Dollar Tree Reports Disappointing Q4 Results Amid Family Dollar Sale

Dollar Tree, Inc. (DLTR) has released its fourth-quarter fiscal 2024 results, revealing disappointing earnings and sales below the Zacks Consensus Estimate, alongside a year-over-year decline. The weaker performance stems mainly from categorizing Family Dollar as discontinued operations following the decision to sell the business during a strategic review.

For the latest EPS estimates and surprises, visit Zacks Earnings Calendar.

On March 25, 2025, Dollar Tree entered a definitive agreement to sell its Family Dollar division to Brigade and Macellum for $1.007 billion, subject to adjustments related to working capital and net debt. This transaction is expected to finalize within 90 days, pending customary closing conditions, including U.S. antitrust approval. The estimated net pre-tax proceeds are projected at $804 million, with potential tax benefits of $350 million from the sale’s losses. Family Dollar’s headquarters will remain in Chesapeake, VA.

In the fourth quarter of fiscal 2024, Dollar Tree classified Family Dollar as held for sale; its results are reported as discontinued operations. Consequently, the earnings and sales figures for the fiscal fourth quarter exclude Family Dollar’s contributions, and prior periods have been adjusted to align with this presentation.

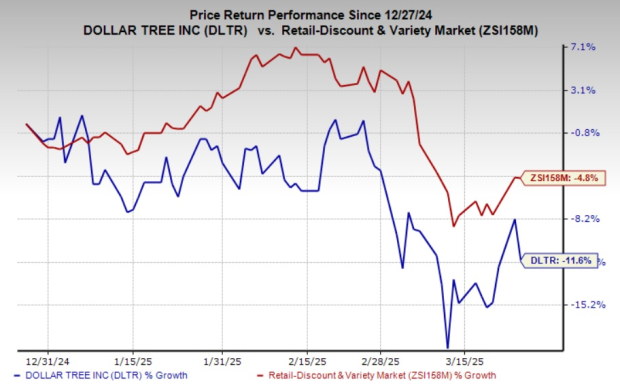

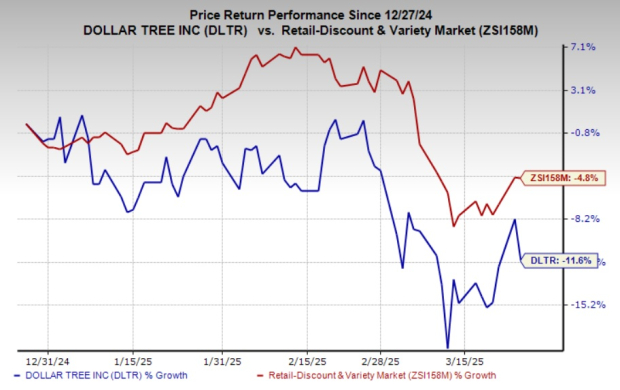

Investors responded positively, as Dollar Tree shares rose 5% in pre-market trading after announcing the fourth-quarter results. The completion of the Family Dollar sale is seen as a strategic move that will enable the company to focus on long-term value creation for associates, customers, and shareholders. However, shares of this Zacks Rank #3 (Hold) company have decreased by 11.6% over the past three months, compared to a 4.8% decline in the retail discount industry.

Image Source: Zacks Investment Research

Quarterly Performance: Key Metrics & Insights

Dollar Tree’s adjusted earnings per share (EPS) from continuing operations dropped 15.3% year over year to $2.11 and fell short of the Zacks Consensus Estimate of $2.18. The quarter’s EPS included 18 cents from discontinued operations. Had Family Dollar’s contribution been included, EPS would have been $2.29.

Net sales from continuing operations, excluding Family Dollar, reached $4.997 billion, reflecting a year-over-year increase of 0.7%, but significantly lagging behind the Zacks Consensus Estimate of $8.23 billion. Same-store sales rose 2% year over year, driven by a 0.7% increase in store traffic and a 1.3% boost in the average transaction amount.

The gross profit decreased 2.8% year over year to $1.9 billion, with a contraction of 130 basis points in gross margin to 37.6%. Factors contributing to the margin decline included loss of leverage from an extra sales week in fiscal 2023, lower initial mark-on, and increased costs from shrink, distribution, and markdowns, somewhat offset by lower freight costs. Notably, freight costs included a $25 million accrual for duties tied to an anti-dumping case against fiscal 2024 imports.

We had projected a year-over-year decline of 1.2% in adjusted gross profit and a 100 basis point expansion in the gross margin.

Dollar Tree, Inc. Price, Consensus and EPS Surprise

Dollar Tree, Inc. price-consensus-eps-surprise-chart | Dollar Tree, Inc. Quote

Adjusted selling, general and administrative (SG&A) expenses constituted 27% of sales, an increase of 260 basis points from the prior year. This rise was mainly due to software impairments and costs associated with the Family Dollar sale, including higher depreciation, stock compensation, professional fees, and utility expenses. The additional costs from the extra sales week in 2023 further strained the margins. However, there was some relief from a decrease in general liability claims adjustments. Adjusted SG&A expense rates grew by 100 basis points to 25.1%, excluding the impacts of software write-offs, stock compensation, and professional fees.

Adjusted operating income fell by 15.2% year over year to $627.8 million, with the operating margin contracting by 230 basis points to 12.6%. Our estimates indicated a 13.9% decline in adjusted operating profit and a 90 basis point contraction in adjusted operating margin.

Financial Health of Dollar Tree

As of the end of fiscal 2024, Dollar Tree reported cash and cash equivalents totaling $1.3 billion. On February 1, 2025, net merchandise inventories stood at $2.67 billion, representing a year-over-year growth of 7.1%. The company had net long-term debt, excluding the current portion, of $2.43 billion, along with shareholders’ equity amounting to $3.98 billion as of the same date.

During fiscal 2024, Dollar Tree repurchased 3.3 million shares for a total of $403.6 million. While share repurchases are not factored into the current outlook, as of February 1, 2025, the company retains $952 million remaining on its $2.5 billion repurchase authorization.

On March 21, 2025, Dollar Tree secured a $1.5 billion revolving credit facility with JPMorgan Chase Bank, extending its previous $1.5 billion facility, which was due to expire in December 2026. Additionally, the company has established a $1 billion 364-day revolving credit facility in preparation for the upcoming maturity of its 4.00% senior notes set to expire in May 2025.

Store Expansion Updates

In the fourth quarter of fiscal 2024, Dollar Tree opened 33 new stores, bringing the total openings for the fiscal year to 525. At the end of fiscal 2024, the company operated approximately 2,900 Dollar Tree 3.0 multi-price format stores, which included 2,600 conversions and 300 new locations.

Dollar Tree’s Outlook for Q1 & FY25

Dollar Tree has provided its fiscal 2025 outlook based on continuing operations, which encompasses the Dollar Tree segment alongside corporate and other support functions. The company anticipates net sales of $18.5-$19.1 billion, supported by expected comps growth of 3-5%. Adjusted EPS is projected to fall between $5.00 and $5.50.

However, earnings are likely to be impacted by 30-35 cents per share due to shared services costs associated with the Family Dollar sale, predominantly in the first two quarters of fiscal 2025. While these costs will incur throughout 2025, reimbursements will only begin in the second half under a Transition Services Agreement (“TSA”) expected to start after the sale closes in June 2025.

For the fiscal first quarter, Dollar Tree forecasts net sales between $4.5 and $4.6 billion, accompanied by comps growth of 3-5%. Adjusted EPS is estimated in the range of $1.10 to $1.25, encapsulating the full impact of shared services costs without any offset from TSA reimbursements.

Additional Stock Insights

We have also highlighted three better-ranked stocks: Nordstrom (JWN), The Gap Inc. (GAP), and Tapestry.

Gap, Nordstrom, and Tapestry: An Overview of Retail Performance

Gap Inc. (GAP), a well-known international specialty retailer providing a wide array of clothing, accessories, and personal care items, currently holds a Zacks Rank of #1 (Strong Buy). The complete list of today’s Zacks #1 Rank stocks can be found here.

The Zacks Consensus Estimate projects a 1.6% increase in Gap’s financial-year sales and a 7.7% rise in earnings per share (EPS) compared to last year’s figures. Notably, Gap has historically exceeded expectations, delivering an average earnings surprise of 77.5% over the trailing four quarters.

Nordstrom’s Current Standing

Nordstrom Inc. (JWN), another key player in the U.S. fashion retail market, currently also boasts a Zacks Rank of #1. However, it has experienced a trailing four-quarter average negative earnings surprise of 26.1%.

The Zacks Consensus Estimate for Nordstrom anticipates a modest sales growth of 1.9% for the current fiscal year. Despite this growth outlook, the EPS consensus indicates a slight decline of 1.8% compared to the previous year.

Tapestry’s Growth Outlook

Tapestry Inc. (TPR) specializes in high-quality accessories and gifts marketed to both men and women. It is currently rated as a Zacks Rank #2 (Buy).

The latest Zacks Consensus Estimate suggests that Tapestry will achieve a 3% rise in sales and a substantial 14.5% increase in EPS for the current fiscal year, based on previous year comparisons. Furthermore, Tapestry has successfully delivered an average earnings surprise of 11.9% over the last four quarters.

Zacks Highlights a Top Semiconductor Stock

In another sector, Zacks has identified a standout semiconductor stock. Though only a fraction of NVIDIA’s size, which has seen growth exceeding 800% since its recommendation, the new top chip stock exhibits significant potential for future expansion.

As demand for Artificial Intelligence, Machine Learning, and the Internet of Things grows, the global semiconductor manufacturing market is expected to soar from $452 billion in 2021 to $803 billion by 2028. This positions the featured chip stock to potentially thrive amidst escalating demand.

See This Stock Now for Free >>

If you’re interested in more investment insights, download Zacks’ latest recommendations for the best stocks to consider over the next 30 days.

Additionally, explore the following free stock analysis reports:

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.