Analysts Project Strong Upside for Vanguard Tech ETF and Holdings

At ETF Channel, we analyzed the holdings within our ETF coverage universe, focusing on the Vanguard Information Technology ETF (Symbol: VGT). We compared the current trading prices of its holdings to the average analyst 12-month forward target prices. The findings indicate that the implied analyst target price for VGT stands at $734.98 per unit.

As VGT is currently trading around $578.36 per unit, this reveals a potential upside of 27.08%, as suggested by analysts based on their target prices for the ETF’s underlying holdings. Notably, three specific holdings are highlighted for their substantial upside compared to their respective analyst target prices: TeraWulf Inc. (Symbol: WULF), Zeta Global Holdings Corp (Symbol: ZETA), and NextNav Inc (Symbol: NN).

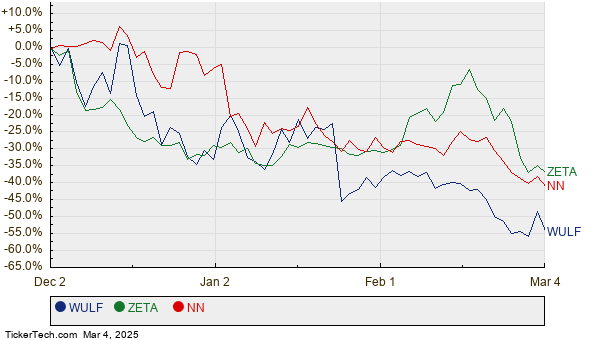

For instance, TeraWulf is trading at $3.67 per share, while the average analyst target is significantly higher at $9.83 per share, reflecting an upside potential of 167.93%. Zeta Global shares are priced at $16.57, yet analysts predict a target of $37.23, indicating a 124.68% upside. NextNav, currently at $9.95 per share, has an analyst target price of $20.00, suggesting a potential increase of 101.01%. The following chart depicts the twelve-month price history for WULF, ZETA, and NN:

Here’s a summary of the current analyst target prices we discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Information Technology ETF | VGT | $578.36 | $734.98 | 27.08% |

| TeraWulf Inc. | WULF | $3.67 | $9.83 | 167.93% |

| Zeta Global Holdings Corp | ZETA | $16.57 | $37.23 | 124.68% |

| NextNav Inc | NN | $9.95 | $20.00 | 101.01% |

The critical question remains: Are analysts’ target prices justified, or could they be overly optimistic regarding future stock performance? Investors should consider whether the analysts’ forecasts are grounded in recent developments within these companies and the technology sector as a whole. While high target prices might reflect positive future expectations, they may also lead to potential downgrades if they no longer align with market conditions. Thorough analysis is essential for investors navigating these stocks.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Institutional Holders of NUGO

Institutional Holders of JGRW

OrthoPediatrics Past earnings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.