Dutch Bros: A Strong Contender Amid Market Volatility

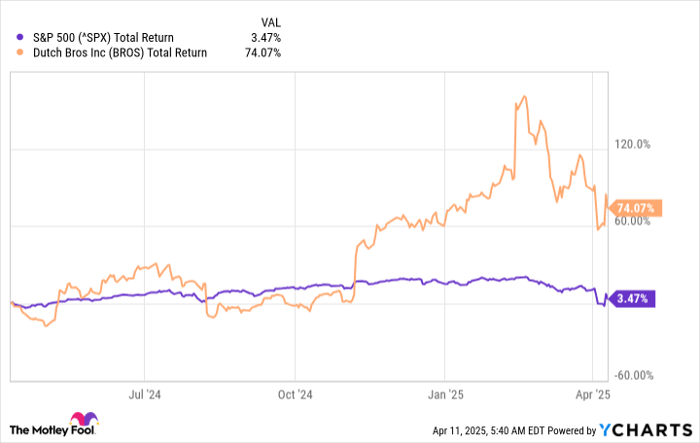

The stock market has been volatile in recent days as companies and investors navigate President Trump’s tariff directives. Fluctuating tariffs are creating uncertainty, leaving many investors uneasy about their positions. However, some stocks, like Dutch Bros (NYSE: BROS), are demonstrating resilience. This young coffee chain has seen a 9% increase this year, contrasting sharply with the S&P 500 index’s 10% decline. Over the past year, Dutch Bros has significantly outperformed the market.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

^SPX data by YCharts

Now, let’s examine why Dutch Bros Stock is gaining traction and its potential for future growth.

Understanding Coffee Preferences and Market Positioning

Starbucks’ ongoing challenges offer important lessons for investors. While not out of the race, its size has made it less agile. In contrast, Dutch Bros has capitalized on Starbucks’ struggles, embracing a fresher, more flexible approach. Since becoming public in 2021, Dutch Bros has nearly doubled its store count and revenue, demonstrating impressive growth in a short period.

Headquartered in Oregon, Dutch Bros now boasts over 1,000 locations on the West Coast, primarily in California, and it is expanding steadily into 18 states. Customers appreciate its quick service, ease of ordering, and unique beverage offerings.

In the fourth quarter of 2024, revenue rose by 35% year-over-year, fueled by 32 new shops and a 6.9% increase in same-store sales. The company’s contribution margin improved by 2.8 percentage points to 21.4%, signaling increased profitability. Furthermore, the net income shifted from a $3.8 million loss a year prior to a profit of $6.4 million. For the full year, net income soared from $10 million to $66.5 million.

Future Expansion Plans

Management envisions significant opportunities ahead. Currently, Dutch Bros aims to grow its store count from 4,000 to at least 7,000 over the long term, a notable increase from its current base. The short-term goal includes reaching 2,029 locations by 2029. Such ambitious targets are intriguing for investors, particularly given the company’s accelerating comparable sales growth despite economic challenges. A more favorable environment could further boost discretionary spending.

In the previous year, Dutch Bros opened 151 stores and plans to grow that to a minimum of 160 this year. The appointment of a new CEO has led to changes that prepare the company for larger scale operations. Adopting modern technology, such as mobile ordering, and improving its membership program should drive growth both now and in the future.

Investing in Dutch Bros: Pros and Cons

It’s evident why investors are excited about this Stock, although it currently trades at a forward, one-year price-to-earnings (P/E) ratio of 69. While the market does present other bargain opportunities, Dutch Bros is not one of them. However, the stock has shown resilience amidst market fluctuations, maintaining a strong position due to its high growth potential. For those with a long-term horizon and appetite for risk, Dutch Bros may be an appealing addition to a portfolio.

Should You Invest $1,000 in Dutch Bros?

Before making an investment in Dutch Bros, take the following into account:

The Motley Fool Stock Advisor analyst team has recently highlighted the 10 best stocks for investors, and Dutch Bros did not make the list. The identified stocks could yield substantial returns in the upcoming years.

Consider this: When Netflix was recommended on December 17, 2004, a $1,000 investment would have grown to $495,226!*

Or when Nvidia was recommended on April 15, 2005, a $1,000 investment would now be worth $679,900!*

The Stock Advisor’s total average return stands at 796%, significantly outperforming the 155% return of the S&P 500. Don’t miss the latest top 10 list available with a subscription to Stock Advisor.

*Stock Advisor returns as of April 10, 2025

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.