Unraveling the Success of Vanguard’s Top ETF: A $10K Investment Transformed into $93K

Vanguard offers a wide range of 86 exchange-traded funds (ETFs), covering various bond and stock options.

Out of these, thirty Vanguard ETFs have achieved year-to-date returns of at least 20%. While impressive in the current stock and bond market boom, it’s critical to assess their long-term performance.

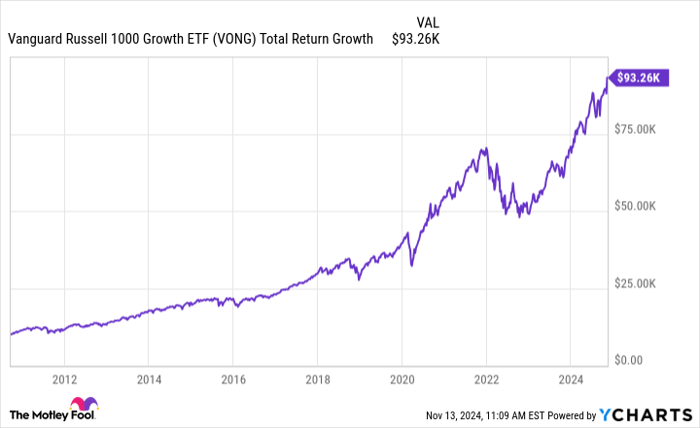

For investors seeking standout options, one Vanguard ETF stands out significantly. It has transformed an initial investment of $10,000 into over $93,000 since 2010.

Image source: Getty Images.

Outperforming the S&P 500

When people think of stock market performance, the S&P 500 is often the first index that comes to mind. This is not surprising, as the S&P 500 reflects the 500 largest U.S. companies, many of which are well-known brands. The direction of the S&P 500 often indicates market trends.

In a surprising twist, the top performer among Vanguard ETFs is not one that follows the S&P 500. Rather, it’s the Vanguard Russell 1000 Growth ETF (NASDAQ: VONG). This ETF aims to track the Russell 1000 Growth Index, which includes growth stocks from the 1,000 largest U.S. companies, accounting for about 93% of all U.S. equities.

The Vanguard Russell 1000 Growth ETF is composed of 394 stocks, with a median market capitalization of $1.4 trillion. The ETF’s top seven holdings – Apple, Microsoft, Nvidia, Amazon, Meta Platforms, Alphabet Class A, and Alphabet Class C – make up approximately 51.5% of the fund.

This ETF ranks as the third highest-performing Vanguard ETF over the last five years and second over the past decade. However, it holds the title for the best-performing Vanguard ETF since its inception in September 2010.

What Led to the ETF’s Remarkable Growth?

Starting from an initial investment of $10,000 in the Vanguard Russell 1000 Growth ETF in 2010, investors now see that amount ballooning to around $93,260. The question arises: how did this ETF achieve such significant growth in just 14 years? Four key factors are essential to its success.

VONG Total Return Level data by YCharts

The primary reason is that many of the stocks within the Vanguard Russell 1000 Growth ETF have seen extraordinary gains since 2010. The ETF’s top six holdings have all surged by at least 1,000% over this period, with Nvidia’s shares skyrocketing by an astonishing 48,700%.

Regular rebalancing of the ETF has also contributed to its success. Underperforming stocks are removed from the Russell 1000 Growth Index, which in turn keeps them out of the Vanguard ETF’s holdings, while rising stocks are weighted more heavily in the fund.

Moreover, dividends have played a significant role. If dividends hadn’t been reinvested, a $10,000 investment would have grown to about $79,200 rather than the current $93,260. While this is still a solid return, it demonstrates the importance of reinvestment in maximizing gains.

Finally, Vanguard’s commitment to low costs cannot be overlooked. The Vanguard Russell 1000 Growth ETF boasts an impressively low annual expense ratio of just 0.08%. In contrast, the average expense ratio for similar funds is more than 11 times higher at 0.94%.

Should You Consider the Vanguard Russell 1000 Growth ETF Today?

While past performance has been remarkable, there’s no assurance that the Vanguard Russell 1000 Growth ETF will continue to perform at this level. Current valuations may raise concerns, given that the average stock in the ETF trades at a price-to-earnings ratio of 36.2.

Additionally, volatility could be a factor moving forward. The ETF’s price has dropped more than 20% on three separate occasions over the previous six years.

Nevertheless, it still appears to be a wise choice for long-term investors. Although it may be unrealistic to expect another nine-bagger performance over the next 14 years, the ongoing factors that have driven its success since 2010 suggest it could continue to outperform in the coming decade and beyond.

A New Opportunity Awaits

Do you ever feel like you’ve missed out on investing in some of the most successful stocks? If so, you might be interested in what’s next.

Occasionally, our team of analysts identifies a “Double Down” stock recommendation for companies they anticipate will see significant growth. If you think the best time to invest has passed, now might be your chance before it’s gone. The numbers illustrate this well:

- Amazon: an investment of $1,000 when we first recommended it in 2010 would be worth $23,818!*

- Apple: a $1,000 investment from 2008 would have grown to $43,221!*

- Netflix: if you invested $1,000 when we recommended it in 2004, it would now stand at $451,527!*

Right now, we are issuing “Double Down” alerts for three exceptional companies, and this may be a rare window of opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Additionally, Suzanne Frey, a senior executive at Alphabet, is part of The Motley Fool’s board of directors. Randi Zuckerberg, who previously directed market development for Facebook and is the sister of Meta’s CEO, is also on the board. Keith Speights has stock positions in Alphabet, Amazon, Apple, Meta Platforms, and Microsoft. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia, and recommends the following options: long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions presented here are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.