Market Dynamics Shift Amidst Turbulent Oil and Gas Landscape

President Donald Trump has instigated significant changes in the oil and gas exploration and production sectors, collectively known as upstream. This environment, which can be likened to a river where fossil fuels flow from extraction to refining, requires investors to understand the intricate hierarchy of the hydrocarbon supply chain. Fossil fuels are first extracted, then transported (midstream), and finally refined before reaching consumers (downstream).

Investments in the exploration and production segment are often closely tied to benchmark indices like West Texas Intermediate and Brent Crude futures. Additionally, domestic and global energy policies can greatly influence demand, introducing both rewards and risks for investors.

The competition for control within the hydrocarbon sector remains intense. Despite fluctuations this year in oil prices, catalysts for change may lie ahead. Notably, Russia’s invasion of Ukraine presents complex challenges for global oil supply chains, influencing market dynamics.

Recently, President Trump has warned of potential “secondary tariffs” on countries buying Russian oil, reflecting deepening geopolitical tensions. Furthermore, the OPEC+ cartel’s power to implement production cuts remains a critical factor that can manipulate prices upwards.

Oil market bulls, however, have significant challenges ahead. Oil prices for both West Texas and Brent have sharply declined since January, indicating a serious demand downturn. Economic forecasts are not optimistic, with some experts warning that Trump’s trade policies could push the economy into recession, dampening demand for hydrocarbons.

Adding to these difficulties, the U.S. oil industry is increasing production levels, which further suppresses prices. The shale sector, in particular, is responding to the call to “drill, baby, drill” initiated by Trump. Although this push may bolster political narratives, it does not alleviate the downward pressure on hydrocarbon prices.

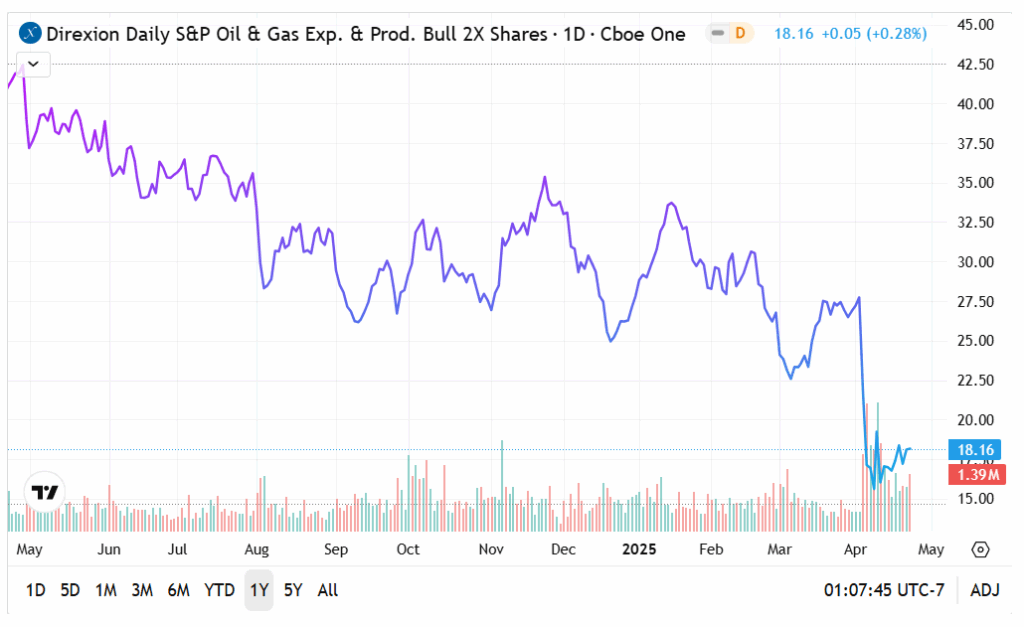

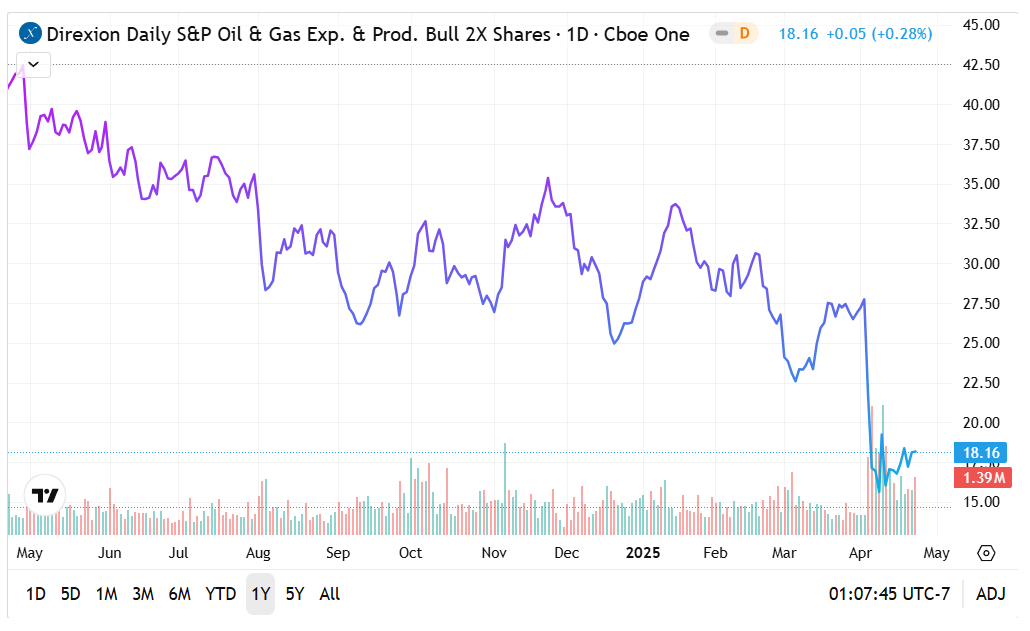

Direxion ETFs Offer High-Risk, High-Reward Options: For investors willing to navigate this volatile landscape, financial services provider Direxion presents two leveraged investment options. The Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares GUSH aims to achieve daily returns that correspond to 200% of the S&P 500 Oil & Gas Exploration & Production Select Industry Index’s performance.

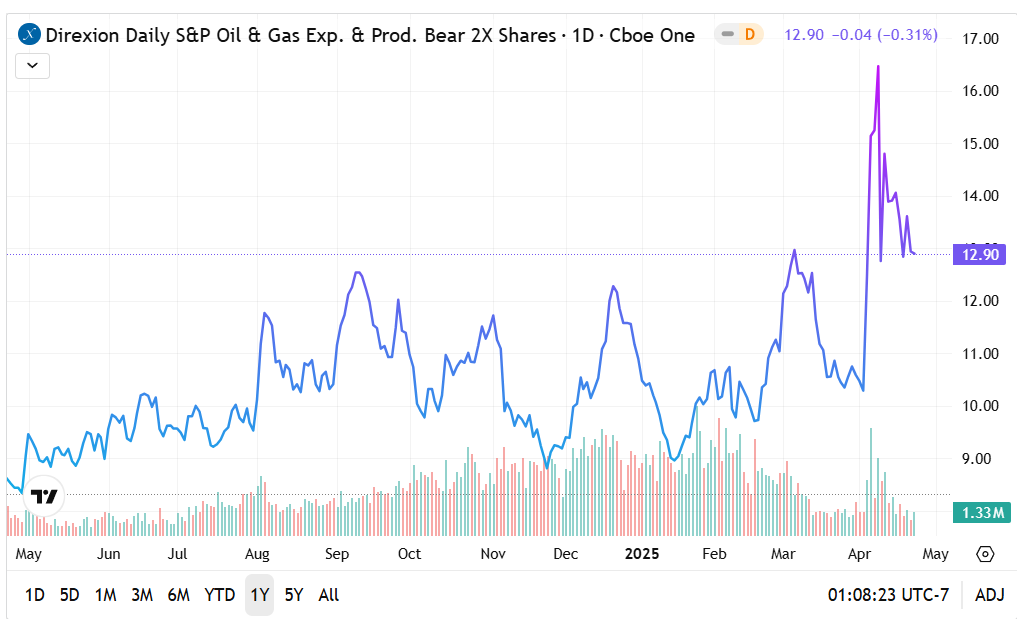

Conversely, those with a bearish outlook can consider the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares DRIP, which seeks 200% of the inverse performance of the same index.

Both ETFs simplify the process for speculators to utilize leverage or engage in short trading without the complexities associated with options trading. Investors can buy and sell shares of these ETFs much like any other publicly traded stock.

However, investors should exercise caution when participating in these leveraged funds. The 200% leverage inherently increases volatility. Additionally, these ETFs are designed for short-term trading and should not be held beyond one day, as this can lead to performance drag due to daily compounding effects.

Performance Review: GUSH ETF: The Direxion GUSH ETF has struggled at the start of the year, experiencing a decline of nearly 35% in market value.

- Over the past two months, GUSH has shown a “5-5” pattern with five weeks of gains and five weeks of losses, resulting in a net negative trend.

- Due to this decline, a potential upcoming “6-4” pattern may also reflect a negative bias, suggesting low chances for recovery.

Performance Review: DRIP ETF: In contrast, the Direxion DRIP ETF has performed well, boasting an over 18% increase.

- It has also recorded a “5-5” performance sequence, but this time with a positive trend. However, historical data suggests that this pattern comes with slightly negative odds.

- Should DRIP achieve a “6-4” sequence, traders may remain hesitant to buy due to concerns about overcrowding in the bear market.

Featured image by AdmiralFox from Pixabay.