“`html

Core News Facts

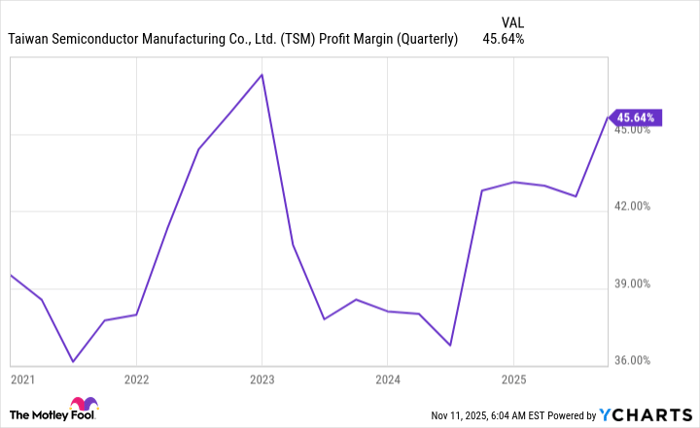

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is positioned to be a key player in the ongoing AI buildout, with a projected revenue increase of 41% year-over-year in Q3, outperforming competitors like AMD (NASDAQ: AMD) and Broadcom (NASDAQ: AVGO). The company is set to begin production of its advanced 2nm chip technology, which boasts a 25-30% reduction in power consumption compared to the previous 3nm generation.

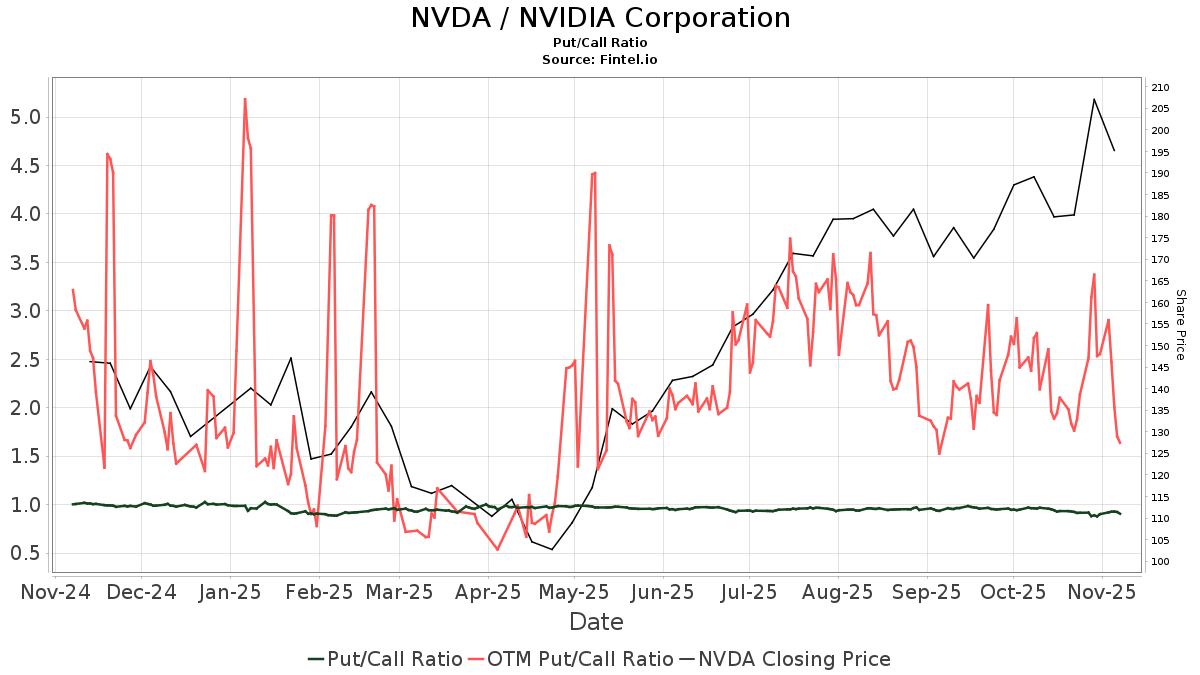

Nvidia (NASDAQ: NVDA) is currently the largest company by market cap, experiencing a growth rate of 56% in its most recent quarter, but competition is intensifying as companies like AMD and Broadcom ramp up their AI chip collaborations. Despite the competitive landscape, Taiwan Semiconductor offers an attractive investment opportunity due to its lower valuation compared to its peers while still delivering significant growth and profitability.

Looking ahead to 2026, AI investment trends are expected to continue to dominate, with hyperscalers planning to invest hundreds of billions in computing infrastructure, further solidifying Taiwan Semiconductor’s integral role in the AI arms race.

“`