Domino’s Pizza Boosts Dividend Payout

Domino’s Pizza made waves on February 21, 2024, by declaring a generous increase in its regular quarterly dividend to $1.51 per share ($6.04 annualized), up from $1.21 per share previously. To qualify for this enticing dividend, shares must be snagged before the ex-div date of March 14, 2024. Shareholders of record as of March 15, 2024, will enjoy the fruit of their investment on March 29, 2024.

Historical Perspectives on Dividend Yields

Reflecting on the past five years, with a sample taken weekly, the average dividend yield for Domino’s Pizza stands at 1.03%. This yield has fluctuated between a low of 0.67% and a high of 1.64%, with a standard deviation of 0.24 (n=233). An intriguing detail – the current yield is a whopping 1.20 standard deviations above this historical average.

Insight into Payout Ratios

Delving into the company’s financial health, the dividend payout ratio stands at 0.41, indicating that Domino’s Pizza pays out 41% of its income as dividends. This ratio is a key indicator of sustainability, with values over 1 signaling concerns about digging into reserves to maintain dividends. Domino’s Pizza’s 3-year dividend growth rate of 0.61% underscores its commitment to rewarding shareholders over time.

Fund Sentiment and Analyst Projections

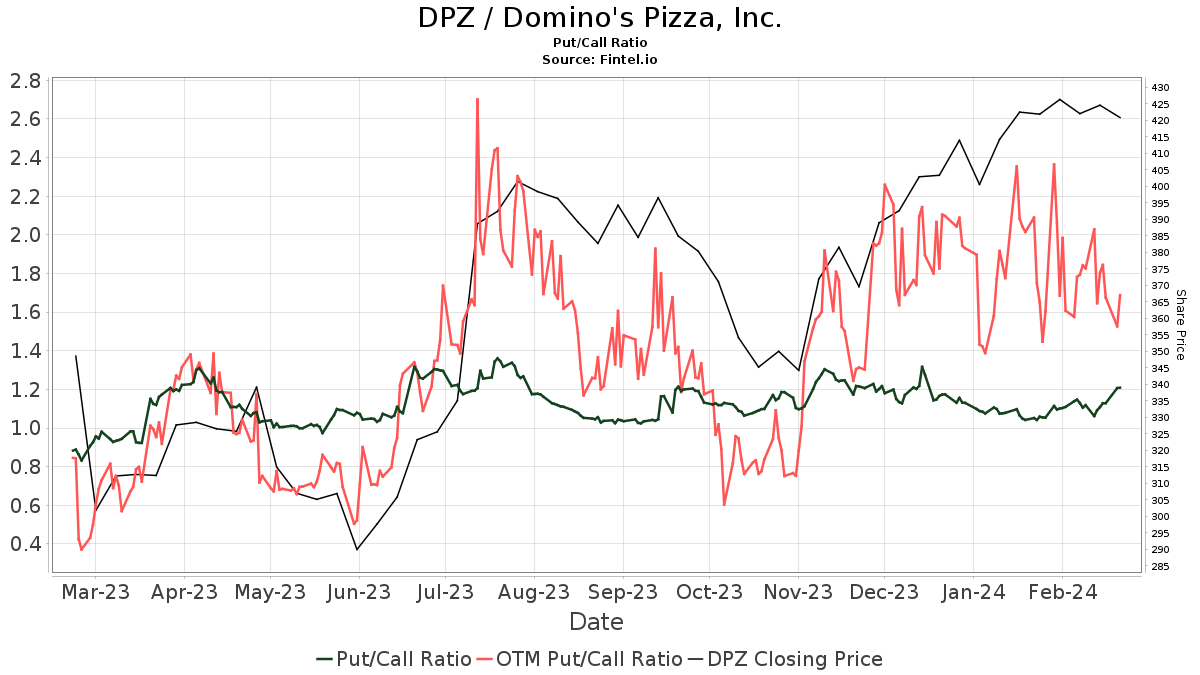

A staggering 1397 funds or institutions have vested interest in Domino’s Pizza, marking a substantial 4.57% uptick in ownership in the last quarter. The average portfolio weight dedication to DPZ has also soared to 0.23%, a notable 2.70% increase. Furthermore, with the put/call ratio at a bullish 0.94, the sentiment around DPZ is optimistic.

Turning towards analyst forecasts, a slight downside of 1.86% is predicted based on a one-year price target of $450.45, contrasting with the current price of $459.00. The annual revenue projection for Domino’s Pizza stands at 5,090MM, reflecting a promising 13.63% increase, with a projected non-GAAP EPS of 16.33.

Shifting Shareholder Dynamics

In the financial dance of ownership, major players such as T. Rowe Price Investment Management, Principal Financial Group, and various funds have either increased or decreased their stakes in Domino’s Pizza. These maneuvers highlight the dynamic nature of investor sentiment and strategic portfolio reshuffling.

Delicious Domino’s Heritage

A home-grown American success story, Domino’s Pizza, founded back in 1960, has evolved into a global pizza empire. Based in Ann Arbor, Michigan, the corporation continues to serve up sizzling slices of financial performance to its investors.