Beyond Meat stock (NASDAQ: BYND) has been on a roller-coaster ride, plummeting 38% since 2023 while the S&P soared gracefully by 32% over the same period. The tale of Beyond Meat’s stock is one of underperformance, volatile revenues, and challenging times ahead.

A Bumpy Road Ahead

Beyond Meat has been grappling with dwindling revenue streams, significant cash burn, and a slew of challenges that have burdened its stock performance. Factors such as inflation, pandemic-induced demand fluctuations, and heightened competition have all contributed to the company’s downward trajectory.

Despite these headwinds, Beyond Meat’s stock price remains under pressure, with concerns about solvency and revenue declines looming large. The company’s US distribution has hit a plateau, inventory levels are high, and operational inefficiencies continue to plague its financial health.

Historical Struggles

The stock has taken a beating, with a staggering decline of 95% from its early 2021 levels, in stark contrast to the S&P 500’s 35% rise over the same period. Beyond Meat’s dismal performance in the past three years, with negative returns of -48% in 2021, -81% in 2022, and -28% in 2023, underscores the uphill battle it faces in the market.

Comparatively, heavyweight stocks in the Consumer Staples sector and tech giants like Google, Tesla, and Microsoft have also struggled to outpace the S&P 500. In contrast, the Trefis High-Quality Portfolio has consistently trumped the index, posing a question of resilience and strategy in a volatile market environment.

Given the prevailing macroeconomic uncertainties marked by soaring oil prices and elevated interest rates, the looming question is whether Beyond Meat can stage a recovery or continue its streak of underperformance in the coming months.

What Lies Ahead?

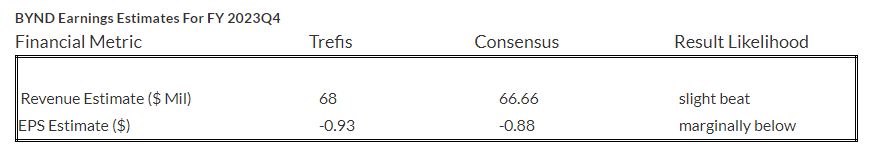

Beyond Meat is gearing up to unveil its fiscal fourth-quarter results, with revenue projections slightly exceeding consensus estimates. With revenues expected to be around $68 million for Q4 2023, the company anticipates a yearly decrease of 21% to 19%, signaling a turbulent period ahead. Earnings per share are also poised to miss consensus estimates marginally, reflecting the ongoing challenges faced by the company.

There is a silver lining, however, as the stock’s price estimate aligns closely with the current market price. Valued at $7 per share, only 5% lower than the prevailing market price, Beyond Meat’s stock seems to be priced fairly, considering its tumultuous journey.

Peer Comparisons

Understanding how Beyond Meat stacks up against its peers is crucial in gauging its market position. By comparing metrics that matter with BYND Peers, investors can gain valuable insights into the company’s competitive standing and potential growth prospects.

As investors brace themselves for Beyond Meat’s upcoming earnings reveal, the stock’s performance in the face of adversity will serve as a litmus test of its resilience and strategic acumen in navigating turbulent market waters.