“`html

The average one-year price target for Dyadic International (NasdaqCM:DYAI) has been revised to $5.10 per share, reflecting a 25.00% increase from the prior estimate of $4.08 made on November 14, 2025. This new target represents a 436.84% rise from the latest closing price of $0.95 per share, with analyst targets ranging from a low of $5.05 to a high of $5.25.

As of now, 53 funds are reporting positions in Dyadic International, which is a decrease of 1 owner (1.85%) from the last quarter. Institutional ownership has increased by 20.62% over the past three months, totaling 6,415K shares. The average portfolio weight allocated to DYAI among these funds stands at 0.02%, up by 17.30%.

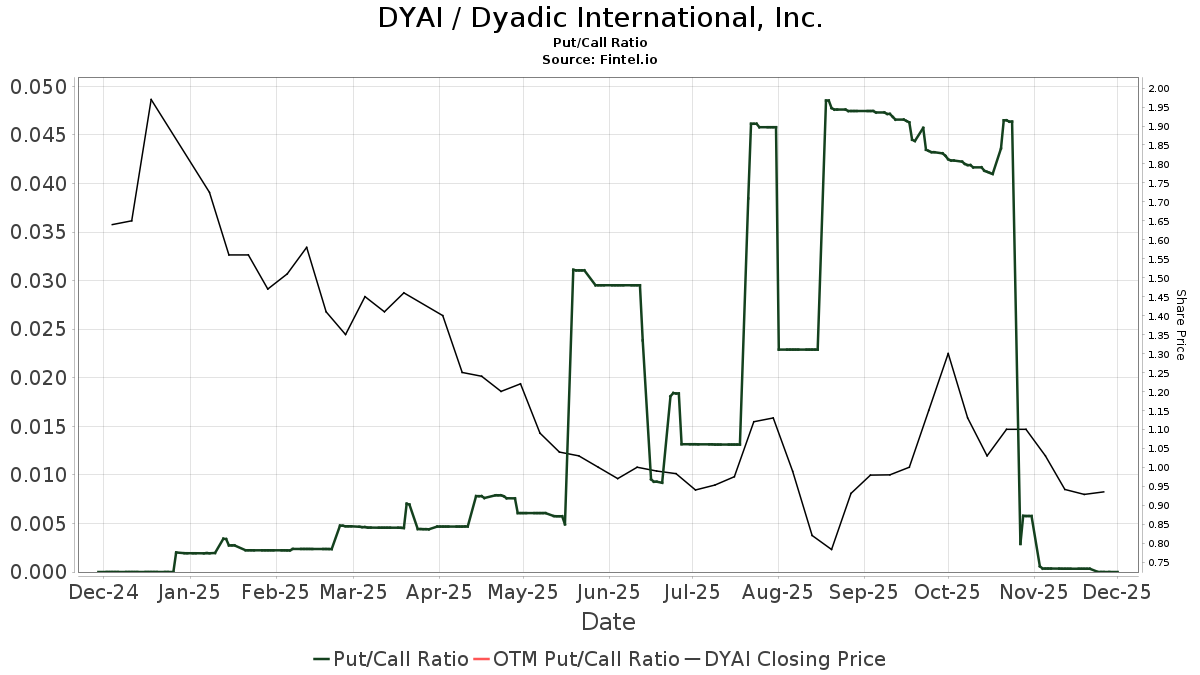

Major shareholders include Apis Capital Advisors with 1,540K shares (4.26% ownership), Chapin Davis with 932K shares (2.58% ownership, up 5.27%), and Perkins Capital Management with 348K shares (0.96% ownership, up 86.25%). The put/call ratio for DYAI is at 0.00, indicating a bullish market sentiment.

“`