DraftKings (NASDAQ: DKNG) achieved an impressive feat with a 100% surge in stock value over the past year. Despite this remarkable growth, Barry Jonas, an analyst at Truist, foresees even greater potential ahead, projecting a target price of $55 – a substantial 35% increase from the stock’s recent closing price.

Following DraftKings’ recent financial report for the fourth quarter, the stock experienced a slight decline. However, the company’s progression towards enhanced profitability and sustained revenue growth presents a favorable opportunity for prospective investors.

The Gateway to Prosperity: DraftKings’ Path to Enhanced Profitability

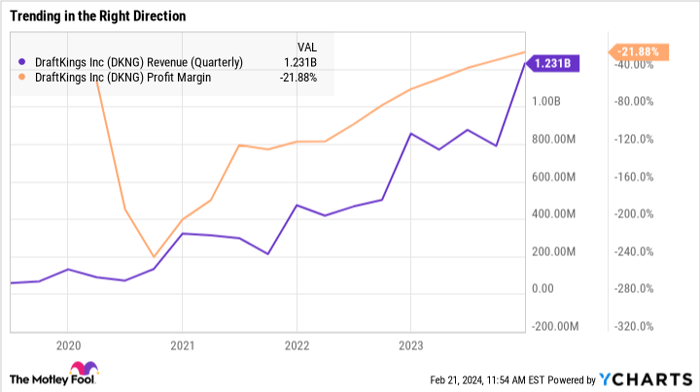

DraftKings has set its sights on the expansive market of online sports betting, demonstrating a significant increase in revenue and market share. Despite facing a setback due to unfavorable betting outcomes, the company managed to achieve a notable 44% year-over-year revenue growth.

Of paramount importance is DraftKings’ progression towards breakeven point. While the company recorded a $44 million net loss in the last quarter, marking a substantial improvement compared to the $242 million loss a year prior, the profit margin remains negative at 22%. However, this margin is swiftly narrowing, indicating promising prospects for the company as it continues to prioritize enhancing the overall customer experience.

DKNG data by YCharts

Reasons to Secure a Spot in DraftKings Stock

The recent surge in market share positions DraftKings for a potentially prosperous decade ahead. During the previous year’s investor day, the management outlined an optimistic forecast, expecting the addressable market to expand from $20 billion to $30 billion by 2028.

Amidst a quarter marked by customer-friendly betting outcomes, DraftKings’ commendable bottom-line performance indicates an accelerated path towards the breakeven mark. Wall Street’s continued confidence in this sports betting stock post last year’s significant growth suggests promising long-term prospects for potential investors.

Is investing $1,000 in DraftKings a wise move at this juncture?

Prior to making any investment in DraftKings, it’s advisable to note the insights:

The Motley Fool Stock Advisor analyst team recently identified what they believe to be the 10 best stocks for investors to consider at present – with DraftKings not among them. These selected stocks are anticipated to yield substantial returns in the forthcoming years.

Stock Advisor furnishes investors with a user-friendly roadmap to investment success, offering guidance on portfolio construction, regular analyst updates, and two fresh stock recommendations monthly. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500 index*.

Explore the 10 recommended stocks

*Stock Advisor returns as of February 20, 2024

John Ballard holds no positions in the mentioned stocks. The Motley Fool has no position in the mentioned stocks. The Motley Fool abides by a strict disclosure policy.

The perspectives and opinions shared in this piece are solely those of the author and may not necessarily align with those of Nasdaq, Inc.