“`html

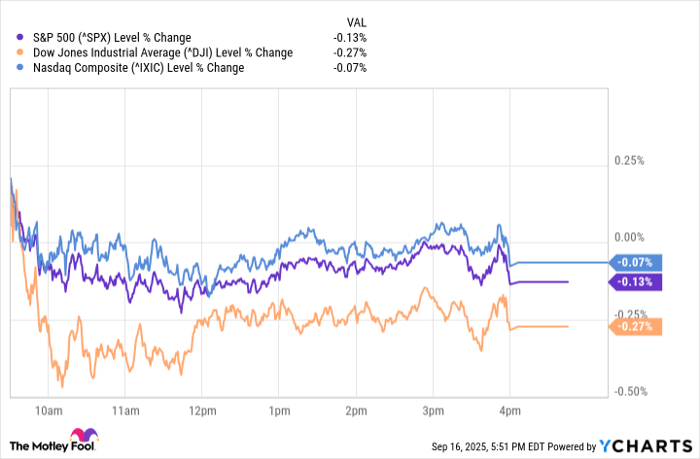

The dollar index (DXY) fell by 0.69% on Tuesday, reaching a 2.5-month low amid expectations that the Federal Reserve will cut interest rates by 25 basis points at the conclusion of a two-day FOMC meeting on Wednesday. The market is pricing a 100% chance of this cut, with an 84% chance of an additional cut in late October, which would bring the federal funds rate down to 3.65% by year-end.

US retail sales for August rose by 0.6%, surpassing the expected 0.2%, while manufacturing production unexpectedly increased by 0.2% against an anticipated decline of 0.2%. Additionally, the euro strengthened against the dollar, rising by 0.88% due to diverging monetary policies, with the ECB likely nearing the end of its rate-cutting cycle.

Gold prices saw a minor increase, closing up by $6.10, aided by dollar weakness and expectations for a Fed rate cut, while silver fell slightly by 0.10%. The demand for precious metals is further supported by geopolitical risks and uncertainty in US and international politics.

“`