AMD: A Compelling Alternative in the AI Chip Market

Investors eager to tap into the artificial intelligence (AI) sector might initially focus on Nvidia, which has firmly established itself as a leader in AI chip development. CEO Jensen Huang’s early investment in this technology has given Nvidia a significant edge over its competitors. However, some investors may find Nvidia’s stock valuation concerning, leading them to explore other options in the growing AI market.

Exploring Competitor AMD

For those seeking alternatives to Nvidia, Advanced Micro Devices (NASDAQ: AMD) emerges as a strong candidate. In an effort to compete with Nvidia’s success, AMD has launched its own series of AI accelerators. The MI300 chips are an attractive option for customers who are either unable to access or afford Nvidia’s pricier alternatives.

Recently, Oracle selected AMD’s MI300X chips for its latest OCI Compute Supercluster instance, signaling AMD’s increasing competitiveness in the AI chip market. Additionally, AMD is set to debut the MI325X chips later this year, which will feature up to 288GB of memory and bandwidths reaching 6 terabytes per second.

Looking ahead, AMD’s CDNA architecture upgrade, planned for 2025, aims to boost computational throughput, creating the potential for substantial advancements in AMD’s position within the AI chip industry.

Financial Performance and Market Position

Currently, AMD’s financial results may not be particularly striking, with $11 billion in revenue for the first half of the year reflecting a modest 6% increase compared to the previous year. A net income of $388 million indicates a recovery from a $112 million loss during the same period last year.

On a brighter note, AMD’s data center segment, which houses its AI chips, generated $5.2 billion in revenue during the first half of the year, marking an impressive 98% year-over-year increase. This segment has grown from accounting for 24% of total revenue in early 2023 to 46% in the first half of this year, reminiscent of Nvidia’s similar trajectory when it increasingly shifted its focus to data centers.

However, AMD’s growth has been hampered by significant revenue declines in its gaming and embedded sectors. If AMD can stabilize or reverse these declines, its financial outlook could improve substantially.

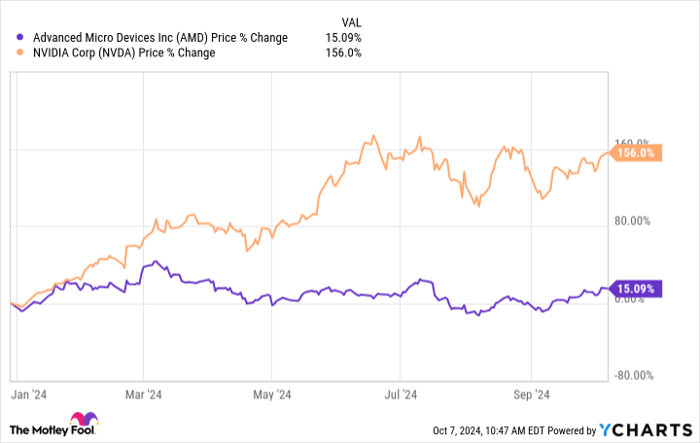

Though AMD’s stock has risen by only 15% this year, Nvidia’s stock has soared by more than 155%. This disparity may suggest an undervaluation of AMD’s stock relative to its potential as it returns to profitability.

AMD data by YCharts

Importantly, AMD’s price-to-sales ratio stands at 12, significantly lower than Nvidia’s 33. This discrepancy indicates that if AMD can successfully close the competitive gap, its stock could experience notable growth as the demand for AI chips continues to rise.

Evaluating the Investment Potential in AMD

Given the current landscape, it may be an opportune moment to consider investing in AMD.

Nvidia’s lead in AI chip technology previously surprised industry observers, but AMD is actively innovating to catch up. Its growing revenue in the data center segment further supports its competitive stance. Although AMD’s stock price has remained relatively stagnant due to declines in gaming and embedded segments, the overall market appears to have set high expectations for Nvidia, potentially leaving room for AMD to shine.

If AMD can maintain growth in its AI chips while also reviving its struggling segments, it may position itself strongly against Nvidia, even if it has not yet completely closed the technological gap.

A Second Chance at a Promising Investment

Have you ever worried that you missed out on the best investment opportunities? Now could be your second chance.

Our team of analysts occasionally recommends a “Double Down” stock, identifying companies they expect to experience significant growth. If you’re hesitant about previous missed opportunities, now might be the time to look into these stocks, especially in light of past successes:

- Amazon: Investing $1,000 when we recommended it in 2010 would be worth $21,022 now!*

- Apple: A $1,000 investment when we doubled down in 2008 would have grown to $43,329!*

- Netflix: If you invested $1,000 following our recommendation in 2004, it would be worth $393,839!*

We are currently issuing “Double Down” alerts for three promising companies, and the opportunity may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Will Healy has positions in Advanced Micro Devices. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Oracle. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.