Investing Strategies Amid Nasdaq Correction: Top Stock Picks

With the Nasdaq Composite currently in correction territory, investors may find it prudent to consider entering the Stock market. A correction is defined as a 10% decline from an all-time high and has historically occurred over once a year since 1980. While some corrections lead to bear markets, many reverse and rise again, making the latter scenario more likely this time around.

Given this backdrop, I’ve identified five compelling stocks to invest in now amid the sell-off. Missing out on these attractive prices could be a regret for many investors.

Where to invest $1,000 right now? Our analyst team has revealed what they believe are the 10 best stocks to buy now. Learn More »

AI Hardware Providers: Nvidia and Broadcom

Some investors associate the current correction with a reversal of artificial intelligence (AI) hype, similar to the dot-com bubble burst in 2000. However, I believe this comparison is misguided.

While both AI and the internet have significantly altered our lifestyles, AI firms differ substantially from the failed internet companies of the past. Namely, they demonstrate robust profitability and possess sound business models.

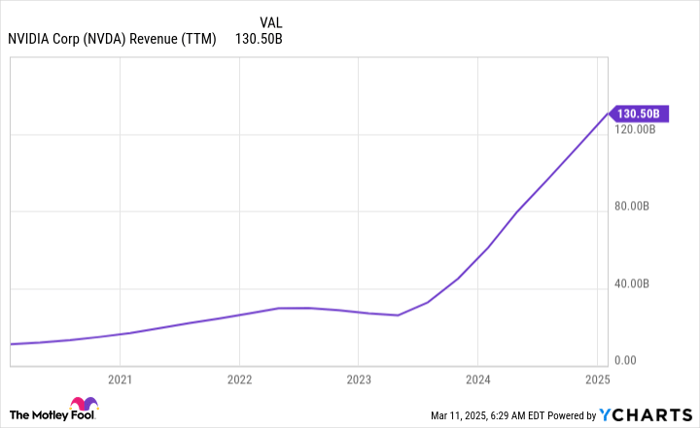

Billions of dollars are currently flowing into AI-related hardware as many companies recognize the future direction of the industry. Consequently, giants like Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) emerge as major beneficiaries.

This year, Nvidia is projected to achieve revenue of $204 billion, highlighting continuing investor confidence in AI. Nvidia’s graphics processing units (GPUs), essential for training and deploying AI models, play a crucial role. With major tech firms planning significant capital expenditures for 2025, Nvidia stands to gain substantially from this financial commitment.

Broadcom also stands to benefit significantly. The company manufactures connectivity switches for data centers and custom AI accelerators, known internally as XPUs. Management at Broadcom reports burgeoning demand for XPUs, which reportedly outperform GPUs for specific workloads.

Currently, Broadcom collaborates with three companies utilizing its specialized XPUs and anticipates a market opportunity yielding $60 billion to $90 billion in revenue by 2027. This estimate excludes four additional clients that are launching their XPUs soon. With a trailing 12-month revenue of $55 billion, Broadcom has considerable growth prospects ahead.

Given these insights, I am confident that Nvidia and Broadcom will perform well in the coming years. Major tech firms must maintain their AI spending or risk falling behind more committed competitors. Thus, I’m strategically purchasing shares of both companies during this dip.

AI Hyperscalers: Amazon, Alphabet, and Meta Platforms

In addition, I am exploring investments in AI hyperscalers, which include tech giants that build AI infrastructure. My focus is on Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Meta Platforms (NASDAQ: META). All three companies are significant customers of Nvidia and Broadcom and have committed to large AI infrastructure investments.

These firms are not short-term speculators; they have established operations that can support their AI ambitions. For Amazon, this foundation exists in its commerce and cloud computing sectors. While its commerce sales might face challenges from rising trade tensions, Amazon Web Services (AWS) continues to thrive.

AWS has been a major growth driver, benefiting from the trend toward cloud migration and increasing AI expenditures. In fact, over the last 12 months, AWS accounted for 58% of Amazon’s operating profits, far surpassing its commerce segment.

Both Alphabet and Meta generate substantial advertising revenue that fuels their AI investments. Each company leverages its diverse platforms—Alphabet with Google and YouTube, and Meta with Facebook, Instagram, WhatsApp, Threads, and Messenger—to generate the necessary cash flow for their AI initiatives.

Although Alphabet and Meta have launched compelling generative AI models, they still strive to capture a larger market share. Although short-term ad revenues may be under pressure, historical trends suggest that spending eventually rebounds. Investors who buy these stocks now and maintain a long-term outlook are likely to secure favorable entry points.

While valuations for these stocks have fluctuated, the recent market downturn has rendered them much more accessible.

NVDA PE Ratio (Forward) data by YCharts

From a forward price-to-earnings (P/E) perspective, many of these stocks exhibit strong appeal, marking some of the best pricing in recent times. It is an opportune moment for investors to capitalize on this market pullback and acquire shares in these long-term growth candidates.

Seize this Second Chance for a Lucrative Investment

Have you ever felt like you missed the opportunity to invest in top-performing stocks? Now may be your chance.

Our expert analysts occasionally issue a “Double Down” Stock recommendation for companies poised for significant growth. If you believe you’ve missed your window for investment, it’s essential to act quickly. The data is compelling:

- Nvidia: a $1,000 investment back in 2009 could now be worth $299,728!*

- Apple: a $1,000 investment in 2008 would have grown to $39,754!*

- Netflix: a $1,000 investment from 2004 could yield $480,061!*

Currently, we are issuing “Double Down” alerts for three exceptional companies. Opportunities like this don’t come around often.

Continue »

*Stock Advisor returns as of March 10, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is also on the board of The Motley Fool. Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet, Amazon, and Nvidia. The Motley Fool has investments in and recommends Alphabet, Amazon, Meta Platforms, and Nvidia and recommends Broadcom. The Motley Fool maintains a disclosure policy.

The opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.