Many years ago, the film “The Magnificent Seven” captivated audiences with its tales of seven hired guns liberating a village. Fast forward to 2023, and these cinematic legends found a new counterpart in the world of finance.

Bank of America’s Michael Harnett coined the term “Magnificent Seven” to represent seven tech giants: Alphabet, Amazon, Apple, Microsoft, Meta Platforms, NVIDIA, and Tesla. These modern titans have been driving market growth with their disruptive innovations in electric vehicles, cloud computing, and artificial intelligence.

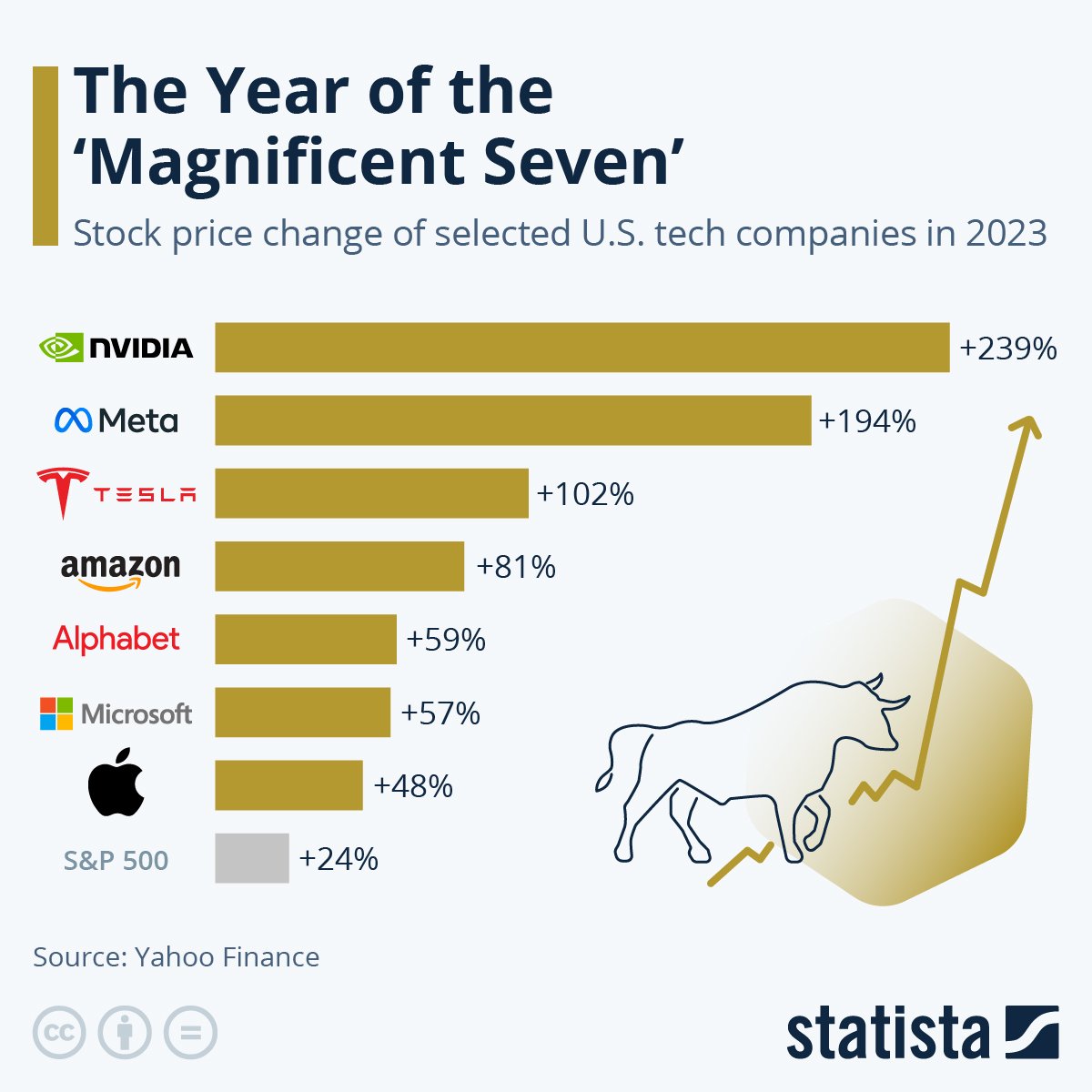

In 2023, as the S&P 500 surged, these Big Tech powerhouses outshone the broader market. Their influence, akin to the iconic movie, marks a new chapter in market dynamics.

The Reign of the Magnificent Seven

These tech behemoths, with their massive market capitalization, held a significant sway over the S&P 500. Accounting for nearly 28% of its weight, their performance wielded immense influence. Despite a broader market rally in the latter part of the year, their dominance remained unchallenged.

Shifts in the Market Landscape

As the year progresses, a wind of change sweeps through the market, reshuffling investments. Among the Magnificent Seven, only four presented solid earnings reports this season. Notably, NVIDIA emerged as a standout performer, heralding a paradigm shift.

- Meta boasted a remarkable 24.7% revenue increase and a 202.8% surge in earnings per share.

- Amazon exceeded analyst expectations with adjusted earnings per share and revenue surpassing estimates.

- Microsoft reported impressive earnings and revenue growth.

Yet, amongst these stars, NVIDIA shines the brightest.

What Sets NVIDIA Apart

NVIDIA, a pioneer in computer graphics for over two decades, revolutionized the industry with its invention of the GPU in 1999. From gaming to AI, NVIDIA’s graphics cards have enhanced computing capabilities across various sectors.

The company’s dominance extends to the AI realm, where it reigns supreme as the go-to processor for tech giants. The demand for NVIDIA’s products is so high that developers often face waiting periods to access its processors, underscoring its unparalleled position in the market.

Following a brief dip at the year’s onset, NVIDIA’s stock surged more than 59% year-to-date, exemplifying its market prowess. Recently touching a $2 trillion market cap, NVIDIA’s trajectory is a testament to its unrivaled success.

In its latest financial report, NVIDIA’s revenue skyrocketed by 265% in the fourth quarter of fiscal year 2024, propelling the stock to new heights.

The Rise of NVIDIA: A Market Leader Emerges

A Record-Breaking Performance

With revenue skyrocketing to an astonishing $22.1 billion year-over-year and data center revenue hitting a record $18.4 billion, NVIDIA has stunned the market. These numbers not only exceeded analyst estimates of $19.14 billion for the fourth quarter but also demonstrated the company’s prowess.

For historical context, NVIDIA’s 2022 revenue of $27 billion pales in comparison, highlighting the phenomenal growth trajectory the company is on.

An Upward Trajectory

Fourth-quarter earnings surged by 486.4% year-over-year to $5.16 per share, leaving analysts in awe as NVIDIA surpassed expectations by 20.3%. Looking towards fiscal year 2024, total revenue hit $60.9 billion, marking a 126% annual increase, while earnings per share stood at $12.96, representing a 288% annual growth – surpassing all forecasts.

A Bright Future Ahead

NVIDIA’s management expressed their confidence, stating that accelerated computing and generative AI have reached a tipping point, driving global demand across various sectors. Forecasts for the first quarter of fiscal year 2025 indicate continued growth, with revenue expected to reach around $24.0 billion, reflecting a substantial 268% year-over-year revenue surge.

Money on the Move

A ripple effect spread through the market as NVDA surged by 16%, leading the S&P 500 to a new height, with the Dow and NASDAQ following suit. NVIDIA has undeniably claimed the throne as the newest market leader, ushering in a new wave of investment fervor.

Picking the Next Big Winners

While acknowledging NVIDIA’s dominance, attention is turning to other stocks primed for success. Small- and mid-cap stocks have captured investor interest, especially after the robust performance of the Russell 2000. These stocks, poised for growth, present a lucrative opportunity in the market.

Seizing upon this trend, investors are eyeing small- and mid-cap stocks with superior fundamentals, projecting significant earnings and sales growth. With a flood of $6 trillion expected to enter the market alongside anticipated interest rate cuts, these stocks may soon see substantial gains.

The Accelerated Profits service provides a roadmap to identify promising stocks, offering a comprehensive strategy to navigate the evolving market landscape. Leveraging advanced algorithms, investors can uncover hidden gems poised for success.

Sincerely,

Louis Navellier

Editor, Market 360