Analysts Project Significant Upside for Invesco NASDAQ Next Gen 100 ETF

Current trading suggests room for growth in QQQJ, with promising targets for major holdings.

At ETF Channel, we analyzed the underlying assets of various ETFs to assess their potential. For the Invesco NASDAQ Next Gen 100 ETF (Symbol: QQQJ), we derived an implied analyst target price of $37.10 per unit based on the portfolio’s holdings.

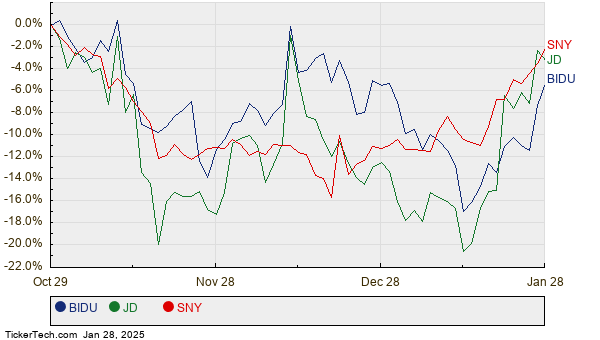

Currently, QQQJ trades around $32.00 per unit, suggesting analysts anticipate a 15.93% increase for this ETF according to the target prices of its underlying assets. Notably, three holdings present substantial upside: Baidu Inc (Symbol: BIDU), JD.com, Inc. (Symbol: JD), and Sanofi (Symbol: SNY). Baidu, priced at $88.51 per share, has an average analyst target of $111.61, indicating a potential upside of 26.10%. JD’s recent share price of $40.30 aligns with an average target of $48.59, giving it a 20.57% upside. Lastly, analysts expect Sanofi to reach $63.80 per share, offering a 19.61% increase from its recent price of $53.34. Below is a twelve-month performance chart for BIDU, JD, and SNY:

Below is a summary table of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco NASDAQ Next Gen 100 ETF | QQQJ | $32.00 | $37.10 | 15.93% |

| Baidu Inc | BIDU | $88.51 | $111.61 | 26.10% |

| JD.com, Inc. | JD | $40.30 | $48.59 | 20.57% |

| Sanofi | SNY | $53.34 | $63.80 | 19.61% |

Are analysts too optimistic or justified in their expectations for these stocks a year from now? It’s important for investors to consider if these target prices reflect an accurate assessment of the companies’ futures or if they are remnants of past performance. High target prices can indicate optimism, but they may also lead to future downgrades if they prove unattainable. Conducting thorough research is vital for informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• GTLL Insider Buying

• BA market cap history

• CTMX Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.