DuPont’s First-Quarter 2025 Outlook: Revenue Gains Amid Pricing Pressures

DuPont de Nemours, Inc. (DD) is set to release its first-quarter 2025 earnings before the market opens on May 2.

The company has consistently exceeded the Zacks Consensus Estimate over the last four quarters, achieving an average earnings surprise of approximately 16.1%. In the latest quarter, DuPont recorded an earnings surprise of about 15.3%.

DuPont’s performance is likely to have benefited from its strategic focus on innovation and recent acquisitions, specifically the Spectrum Plastics Group and Donatelle Plastics, despite facing challenges from declining prices in Q1.

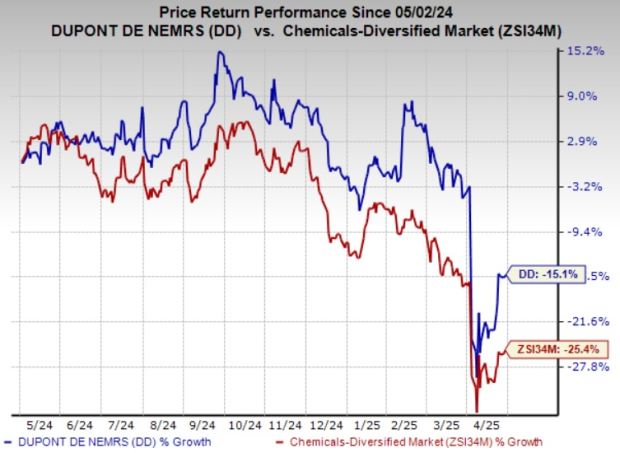

Over the past year, DD’s shares have dropped 15.1%, while the Zacks Chemicals Diversified industry has experienced a steeper decline of 25.4%.

Image Source: Zacks Investment Research

Let’s examine what to expect for this upcoming announcement.

Revenue Estimates for DuPont

The current Zacks Consensus Estimate for DuPont’s first-quarter revenues stands at $3,040 million, reflecting a year-over-year increase of 3.7%.

Specifically, revenue predictions for the Electronics & Industrial segment are set at $1,479.8 million, indicating an 8.4% rise year-over-year. The Water & Protection unit’s estimate is at $1,293.6 million, suggesting a modest 0.2% increase year-over-year.

Key Factors Impacting DuPont

DuPont is expected to have benefitted from its cost efficiency measures and innovative growth strategies in the reported quarter. The company is directing its investments towards high-growth sectors while aiming to enhance returns from R&D.

Additionally, DuPont likely achieved cost synergies and productivity improvements, targeting annualized savings of $150 million through various restructuring actions. The company’s price increases to counteract cost inflation are also expected to contribute positively.

The acquisitions of Spectrum Plastics and Donatelle Plastics are anticipated to enhance DuPont’s standing in the healthcare markets, solidifying its position in these sectors.

However, DuPont may also experience headwinds from lower prices affecting its sales and margins, similar to trends observed in the fourth quarter of 2024.

DuPont de Nemours, Inc. Price and EPS Surprise

DuPont de Nemours, Inc. price-eps-surprise | DuPont de Nemours, Inc. Quote

Earnings Predictions for DuPont

Our analysis indicates that predicting an earnings beat for DuPont this quarter is inconclusive. A positive earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) increases the chances of an earnings beat, but this is not the case for DuPont.

Earnings ESP: The earnings ESP for DD is currently -0.32%. The Zacks Consensus Estimate for this quarter stands at 95 cents.

Zacks Rank: DuPont holds a Zacks Rank of #4 (Sell).

Additional Basic Materials Stocks to Consider

Here are some companies within the basic materials sector that may warrant attention as they possess favorable conditions for potential earnings surprises:

ICL Group Ltd (ICL), expected to report on May 19, has an earnings ESP of +12.50% and a Zacks Rank of #3. The consensus estimate for ICL’s first-quarter earnings is currently 8 cents.

IAMGOLD Corporation (IAG), set to release earnings on May 6, reports a +9.96% earnings ESP and holds a Zacks Rank of #3. The consensus earnings estimate for IAG stands at 10 cents.

Kinross Gold Corporation (KGC), also announcing results on May 6, carries an earnings ESP of +11.07%. The consensus estimate for Kinross Gold’s first-quarter earnings is 22 cents, and it holds a Zacks Rank of #2.

For comprehensive insights about DuPont and relevant companies, additional analyses are available.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.