The tides are turning in the world of energy, as nations globally steer towards decarbonization. This seismic shift presents a golden opportunity for investors to sow seeds in one of the fastest-growing sectors – clean energy, boasting a Compound Annual Growth Rate (CAGR) that outstrips the global GDP growth.

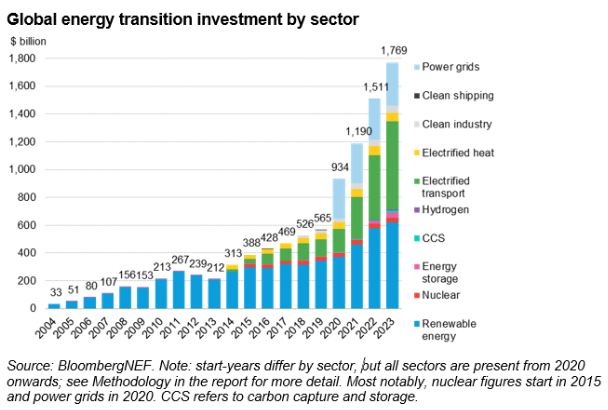

A clear testament to the burgeoning interest in clean energy, investments in this sector soared past $1.8 trillion last year, surging by 17% annually to set a new record, as per data from BloombergNEF. Over the past decade, the energy transition landscape witnessed a remarkable 24% CAGR, as highlighted by market strategist Paul Wong, CFA, and ETF product manager Jacob White, CFA, from Sprott Asset Management in a recent research paper.

Image source: BloombergNEF

Feeding this ballooning enthusiasm for clean energy, however, is the stark reality that current investments fall woefully short of the monumental outlay needed to attain net-zero ambitions. According to BloombergNEF, an annual investment of $4.8 trillion between 2024-2030 is the requisite sum to sufficiently slash emissions in line with the Paris Agreement benchmarks.

“The narrative of renewable energy’s growth is now akin to an exponential rocket ship,” penned Wong and White in a compelling February expose.

A Revved-Up Growth Story: Renewable Energy’s CAGR

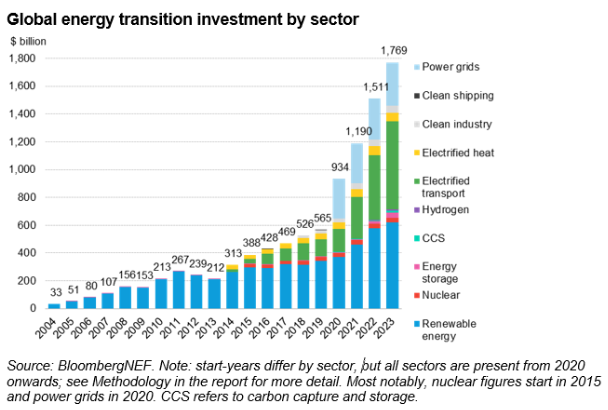

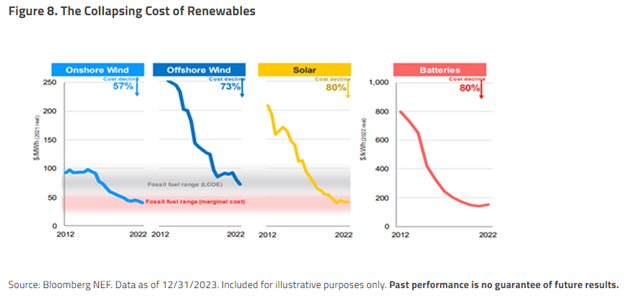

The remarkable trajectory of renewable energy stems from an amalgam of key drivers relentlessly driving down costs. Factors such as adoption growth following an S-curve, supportive regulatory frameworks, geopolitical dynamics, and considerations about energy security collectively propel this growth. As costs plummet, renewables are on a path to undercut fossil fuels, fostering broader market penetration.

Illustrating this triumph, investments in energy transition technologies outstripped those in fossil-fuel supply by a monumental $671 billion in 2023, as per BloombergNEF. This yawning disparity had stood at $508 billion in 2022, showcasing the firm commitment to a greener world and the increasing feasibility of renewable energy sources.

“Renewable energy has shed its ‘expensive tag,’” asserted Wong and White. “Solar and wind have morphed from assisted rookies to the most budget-friendly options for new electricity generation.”

Image source: Sprott Asset Management

The transformative journey that propelled wind and solar power from infancy to maturity rode on significant private investments, enabling a plethora of renewable technologies to traverse their S-curves from pricy to cost-efficient. The cost of onshore wind power nosedived by 57% between 2012-2022, mirroring an 80% drop in solar costs over the same period. Forecasts predict a repeat performance by halving costs once more by 2030.

The striking embrace and widescale adoption of solar and wind power exemplify ripe investment opportunities within the energy transition. For instance, the Sprott Energy Transition Materials ETF (SETM) provides investors with a direct conduit to companies pivotal in mining minerals essential for the energy transition. These minerals include copper, uranium, lithium, nickel, silver, graphite, among others.

Designed to mirror the Nasdaq Sprott Energy Transition Materials Index, the ETF encapsulates companies enmeshed in the global energy transition materials landscape, including rare earth element miners. Sporting an expense ratio of 0.65%, SETM beckons to investors eyeing this promising sector.

For additional news, insights, and analysis, explore the Gold/Silver/Critical Materials Channel.

Please note, the views expressed are solely those of the author and do not reflect the opinions of Nasdaq, Inc.