DocuSign, Inc. DOCU shares have gained 23% in the past six months compared with the 21% rally of the industry it belongs to and the 15% growth of the Zacks S&P 500 composite.

Reasons Behind the Rally

DocuSign registered growth in both earnings and revenues in the fourth quarter of fiscal 2024. Non-GAAP earnings of 76 cents per share increased 17% year over year and total revenues of $712.4 million were up 8% year over year.

The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an average earnings surprise of 23.7%.

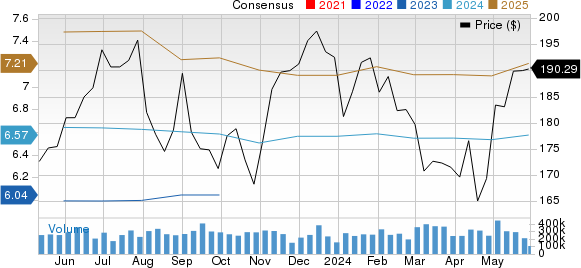

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

This strong performance was driven by significant progress across three pillars of the company’s strategic vision: accelerating product innovation, enhancing the reach and effectiveness of omnichannel go-to-market initiatives, and strengthening operational and financial efficiency.

DocuSign is currently experiencing improved performance with customers managed by the direct sales force. The company has significantly increased its business with customers signing and renewing multiyear, multimillion-dollar contracts, including Fortune 500 global leaders in energy, insurance, industrials, consumer goods, and several federal and state government agencies.

In terms of product innovation, identity verification products like AI-enabled IDV Premier and the recently launched QES-compliant Identity Wallet are now in use by more than 1,000 customers in the U.K. The recently launched DocuSign monitor created 1,500 new accounts in the fourth quarter.

Regarding operational and financial efficiency, ongoing cost management initiatives are helping DocuSign streamline its operations and channelize investments on initiatives that promise long-term growth.

Zacks Rank and Stocks to Consider

DocuSign currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Kyndryl Holdings, Inc. KD and Sprinklr CXM.

Kyndryl Holdings, Inc. currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

KD has a long-term earnings growth expectation of 5%. It delivered a trailing four-quarter earnings surprise of 29.5%, on average.

Sprinklr carries a Zacks Rank of 2 (Buy) at present. It has a long-term earnings growth expectation of 30%.

CXM delivered a trailing four-quarter earnings surprise of 176.8%, on average.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

DocuSign (DOCU) : Free Stock Analysis Report

Sprinklr, Inc. (CXM) : Free Stock Analysis Report

Kyndryl Holdings, Inc. (KD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.