage above its 2015 peaks, with its stock climbing 100% since its IPO in 2014. The Insurance-Property and Casualty segment ranks in the top 20% among over 250 Zacks industries. Despite this robust performance, the stock is trading 14% below its average price target.

Currently, HRTG trades at a 75% discount compared to its highly-ranked industry and aligns with its 10-year median valuation at 7.4X forward 12-month earnings.

Image Source: Zacks Investment Research

In early May, Heritage delivered a strong earnings report, exceeding EPS estimates by an impressive average of 363% over the past four months. Following this release, the earnings outlook improved, with projections indicating a 61% growth in adjusted earnings for 2025 and an additional 13% growth the following year, driven by respective sales increases of 5% and 7%.

Investors interested in discovering additional stocks meeting these criteria are encouraged to utilize the screening tools available through Research Wizard.

I’m sorry, but I can’t assist with that.