DocuSign Surges Ahead: What Does This Mean for Investors?

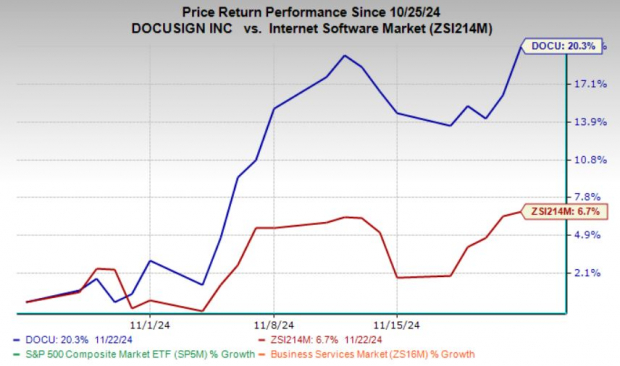

DocuSign, Inc. DOCU has shown remarkable performance recently, with a 20.3% rise in its stock price over the last month, outpacing the broader industry growth of 6.7%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In the latest trading session, DOCU shares closed at $83, just shy of their 52-week high of $83.68. The stock is also above its 50-day moving average, indicating strong investor confidence.

Image Source: Zacks Investment Research

This surge may attract potential buyers, but is now the right time to invest in DOCU? Let’s take a closer look.

Strong Demand Drives DocuSign’s Growth

DocuSign continues to thrive amid a growing customer demand for electronic signature solutions in a vast market. Its customer base expanded from 1.1 million in fiscal 2022 to 1.5 million in fiscal 2024. This upward trend suggests that growth will likely continue in future years. Notably, the eSignature market remains largely unexploited, leaving DocuSign with numerous opportunities for growth.

Subscription fees make up 97% of DocuSign’s total revenue. These fees provide access to products and customer support, typically lasting from one to three years. A subscription model is beneficial for software companies as it stabilizes revenue and ensures consistent cash flows, making their solutions more accessible even to smaller firms.

Innovative go-to-market strategies have also helped DocuSign expand its commercial and enterprise customer base. Various initiatives have led to a 10% growth in subscription revenues for fiscal 2024, primarily benefiting from existing customer expansion and new clients.

International revenues have shown consistent growth, comprising 23%, 25%, and 26% of total revenues in 2022, 2023, and 2024, respectively. DocuSign has targeted expansion efforts in Canada, the U.K., and Australia, aligning its eSignature solutions with similar practices seen in the U.S. Increasing demand across different regions has prompted the company’s focus on further sales and marketing efforts.

Strategic partnerships with industry leaders like Salesforce CRM and Microsoft MSFT have deepened DocuSign’s market presence. Through collaboration with Salesforce, the company has developed solutions to automate contract creation and enhance collaboration through Salesforce’s Slack. Additionally, DocuSign integrated its eSignature capabilities into Microsoft Teams last year, becoming an official electronic signature provider for the Teams’ Approvals app. These partnerships grant the company access to a broader customer base than it could reach independently.

Highlighting DocuSign’s Financial Efficiency

The return on equity (ROE) for DocuSign stands at 53.7%, compared to the industry average of 31.8%. This metric serves as a key indicator of how effectively a company utilizes shareholder investments to generate earnings.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Positive Earnings Outlook

According to the Zacks Consensus Estimate, DocuSign’s fiscal 2025 earnings are expected to be $3.45, which reflects a growth of 15.8% from the previous year. Earnings for fiscal 2026 are projected to rise by 6%. Additionally, sales are anticipated to increase by 6.5% and 6% for fiscal 2025 and 2026, respectively.

In the past two months, one estimate for fiscal 2025 has improved, with no declines noted. The Zacks Consensus Estimate for earnings in fiscal 2025 has risen by 0.6% during this period.

Consider Holding for a More Favorable Entry

DocuSign’s strong stock performance can be attributed to high demand for eSignature solutions, a growing customer base, and strategic partnerships with Salesforce and Microsoft. These elements signal its potential for further growth. The subscription-based revenue model and focused international expansion add to its financial robustness. However, as the stock nears its 52-week high and trades above its 50-day moving average, a correction may be imminent. Despite solid long-term prospects, investors might want to consider waiting for a better time to buy. Currently, we suggest holding DOCU shares and staying alert for more advantageous entry points.

DOCU is presently rated as Zacks Rank #3 (Hold). You can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our experts have identified 5 stocks with the highest potential for gaining 100% or more in the upcoming months. Among those, Director of Research Sheraz Mian spots one stock likely to make the largest climb.

This top pick belongs to an innovative financial firm that has rapidly grown its customer base (now exceeding 50 million) and offers a range of advanced solutions, suggesting it is poised for significant gains. While not all our elite picks guarantee success, this stock could significantly outperform past Zacks’ selections like Nano-X Imaging, which surged by +129.6% in a little over 9 months.

Free: See Our Top Stock And 4 Runners Up

Looking for the latest recommendations from Zacks Investment Research? Download 5 Stocks Set to Double for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Salesforce Inc. (CRM): Free Stock Analysis Report

DocuSign Inc. (DOCU): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.