Investors Shift Focus as AI Hype Fades: Meta’s Strong Performance

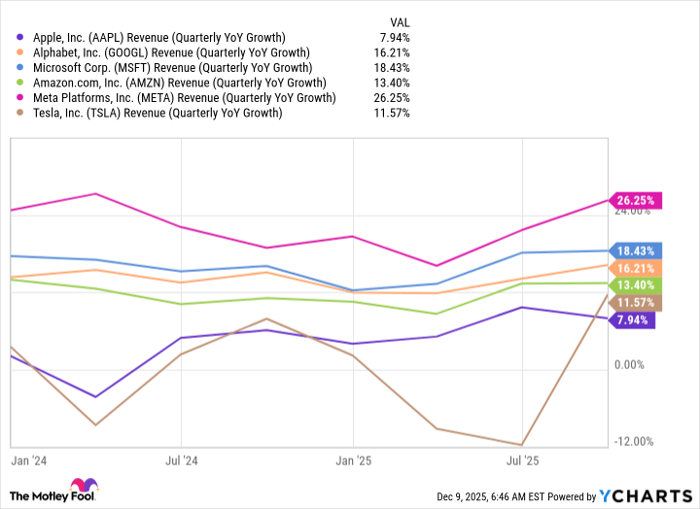

The excitement over artificial intelligence (AI) seems to have peaked. Investors on Wall Street are now prioritizing companies with solid fundamentals and effective execution over those relying solely on speculative technologies. Stocks of major AI players, including Microsoft and Amazon, have faced pressure due to current market conditions. However, Meta Platforms (NASDAQ: META) has distinguished itself, benefiting from its substantial scale, geographic reach, impressive pricing power, and capability to capitalize on advanced AI technologies.

Image source: Getty Images.

While the benchmark S&P 500 index remains flat, Meta’s stock has risen nearly 12% so far in 2025. Following an outstanding first-quarter report on April 30, the company’s stock surged by almost 19%. Revenue for the period increased 16% year over year, reaching $42.3 billion, while net income jumped 35% to $16.6 billion. Both revenue and earnings figures exceeded Wall Street forecasts.

From Social Network to AI Powerhouse

Meta’s transformation over the past two decades has been remarkable. Originally launched as Facebook, the company has grown from a college-focused social networking site to a major global digital advertising platform, boasting 3.4 billion daily active users—nearly half of the world’s population. This vast scale provides Meta with significant data advantages and a powerful network effect that competitors find hard to replicate.

Users maintain deep personal connections within Meta’s suite of applications (Facebook, Instagram, WhatsApp, Messenger, and Threads), making it challenging for them to exit the ecosystem. The wealth of personalized data available allows Meta to optimize content recommendations and refine ad targeting, enhancing user engagement.

The success of AI-driven content recommendations is evident, leading to a 7% increase in time spent on Facebook and a 6% increase on Instagram, along with a staggering 35% increase on Threads over the past six months. As more users spend time on these platforms, advertisers increasingly target them effectively, resulting in greater advertising revenue that can be reinvested into improving user experience.

In the first quarter, Meta’s advertising revenue climbed to $41.4 billion, reflecting a 16% year-over-year increase, driven by higher ad impressions and improved average ad pricing.

Exploration of New Growth Avenues

While its digital advertising segment remains lucrative, Meta is also pursuing other AI-driven business opportunities, including business messaging and the development of conversational agents and open-source large language models.

WhatsApp has established a solid presence in regions like Thailand and Vietnam for business messaging, and Meta aims to adapt this model for developed markets, where business expenses are typically higher.

The Meta AI conversational assistant now serves nearly one billion monthly active users, facilitating inquiries about suggested content. Recently, Meta launched a stand-alone Meta AI app in the U.S. and Canada, with plans to boost engagement through this platform in 2025.

Moreover, Meta is developing the Llama family of large language models to strengthen its AI infrastructure and attract developers. This initiative aims to create a loyal enterprise customer base, enhancing the company’s ecosystem.

Strong Financial Position

Meta’s financials are robust, with Q1 revenue rising 16% year over year to $42.3 billion, significantly outpacing analyst expectations. Operating income surged 27% to $17.6 billion, resulting in a 41% operating margin. Similarly, net income climbed 35% to $16.6 billion, indicating a net profit margin of 39%.

In Q1, Meta generated $10.3 billion in free cash flow, representing a 29% free-cash-flow margin. The company reported $70.2 billion in cash and $28.8 billion in debt as of the end of Q1, positioning it well to manage a planned capital expenditure range of $64 billion to $72 billion.

Valuation Insights

Currently, Meta’s stock trades at 21.5 times forward earnings, below its five-year average of 25.2. Given its extensive scale, data advantages, powerful network effects, and healthy financials, Meta appears to be a strong investment opportunity in May.

Final Considerations on Investing in Meta Platforms

Before investing in Meta Platforms, consider that this stock did not make the list of the 10 best stocks identified by analysts recently. Stocks that did make the list may see substantial growth in the coming years, showcasing the potential for significant returns.

It is noteworthy that past recommendations from the advisory service have performed exceptionally, with some initial investments yielding impressive returns over time.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.