Two Companies Increasing Dividends: AXP and Pearson Under Review

Investors have a fondness for dividends, as these payments create passive income, mitigate losses in other investments, and present multiple avenues for profit. Companies with a track record of raising their dividends are particularly attractive, signaling their dedication to rewarding shareholders.

Moreover, persistent dividend increases indicate a company’s success and its decision to distribute profits to investors. For those on the lookout for companies that have recently enhanced their payouts, American Express (AXP) and Pearson (PSO) are two promising options. Here’s a closer look at each.

AXP: Consistent Payouts for Investors

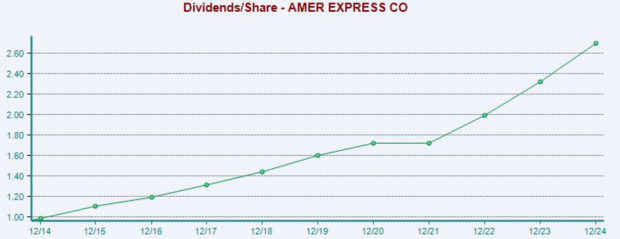

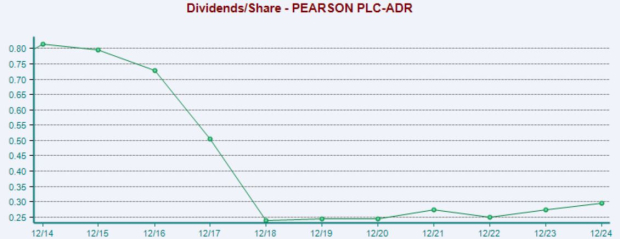

American Express has long been recognized as a solid choice for income-focused investors due to its reliable dividend payouts. In fact, the company boasts an impressive 12.5% five-year annualized growth rate in dividends. Below is a visual representation of the company’s annual dividends per share.

Image Source: Zacks Investment Research

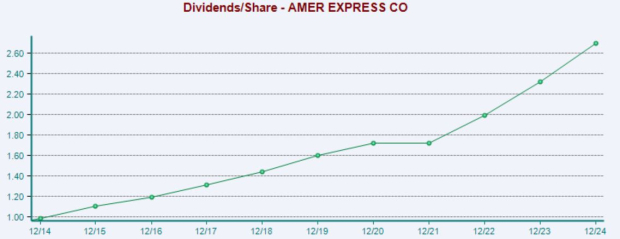

Analysts have adopted an optimistic outlook for AXP’s earnings this year, with an EPS estimate of $15.31 per share, reflecting a 4% increase from last year and suggesting a robust 15% year-over-year growth rate. The stock currently holds a favorable Zacks Rank of #2 (Buy).

Image Source: Zacks Investment Research

Recently, AXP raised its quarterly dividend by 17%, totaling $0.82 per share. This results in a current yield of 1.1%, compared to the S&P 500’s yield of 1.3%.

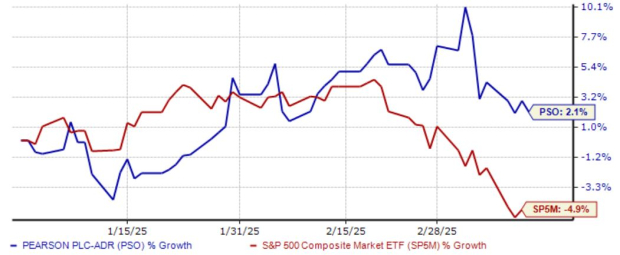

PSO: A Rebound in Shareholder Returns

Pearson shares have displayed notable relative strength in 2025, achieving a 2% gain against a 5% decline in the S&P 500. In late February, Pearson announced a significant 120% increase in its quarterly payout, now at $0.21 per share.

Image Source: Zacks Investment Research

The company has been gradually improving its commitment to shareholders after reducing payouts between 2015 and 2019. This change indicates a shift back to being more shareholder-friendly.

Image Source: Zacks Investment Research

Similar to AXP, Pearson has benefited from positive revisions to earnings estimates for its current fiscal year, allowing the stock to achieve a favorable Zacks Rank of #2 (Buy). The latest Zacks Consensus EPS estimate of $0.88 suggests a 13% increase year-over-year.

Conclusion

Dividends offer several advantages to investors, including passive income and the potential for enhanced returns through reinvestment. Companies tend to increase payouts when their businesses thrive, sending a positive signal about their long-term prospects. The ability to generate consistent cash flow is a key strength.

For those interested in companies committed to increasing shareholder returns, American Express (AXP) and Pearson (PSO) are both strong candidates.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team has unveiled five stocks with the highest potential for gaining +100% or more in the near future. Among these, Director of Research Sheraz Mian emphasizes one stock expected to achieve significant growth.

This leading choice belongs to one of the most innovative financial firms. With a rapidly growing customer base of over 50 million and a diverse range of advanced solutions, this stock is well-positioned for substantial gains. Although not all of our featured picks succeed, this one could outperform previous Zacks Stocks Set to Double, like Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

American Express Company (AXP): Free Stock Analysis Report

Pearson, PLC (PSO): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.