Three Resilient Closed-End Funds for Steady Income

Income investors are increasingly looking for stocks and funds that are capable of weathering market storms. Below, I present three closed-end funds (CEFs) offering an impressive average yield of 6.8%.

These funds have demonstrated resilience against various challenges, including wars, pandemics, and inflation. Notably, they have consistently provided annualized total returns exceeding 15%, including reinvested dividends.

Secure Your Portfolio with High-Yield CEFs

The attractive returns of these funds can be attributed to their focus on technology and effective management that ensures their stability.

It’s essential to clarify that these funds are not traditional tech ETFs. Investing in tech ETFs can be risky due to the sector’s volatility, and if purchased at an inopportune time, recovery may take longer. Moreover, the dismal yields of tech ETFs offer no income during those waiting periods.

In contrast, tech-focused closed-end funds (CEFs) aim to deliver substantial dividend payouts by converting their profits into steady income. The management teams of these funds play an active role, which often leads to better performance and yields that are more than ten times higher than standard tech-focused index funds.

Let’s explore these three high-yield tech CEFs in detail.

Tech CEF #1: Big Names, Big Returns

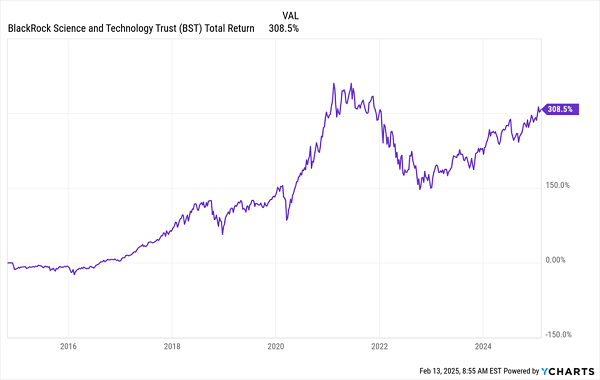

Managed by BlackRock, the world’s largest asset manager with over $10 trillion in assets, the BlackRock Science and Technology Trust (BST) has returned over 308% (including dividends) since its launch just over ten years ago. (BST is also a part of my CEF Insider service.)

Strong Payouts Drive BST’s Success

BST’s portfolio includes major companies such as Amazon.com (AMZN), Tesla (TSLA), and Microsoft (MSFT), along with influential smaller firms like Cadence Design Systems (CDNS), which plays a vital role in semiconductor development.

The fund also generates income through selling covered call options on its holdings. This strategy allows BST to earn fees without depending on the outcomes of the trades, enhancing stability in volatile markets and supporting its 7.8% dividend yield. As a result, investors enjoy exposure to tech while maintaining solid risk management.

Additionally, BST’s 4.3% discount to net asset value (NAV) indicates potential for further gains, as it currently trades below the value of its underlying assets; in recent years, BST has peaked at a premium of 2.8%.

Tech CEF #2: Balanced Growth & Technology

The Virtus Artificial Intelligence & Technology Opportunities Fund (AIO) stands out in its field, having more than doubled investors’ money in just four years while delivering 17.8% annualized returns as of now.

AIO invests broadly in disruptive technology, including AI stocks such as NVIDIA (NVDA), Microsoft, and Amazon, while also including more stable companies like Eli Lilly & Co. (LLY) and JPMorgan Chase & Co. (JPM) that leverage tech innovations.

The fund combines growth opportunities with convertible securities to provide a safety net while offering a 7.3% dividend, ensuring consistent returns.

AIO’s performance has led to a 38.5% increase in its regular payouts over the past five years, along with occasional special dividends contributing to an impressive total return of 119% during that period.

AIO’s Impressive Growth

This hybrid investment approach has garnered more interest from investors, leading AIO to trade at a 7.3% premium to NAV. Such enthusiasm suggests that the fund could experience an even greater premium, particularly if it maintains its upward trajectory in dividend growth.

Tech CEF #3: Discovering a “Hidden” Yield

Lastly, the Columbia Seligman Premium Technology Growth Fund (STK) boasts an 18.6% annualized return over the past decade, marking it as one of the market’s top performers.

Rare Investment Opportunity: STK Goes on Sale

STK’s consistent performance typically results in a premium valuation; however, it is currently available at par due to a significant increase in NAV. Historically, such occurrences are uncommon and unlikely to endure.

Exceptional Special Dividends Enhance Regular Income

The fund’s standard yield is modest at 5.6%, but its track record of significant special payouts can boost this number substantially. After a remarkable 78% return in 2023-2024, STK rewarded its investors with a sizable one-time cash dividend.

Reviewing STK’s historical dividends, investors have enjoyed an average annual yield of 17%, based on their initial investment. Clearly, STK exemplifies an income-generating asset currently undervalued in the market.

Explore Additional “Crash-Resistant” Monthly Payers

These three funds represent just the starting point. There are five more “crash-resistant” CEFs that offer even higher dividends, averaging around 10% and providing monthly payouts.

These five CEFs show strong potential for growth in the coming year, with some funds having steadily increased their dividends for years.

These monthly payers are trending toward higher values, making now an opportune time to invest. Click here for complete details on these five high-yield monthly payers, along with a free Special Report that includes their names and tickers.

Also see:

Warren Buffett Dividend Stocks

Dividend Growth Stocks: 25 Aristocrats

Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.