Quantum Computing Debate: Are Experts on Opposite Sides?

Jensen Huang, the co-founder and CEO of Nvidia (NASDAQ: NVDA), has a reputation for making insightful business decisions, leading Nvidia to exceed $100 billion in annual revenue. However, Dr. Alan Baratz, CEO of D-Wave Quantum (NYSE: QBTS), argues that Huang’s views on the timeline for quantum computing development are misguided.

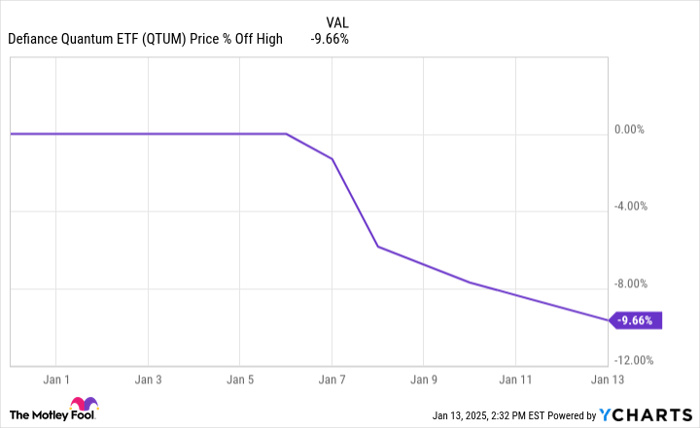

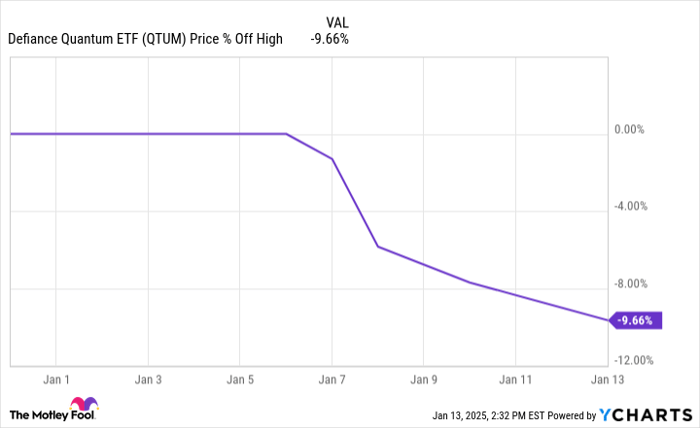

During an interview at the CES expo in Las Vegas on January 7, Huang estimated that it might take “15 to 30 years” before we see “very useful” quantum computers. Following his comments, the stock prices in the quantum computing sector, particularly the Defiance Quantum ETF (NASDAQ: QTUM), have sharply declined.

Considering an investment of $1,000? Check out the top 10 stocks our analysis team recommends right now. See the 10 stocks »

Data by YCharts.

In fact, shares of D-Wave Quantum have fallen more than 60% from their 2025 peak, and the new year is just beginning. Baratz believes that he must clarify the misunderstanding surrounding the potential of quantum computing.

The Complexity of Quantum Computing

Both Huang and Baratz are well-educated and knowledgeable figures. Huang holds a Master of Science in Electrical Engineering from Stanford, while Baratz earned his PhD in computer science from MIT. Given their backgrounds, both provide valuable perspectives on quantum computing—a subject that is not easily grasped.

Understanding quantum computing requires more than basic computer knowledge. Unlike classical computers, which operate on binary code, quantum computers utilize quantum bits or qubits, allowing them to exist in multiple states at once. This capability poses numerous advantages over traditional computing methods.

For example, in a maze with 1,000 paths, a classical computer would evaluate each option sequentially. In contrast, a quantum computer solves the maze by evaluating all paths simultaneously, significantly reducing the time needed to find a solution.

Despite lacking technical credentials, it’s clear that quantum computers hold great potential for innovation.

However, many firms in the quantum computing space, including Rigetti Computing (NASDAQ: RGTI) and IonQ (NYSE: IONQ), approach development in diverse ways, complicating investor analysis. Rigetti uses superconducting technology, while IonQ utilizes trapped ions. D-Wave, on the other hand, employs a quantum-annealing approach, illustrating the range of strategies in the field.

This complexity highlights that not all quantum computing companies are alike. Investors should approach this sector with caution and avoid drawing quick conclusions.

Could Both Baratz and Huang Be Correct?

Huang indicated that if someone suggested 15 years for very useful quantum computers, that timeline might be optimistic. He believes the reality is closer to 20 years. Baratz, however, strongly disagrees.

In an appearance on CNBC, Baratz insisted that Huang is mistaken, asserting that D-Wave is already “commercial today.” Nevertheless, this topic is nuanced and requires careful consideration. D-Wave has indeed started to commercialize, reporting revenue of $1.9 million in Q3 2024, with bookings reaching $2.3 million and a customer base of 132.

While D-Wave is operational now, this doesn’t guarantee that its quantum computers are “very useful.” This leaves open the possibility that Huang might still hold a valid point.

The discrepancy might stem from Huang’s misunderstanding of the quantum-annealing process or Baratz’s overstatement of D-Wave’s current utility. Personally, I lean toward Baratz’s perspective. He suggests that gate-model architecture could take 15 years before achieving its full potential, but acknowledges that companies like IonQ also qualify as “commercial” today, showcasing significant revenue, with nearly $64 million booked in Q3.

Regardless of differing views, the key takeaway for investors is that quantum computing presents considerable promise, yet its intricacies make it difficult for most to invest successfully.

Given this complexity, the Defiance Quantum ETF may serve as a more suitable investment for those interested in the sector. It offers a way to tap into potential growth without needing to analyze individual stocks.

Should You Invest $1,000 in D-Wave Quantum Right Now?

Before investing in D-Wave Quantum, reflect on the following:

The Motley Fool Stock Advisor team has identified their choices for the 10 best stocks to buy currently—and D-Wave Quantum is not included. The stocks recommended could yield significant returns in the near future.

Consider this: when Nvidia was on this list on April 15, 2005, a $1,000 investment would be worth $816,504!*

Stock Advisor offers a straightforward approach to investing, providing portfolio-building guidance, regular updates from analysts, and two new stock picks each month. Since 2002, the service has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s, and do not necessarily reflect those of Nasdaq, Inc.