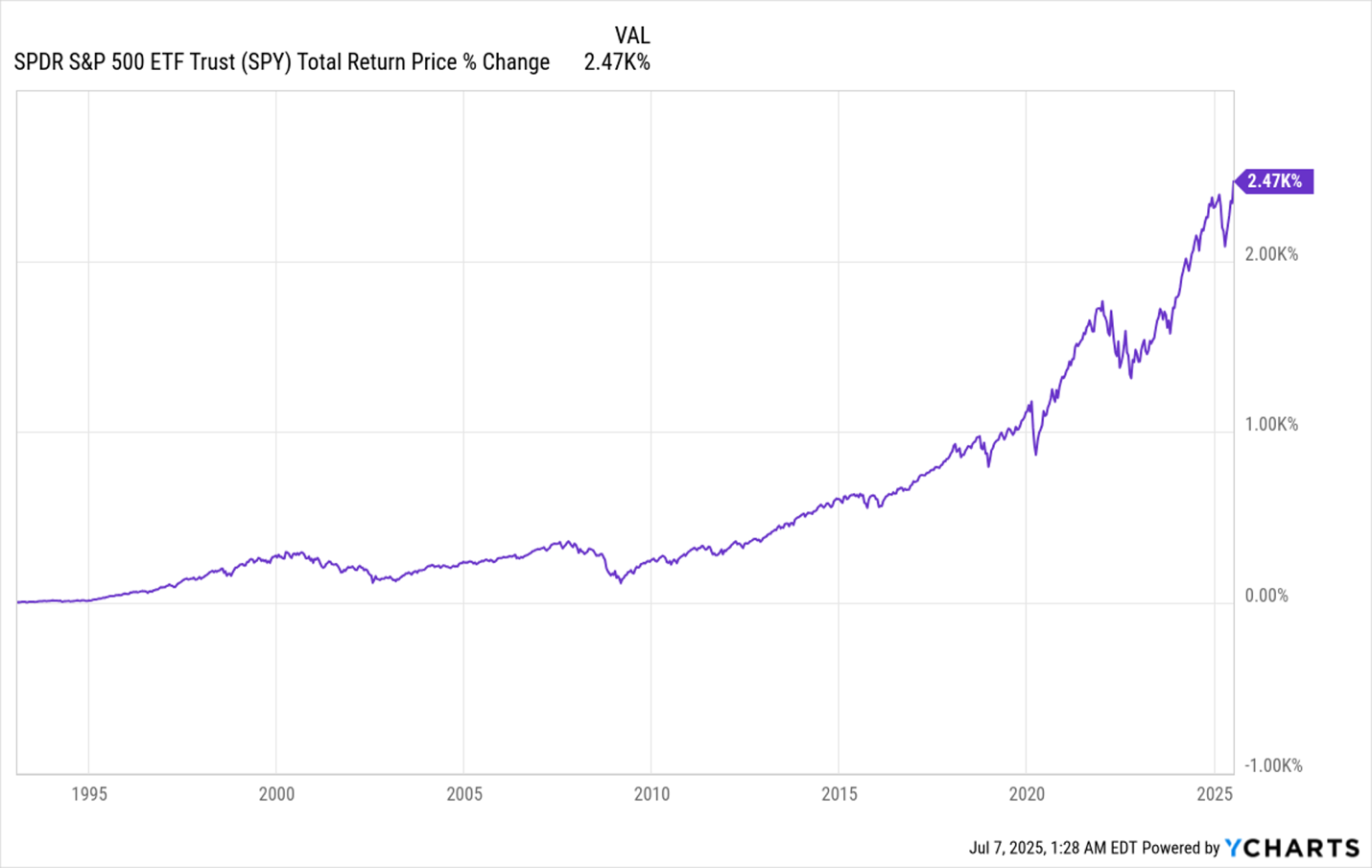

Over the last 32 years, U.S. stocks have risen approximately 10.7% annually, reinforcing the idea that long-term investing is preferable to reacting to media headlines about economic conditions such as tariffs, inflation, and interest rates. Notably, the S&P 500 experienced a “lost decade” from 2000 to 2010, where stock prices did not see significant growth.

To mitigate downturns, diversification into assets like real estate investment trusts (REITs) and corporate bonds is suggested. The Cohen and Steers Total Return Realty Fund (RFI), which yields 7.9%, is highlighted for its robust performance, returning triple digits during the aforementioned “lost decade.” In conjunction with funds like the Adams Diversified Equity Fund (ADX) and Liberty All-Star Growth Fund (ASG), investors can achieve an average dividend yield of 7.9% across the three funds.

Overall, adopting a diversified portfolio that includes various asset classes can help investors minimize risk and maximize returns, allowing them to ignore volatile headlines and focus on long-term growth.