Dow Experiences Major Decline Amid Trade War Concerns

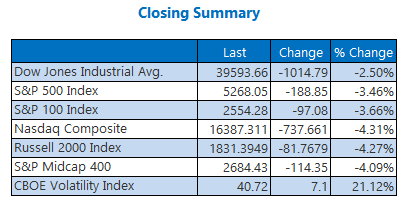

Major indexes declined sharply, dismissing yesterday’s brief reprieve from escalating trade war worries. The Dow Jones Industrial Average fell nearly 1,015 points, contrasting sharply with the previous day’s historic surge. Notably, on Wednesday, President Trump announced a 90-day halt to reciprocal tariffs, excluding China, where the overall tariff on all goods now reaches 145%. Leading the decline, significant technology stocks, such as Apple (AAPL) and Meta Platforms (META), faced losses.

Continue reading for more on today’s market, including:

5 Things to Know Today

- Bridget Brink, appointed by Biden, will leave her role as U.S. Ambassador to Ukraine after three years. (Bloomberg)

- Trump’s latest budget plan has successfully passed through the House of Representatives. (Reuters)

- Tech stocks continue to decline following Wednesday’s rally.

- Buzz surrounding sales has led to a rise in Costco Wholesale’s stock. Stock

- Today marks struggles for two specific fintech stocks.

Gold Futures Reach Three-Year High

During today’s session, crude oil prices fell alongside the overall market. May-dated West Texas Intermediate (WTI) crude dropped by $2.28, or 3.66%, settling at $60.07 per barrel.

As fears surrounding trade intensified and the U.S. dollar weakened, investors turned their attention to precious metals. June-dated gold was last reported 3.3% higher, priced at $3,179.4 per ounce.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.