Disney Faces Tough Earnings Ahead Amid Strong Netflix Performance

Earnings season is now in full swing, and this week has been particularly busy. So far, performance has been decent, but recent tariff discussions have led analysts to lower their earnings expectations for both the current quarter (Q2) and the upcoming periods.

This week, investor attention turns to Disney (DIS), a major player in the entertainment sector with assets that include movies, television shows, and theme parks.

As we approach its earnings release, it’s vital to assess how Disney is positioned, particularly in streaming. The streaming results from Netflix (NFLX) serve as a useful indicator of consumer demand. Here’s a detailed analysis.

Netflix Delivers Strong Results

Netflix has seen strong results that have propelled its stock up by 90% over the past year. The reaffirmation of its fiscal year 2025 guidance has eased investor concerns, making the stock one of the standout performers in a challenging market environment.

Image Source: Zacks Investment Research

Overall subscriber growth has been a hallmark of Netflix’s recent success, with only one quarter of negative subscriber growth in the past three years. The introduction of ad-supported tiers surprised many consumers initially, but their successful rollout has become increasingly apparent.

A recent crackdown on password sharing, initially met with resistance, has provided additional revenue opportunities by converting previously unauthorized viewers into paying subscribers.

Disney’s Earnings Outlook Appears Weak

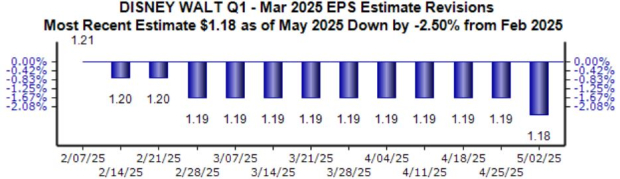

Analysts maintain a cautious stance on Disney’s upcoming quarter, with the current Zacks Consensus EPS estimate at $1.18, reflecting a roughly 3% decline since early February. This estimate indicates a year-over-year pullback of 3%, while sales are anticipated to increase by 5% to $23.1 billion.

Image Source: Zacks Investment Research

Disney concluded its most recent period with 174 million Disney+ Core and Hulu subscriptions, including over 120 million Disney+ Core paid subscribers, marking a quarter-over-quarter increase of 4.4 million.

Even though Disney has shown overall subscriber growth, the rate lags behind Netflix, hinting at challenges in implementing effective growth strategies.

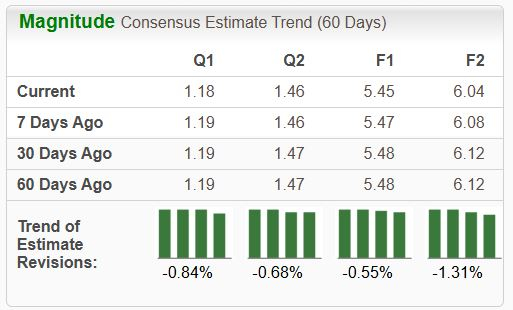

The broader outlook for Disney remains negative, as indicated by its Zacks Rank #4 (Sell), reflecting pervasive negative revisions.

Image Source: Zacks Investment Research

Conclusion

As Disney prepares to report its earnings, it faces a challenging backdrop compared to Netflix, which has posted notably strong results. Analysts are cautious about Disney’s earnings outlook, with the current Zacks Consensus EPS estimate reflecting a downward trajectory since February. The unfavorable Zacks Rank #4 (Sell) further underscores this negative sentiment. Investors should monitor for any indications of improved earnings estimates following Disney’s release, as this could signal a shift in sentiment.