“`html

Understanding Closed-End Funds: A Pathway to Higher Income

Many investors remain unaware of the potential benefits of closed-end funds (CEFs), despite their ability to enhance income and diversification.

Three Key Advantages of Closed-End Funds

- CEFs provide diversification across various asset classes, including stocks, corporate bonds, municipal bonds, and real estate investment trusts (REITs).

- Many CEFs trade at a discount to their net asset value (NAV), allowing investors to purchase shares in quality companies like Apple (AAPL) for less than their market price, an opportunity not typically available with ETFs.

- The average dividend yield for CEFs is currently 8.2%, offering a strong income stream for investors.

While the diversification aspect (Point #2) is crucial, it’s the high income provided by these funds (Point #3) that often captures investor interest. This is understandable, especially since the income generated by CEFs can significantly accelerate savings toward retirement, potentially reducing the time needed to achieve financial independence.

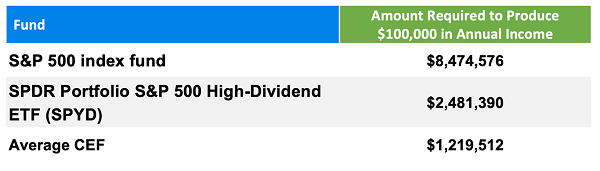

For context, the average stock in the S&P 500 offers a mere 1.2% yield. To achieve $100,000 in annual income with this yield, investors would need to save approximately $8.5 million. In contrast, the SPDR Portfolio S&P 500 High Dividend ETF (SPYD) improves the scenario to $2.5 million with its higher yield of 4%. CEFs, however, can provide similar income with only around $833,333 needed at current average yields.

Some CEFs even boast yields as high as 12%, enabling an investment of $100,000 to generate $1,000 monthly. This is a remarkable opportunity for income generation compared to traditional methods.

Three Top Closed-End Funds to Explore

CEF #1: Gabelli Utility Trust (GUT) – A Reliable 12% Yield

The Gabelli Utility Trust (GUT) offers exposure to major utility companies like Duke Energy (DUK) and NextEra Energy (NEE). This fund’s revenue is strongly supported by the stable cash flows from energy bills across the United States, allowing it to maintain a consistent 12% yield since the 1990s.

Stable Income with Additional Special Dividends

Source: Income Calendar

In the 2000s, GUT offered special dividends, raising its monthly payout from five cents to six cents per share. However, it has since prioritized consistent payouts, which has increased its popularity among investors. Currently, GUT is trading at a premium of nearly 53%, which may pose risks for short-term investors.

CEF #2: Advent Convertible and Income Fund (AVK) – 12.3% Yield at a 7% Discount

Convertible bonds provide an interesting investment opportunity, combining high yields with the option to convert bonds into stocks at a later date if advantageous. The Advent Convertible and Income Fund (AVK) yields 12.3% and distributes monthly payouts, with a notable surge due to a special dividend in late 2021.

AVK Offers Consistency and Discount Benefits

Source: Income Calendar

Presently, AVK trades at a 7.1% discount, a significant change from its former premium state earlier this year. This shift can benefit investors seeking to maximize yield and capital appreciation.

CEF #3: PIMCO’s High-Yield Bond Fund – 11.3% Yield

The PAXS fund features a well-diversified portfolio of 325 high-yield corporate bonds. Managed by PIMCO, recognized for their expertise in the closed-end fund market, it effectively adapts to interest rate changes, making it a notable choice for income investors.

“`

Unlocking Income Potential: Monthly Earnings from CEFs

A Steady Source of Income Each Month

Source: Income Calendar

Launched in January 2022, PAXS joined the market amid challenging conditions as rising interest rates took a toll on bonds. Despite this difficult start, the fund has achieved around 12% returns since its inception. Notably, PAXS has increased its dividend, highlighted by a special payout in late 2022, as shown in the chart above.

PAXS currently trades at a 2.7% premium to its net asset value (NAV), a common trend for PIMCO funds, which often command higher premiums due to their solid track record. In recent months, this fund has even seen premiums rise as high as 9%, indicating potential for continued growth.

The takeaway? Beyond these three funds, a variety of closed-end funds (CEFs) are available, many offering similar yields at discounts. This combination may potentially shorten your time until retirement by allowing you to enjoy a 12% yield along with capital gains.

Four CEFs That Pay $9,800 on Every $100K Investment

As previously mentioned, CEFs can be an effective means to access a wide array of assets at significant discounts, paired with attractive dividend yields. The three funds spotlighted above, which include utility stocks, convertible bonds, and corporate bonds, exemplify this strategy.

There’s another category to consider that may surprise you: AI stocks.

Indeed, with these four CEFs I recommend, investors have the opportunity to earn substantial gains and income as artificial intelligence becomes increasingly integrated into everyday life. This could yield impressive payouts of 9.8%.

Due to these funds being available at significant discounts, we’re able to invest in leading AI companies—such as NVIDIA (NVDA), Microsoft (MSFT), and Broadcom (AVGO)—as well as smaller, rapidly growing firms—at prices not witnessed in months!

This is an excellent opportunity to invest in these four CEFs, and I am eager to share more details. Click here for exclusive insights into these four value-priced, 9.8%-yielding AI funds, along with a complimentary Special Report detailing their names and tickers.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.