Newmont Corporation, known by the ticker NEM, has witnessed a remarkable 24.8% surge in its shares over the last three months, outshining the Zacks Mining – Gold industry’s 12.4% climb. The company’s impressive second-quarter earnings, fueled by heightened selling prices, production levels, and the surge in gold prices, have significantly propelled NEM’s stock.

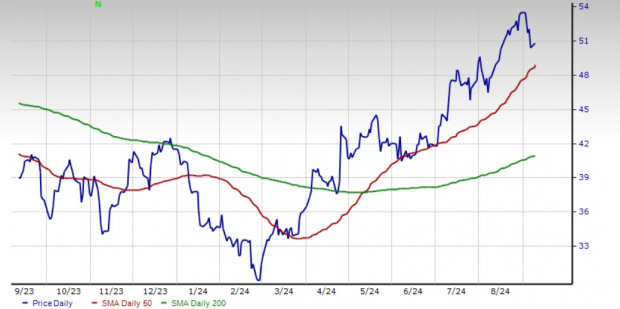

Newmont’s Bullish Technical Trend

Image Source: Zacks Investment Research

It’s crucial to note that NEM shares are currently trading at a slight 6% discount from its 52-week high of $53.88, achieved on Aug. 30, 2024. Technical indicators emphasize the stock’s resilience, consistently trading above the 200-day simple moving average since April 23, 2024. Following a golden crossover on May 13, 2024, between the 50-day and 200-day SMAs, NEM continues to display a bullish trend with the 200-day SMA acting as a strong support level.

Assessing Newmont’s Strategic Focus

Newmont’s strategic investments in growth projects, including developments like Tanami Expansion 2 in Australia, the Ahafo North expansion in Ghana, and Cadia Block Caves in Australia, position the company for enhanced production capacity and prolonged mine life, paving the way for increased revenues and profits.

The strategic acquisition of Newcrest Mining Limited has further bolstered Newmont’s profile, creating a leading industry portfolio with extensive gold and copper production capabilities. The merger is anticipated to yield substantial shareholder value and synergies, with projected pre-tax benefits of $500 million annually by the end of 2025. Newmont remains on track to meet its 2024 gold production target of approximately 6.9 million ounces, validating the success of its Tier 1 assets and the assimilated Newcrest buyout.

Newmont’s Financial Fortitude

Newmont’s strong liquidity position and robust cash flows enable the company to fund growth initiatives, fulfill short-term debt obligations, and drive shareholder value. As of the second quarter of 2024, Newmont boasted liquidity of $6.8 billion, with cash and cash equivalents totaling $2.6 billion. The company’s total operating cash flow doubled year-over-year to $1.4 billion, generating $594 million in free cash flow. Notably, Newmont returned around $539 million to shareholders through dividends and share buybacks in the same quarter.

Evaluating Newmont’s Stock Value

Despite Newmont’s stock currently trading at a premium compared to the industry average, the forward 12-month earnings multiple of 15.74X remains justifiable given the company’s strong earnings trajectory.

Newmont has outperformed the S&P 500, with its shares marking a 22.6% increase year-to-date, benefiting from an upsurge in gold prices. The company’s track record and consistent growth make it a compelling investment for those considering long-term value.

Guidance for Investors Considering Newmont

Considering Newmont’s robust growth projects, financial stability, and positive technical indicators, investors may find the stock appealing. While high production costs pose a concern, the company’s sound financial standing, rising estimates, and attractive dividend yield make it a prudent investment choice. Therefore, maintaining Newmont at a Zacks Rank #3 (Hold) position might be a judicious move for existing shareholders.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.