Amazon’s Quantum Computing Strategy: A Path to Future Growth

Toward the end of 2024, quantum computing—a new facet of artificial intelligence (AI)—started garnering significant attention from investors. Stocks like IonQ, D-Wave Quantum, and Rigetti Computing quickly became popular as leaders in this burgeoning field. However, savvy investors recognize that rising popularity alone does not equate to viable investment opportunities. Although these companies have experienced notable gains recently, much of this activity stems from momentum-driven narratives. For those considering investments in quantum computing, it would be wise to focus on established players like Nvidia or Alphabet.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Recently, one of my favored Magnificent Seven stocks, Amazon (NASDAQ: AMZN), disclosed a significant advancement in its quantum computing initiatives. Below, we will examine Amazon’s role in this quantum revolution and how it may boost the company’s AI goals long-term.

A Closer Look at Amazon’s Quantum Computing Role

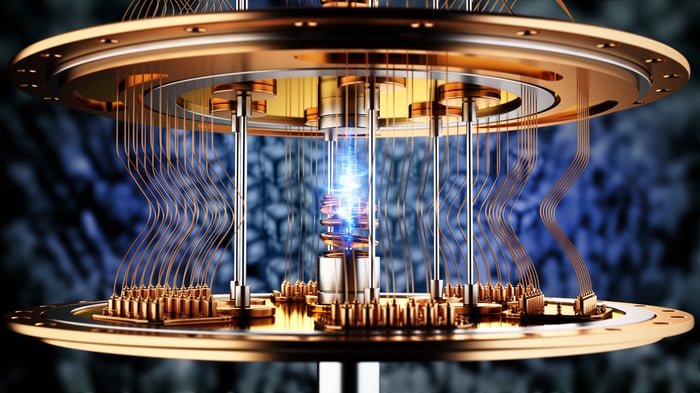

Standard computing relies on binary code or bits—0s and 1s. Conversely, quantum computing takes a different approach. Utilizing qubits (quantum bits), which can exist in multiple states simultaneously through a phenomenon called superposition, quantum computers theoretically can perform complex calculations much faster than classical computers.

However, scientists at Amazon caution about practical limitations:

Vibrations, heat, electromagnetic interference from cellphones and Wi-Fi networks, and even cosmic rays and radiation from space can disrupt qubits, leading to computation errors.

This phenomenon, known as decoherence, presents a challenge that Amazon aims to tackle. The company has developed a new quantum chip named Ocelot, which incorporates error correction into its design. This innovative strategy means that fewer qubits are necessary to manage errors, potentially making computation both more efficient and cost-effective, providing Amazon with a competitive advantage as it builds a scalable quantum platform.

Image source: Getty Images.

The Long-Term Benefits of Quantum Computing for Amazon

Over the past few years, Amazon has invested heavily in AI infrastructure, committing billions to its strategy. Noteworthy investments include $8 billion into Anthropic and the development of custom silicon like Trainium and Inferentia chips.

Image source: Investor Relations.

Thus far, Amazon’s increased capital expenditures (capex) have yielded substantial returns. The company is seeing accelerated growth in Amazon Web Services (AWS), alongside rising profitability. This combination of increasing revenue and expanding profit margins affords Amazon the flexibility to further its AI infrastructure investments, including its foray into quantum computing.

While competition from Microsoft and Alphabet remains, Amazon’s innovative approach with Ocelot in terms of scalability could lead to quicker customer adoption. Consequently, I view quantum computing as an exciting development for AWS, one likely to fuel further revenue and profit growth over time.

Should Investors Consider Amazon Stock Now?

A month ago, Amazon’s stock dropped approximately 11%. While part of this decline may arise from macroeconomic worries about inflation and tariff implications, some investors might perceive challenges specific to Amazon.

The company’s leadership is projecting over $100 billion in capex for this year, which may raise eyebrows among investors. However, most of this spending is directed towards AWS—a business that is currently thriving.

AMZN Price to Free Cash Flow data by YCharts.

Despite this, investors appear skeptical of Amazon’s aggressive growth strategy. Presently, the stock trades with a price-to-free cash flow (P/FCF) multiple of 69, significantly lower than its five-year average of 104. This discrepancy is interesting considering Amazon is a more robust and profitable business today than in previous years. Additionally, I believe that growth potential will likely increase as AI becomes more embedded within Amazon’s ecosystem.

Amazon’s pursuit of quantum computing highlights the company’s focus on creating a diverse AI platform, suggesting it could deliver substantial returns well into the future. For long-term investors, I see Amazon’s stock as a sound option at this time.

Should $1,000 be Invested in Amazon Today?

Before purchasing Amazon stock, keep this in mind:

The Motley Fool Stock Advisor team recently identified the 10 best stocks to buy now, and Amazon was notably absent from this list. The selected stocks show significant potential for exceptional returns in the upcoming years.

Consider when Nvidia joined this list on April 15, 2005… if you invested $1,000 then, you’d have $710,848!*

Stock Advisor provides investors with a straightforward roadmap to success, offering portfolio guidance, analyst updates, and two new Stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002*. Don’t miss the latest top 10 list, available upon joining Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.