DuPont de Nemours Inc’s DD Performance Building Solutions recently introduced Tyvek Trifecta, its newest generation breather membrane. The novel product provides great fire and moisture protection, making it an ideal choice for high-rise building external walls. It comes in a handy and lightweight 1.5m × 25m roll size.

Tyvek Trifecta is a non-combustible breather membrane that offers all of the benefits of a conventional Tyvek breather membrane, but with A2-s1, d0 Class Fire Performance according to the current European Fire Classification conventional EN 13501-1. It exceeds the current U.K. Building Regulations, which require membranes to meet Class B.

DuPont Tyvek Trifecta complements the DuPont AirGuard A2 FR AVCL, resulting in a comprehensive A-rated membrane system. The DuPont AirGuard FR System Tape improves the system’s fire and moisture protection characteristics, making it suitable for use in a variety of building types, including high-rises, single-story residences, commercial enterprises, hotels, hospitals and schools.

Tyvek Trifecta also has a 12-month UV resistance, allowing for project schedule flexibility while facilitating a flawless facade installation by safeguarding the structure during construction. Tyvek Trifecta provides outstanding moisture management capabilities, with Class W1 water resistance according to EN13859-2. Coupled with the product’s low vapor resistance, it makes an effective secondary weather protection layer in external wall systems.

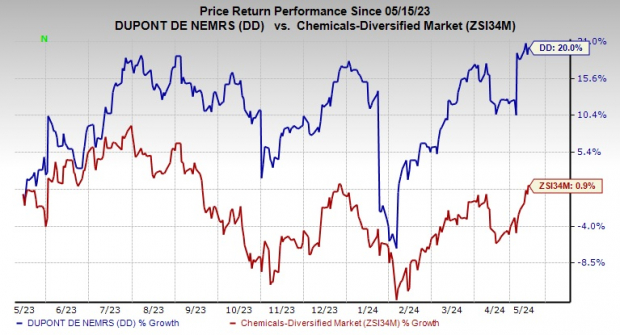

Shares of DuPont have gained 20% over the past year compared with a 0.9% rise of its industry.

Image Source: Zacks Investment Research

DuPont, on its first-quarter call, revised its financial outlook for 2024, increasing its projections for net sales, operating EBITDA and adjusted EPS. The company anticipates full-year 2024 net sales to be approximately $12.25 billion, operating EBITDA to be about $2.975 billion and adjusted EPS to be around $3.60 per share, based on the mid-point of the updated guidance.

For the second quarter of 2024, DuPont expects a sequential improvement in sales and earnings, attributed to favorable seasonal factors, continued recovery in the electronics sector and a decline in channel inventory destocking across industrial-based end-markets such as water and medical packaging. For the second half of 2024, the company expects year-over-year sales and earnings growth, driven by ongoing recovery in the electronics market and a return to volume growth in the Water & Protection segment.

DuPont de Nemours, Inc. Price and Consensus

DuPont de Nemours, Inc. price-consensus-chart | DuPont de Nemours, Inc. Quote

Zacks Rank & Key Picks

DuPont currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. ATI, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

ATI carrying a Zacks Rank #1 (Strong Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have soared 66.9% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company’s shares have soared 108.9% in the past year.

The Zacks Consensus Estimate for Ecolab’s current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company’s shares have rallied roughly 34.4% in the past year.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.