Amidst the turbulent waters of 2024, European carbon allowance (EUA) prices have faced their fair share of challenges.

Recently, the European Commission unveiled a remarkable 15.5% drop in carbon emissions under the EU’s emissions trading system in 2023. While this serves as a testament to the effectiveness of Europe’s eco-friendly policies, it has cast a shadow over EUA prices in the near term.

Nevertheless, glimmers of hope persist in the EUA market. Despite predictions by analysts, Eurozone inflation has taken a dip, hinting at potential rate cuts on the horizon. This decline in inflation could potentially translate to an uptick in industrial production, subsequently boosting the demand for EUAs.

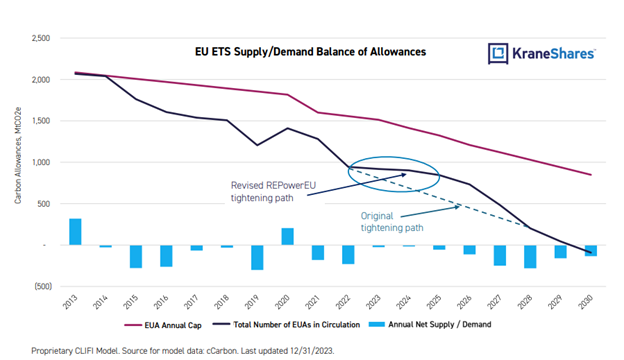

Insights from KraneShares suggest a tightening grip on the European carbon allowances market. Despite the influx of additional EUAs into the market, the tightening industry dynamics are poised to uphold allowances at the same projected levels for 2030.

Gradual Investment in EUAs

In a recent discussion with VettaFi, Luke Oliver, KraneShares’ managing director and head of climate investments, advocated for a measured approach to investing in EUAs. Oliver advised investors to gradually ease into EUAs this year, pointing out that amid the prevalent bearish signals, some bullish pressures are starting to emerge.

Oliver emphasized the heightened volatility of these markets in comparison to equities, combining it with higher expected returns and a more favorable Sharpe ratio. Moreover, he highlighted the diversification benefits that lower the overall portfolio volatility. Despite the challenges, Oliver affirmed that being entrenched in this market long-term is imperative, particularly looking towards 2030 and beyond.

Discover More: Luke Oliver Shares Insights on Carbon Market Investment in 2024

The KraneShares European Carbon Allowance Strategy ETF (NYSE Arca: KEUA) offers investors an avenue to tap into the growth potential of the EUA market. WIth benchmarking to the IHS Markit Carbon EUA Index and exposure to EUA futures, the fund boasts a net expense ratio of 0.79%.

Given the lower correlation of carbon allowances with other asset classes, an investment in KEUA can furnish traders with a means of global portfolio diversification. Despite the recent struggles of EUA prices, KEUA has managed to climb by 3.18% over the past month, hinting at a potential upward trend.

KraneShares’ array of climate-aligned ETFs extends to the KraneShares Global Carbon Strategy ETF (NYSE Arca: KRBN), which oversees around $290 million in assets under management – a testament to investor confidence.

For the latest news, insights, and analysis, explore the Climate Insights Channel.

Read more on ETFTrends.com.

The sentiments and viewpoints expressed here are those of the author and do not necessarily mirror those of Nasdaq, Inc.