Too frequently, investors rely on untested assumptions when selecting stocks, believing their chosen parameters will lead to alpha. But do these strategies actually generate profit?

Without a robust historical test spanning significant market cycles, investment strategies risk being built on shaky ground. Hard evidence is crucial to confirm the effectiveness of selection rules.

Conducting a meticulous, objective examination of the alpha produced over 10 to 15 years of history can unveil vital insights. It offers a reality check on the driving forces behind an investment strategy, especially when it consistently underperforms.

Technology now enables:

- Testing of fundamental, quantitative, technical parameters.

- Comparison of alpha contribution.

- Exploration of parameter combinations for enhanced returns.

- Identification of the most effective selection rules.

- Validation and documentation of results.

Having better information leads to superior decisions and returns. Innovative analytical tools help investors pinpoint stock selection rules that capitalize on recurring performance disparities among stocks.

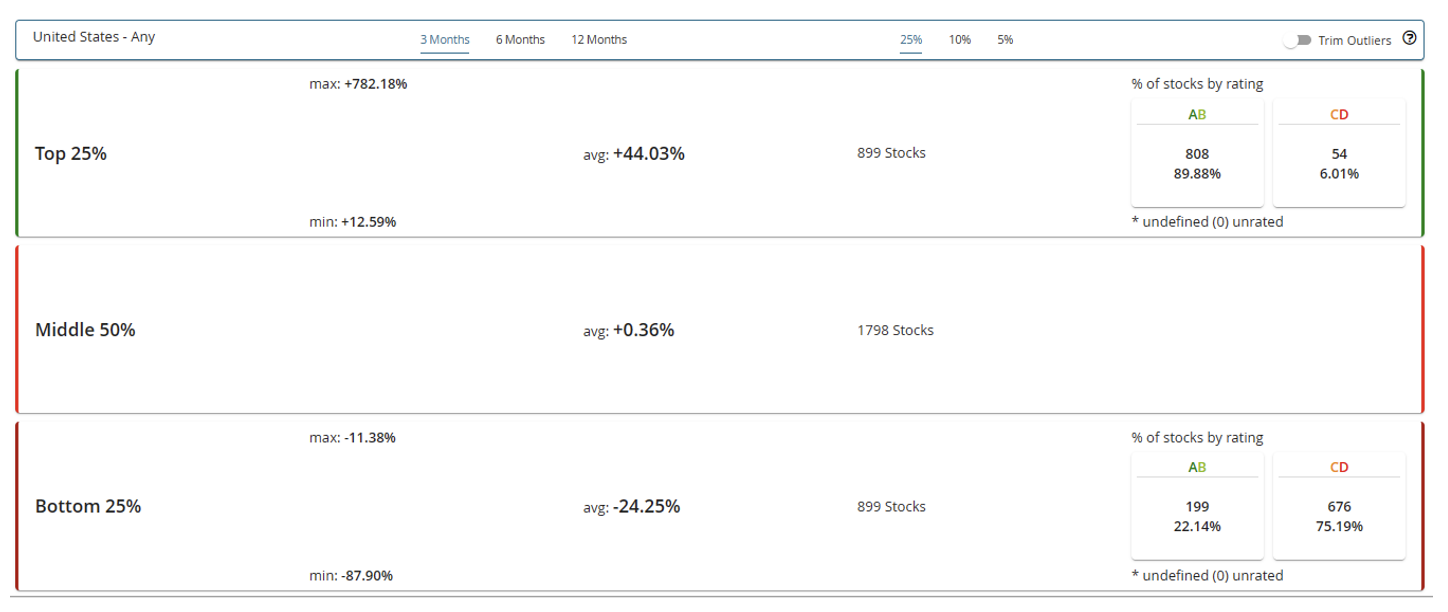

The performance disparity between top and bottom U.S. large-cap stock performers over the last three months, as of February 29, 2024, is summarized in the table below.

Differential of returns top, middle, and bottom US Large Cap performers, past 3 months as of February 29, 2024.

Trendrating

Achieving outstanding performance requires substantial exposure to top performers while minimizing losses and adapting to market trends swiftly. Which fundamental metrics are most conducive to identifying winning stocks?

The chart below offers a factual comparison of the performance of popular fundamental metrics for value and growth investment strategies over the last decade, analyzing the average annual return of each metric within the U.S. large-cap stocks universe.

Fundamental metrics over the past 10 years as of February 29, 2024.

Trendrating

Exploring performance disparities across markets and sectors may necessitate a tailored mix of rules. A pragmatic, rigorous test over a reasonable time frame can unlock valuable insights, as illustrated in the chart below.

After objectively evaluating the alpha contribution of individual selection rules, the next step is to explore alternative combinations of parameters. Investigating diverse combinations can yield significant discoveries and enhance returns.

By refining value and growth strategies or merging the two, investors can optimize their investment approach. Leveraging a factual, methodical test across various metrics and market cycles can revolutionize one’s investment methodology.

Advanced technology now empowers investors to undertake this critical exploration process. Embracing cutting-edge systems that deliver superior information can pave the way for improved decision-making and enhanced performance, ensuring facts prevail over assumptions.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.