DZ BANK Boosts Zurich Insurance Group to “Hold” Amid Mixed Financial Outlook

Analyst Price Target Forecast Indicates Slight Drop

On January 5, 2025, DZ BANK raised their rating for Zurich Insurance Group (SWX:ZURN) from Sell to Hold. As of December 23, 2024, the average one-year price target sits at CHF 541.68 per share. Following this forecast, estimates range from a low of CHF 434.30 to a high of CHF 632.10. This average reflects a projected decrease of 1.15% from the latest reported closing price of CHF 548.00 per share.

Projected Revenue Decline for Zurich Insurance Group

The anticipated annual revenue for Zurich Insurance Group stands at CHF 68,441 million, indicating an 11.07% drop. Additionally, the projected annual non-GAAP earnings per share (EPS) is CHF 45.10.

Steady Dividend Yield Maintained

Zurich Insurance Group is currently delivering a dividend yield of 4.74%. The company maintains a payout ratio of 0.77, signifying that 77% of its income is allocated for dividends. This ratio indicates a balanced approach to distributing earnings, with a payout ratio of one (1.0) indicating full income payouts. A ratio exceeding one means the company is utilizing reserves to sustain its dividend, which may not reflect an ideal financial condition.

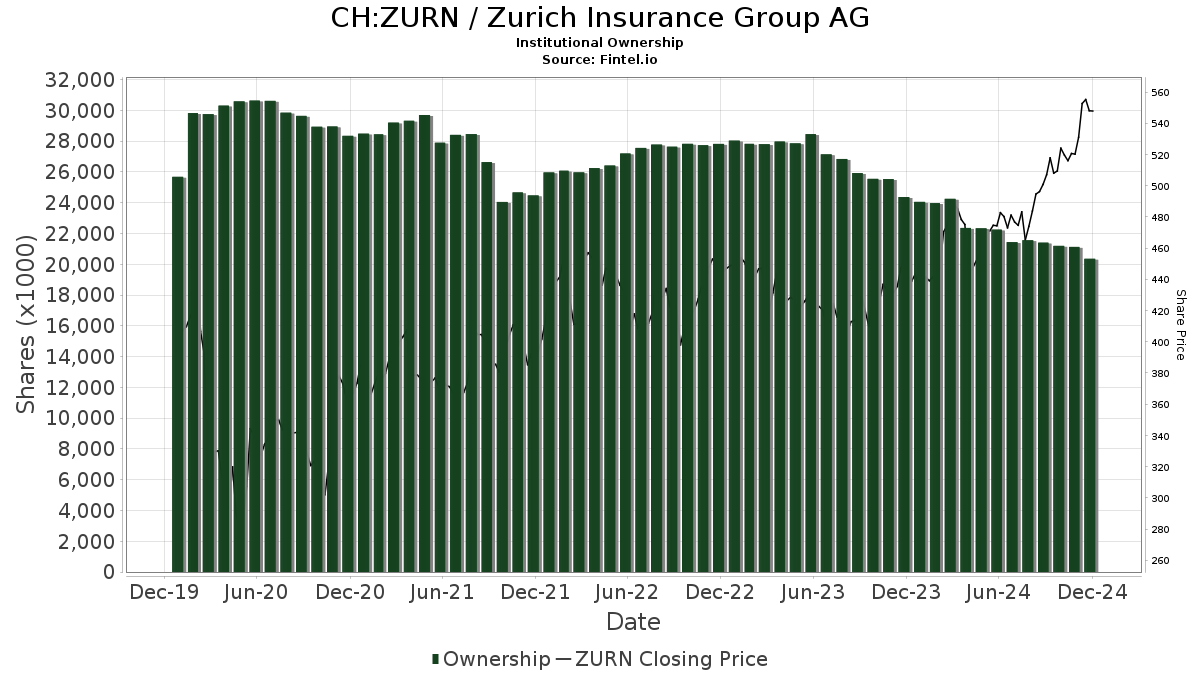

Institutional Sentiment Remains Stable

As of now, there are 421 funds or institutions reporting positions in Zurich Insurance Group, with no changes noted from the previous quarter. The average portfolio weight for funds involved with ZURN is 0.63%, showing a 5.55% increase. However, total institutional shares owned decreased by 3.89% over the last three months, now totaling 20.37 million shares.

Details on Institutional Shareholdings

VGTSX – Vanguard Total International Stock Index Fund Investor Shares now holds 2.009 million shares, a 1.40% ownership, up from 2.003 million shares prior, marking a 0.30% increase. The firm boosted its portfolio allocation in ZURN by 7.45% over the past quarter.

CWGIX – Capital World Growth & Income Fund holds 1.957 million shares with 1.36% ownership, down from 1.981 million shares in the last report, reflecting a decrease of 1.21%. This fund has increased its ZURN allocation by 5.40% in the last quarter.

CAIBX – Capital Income Builder currently owns 1.539 million shares, representing 1.07% ownership. Previously, the fund reported ownership of 1.996 million shares, indicating a decrease of 29.70%, and a 17.51% reduction in ZURN allocation.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares has increased its shareholding to 1.231 million shares (0.86% ownership), up from 1.211 million shares, which is a 1.61% increase in portfolio allocation for ZURN.

IEFA – iShares Core MSCI EAFE ETF holds 900,000 shares, reflecting a 0.63% ownership, with an increase from 877,000 shares, showcasing a 2.59% growth in its portfolio allocation.

Fintel is a leading investment research platform designed for individual investors, financial advisors, and small hedge funds. Our extensive data suite includes fundamentals, analyst ratings, ownership insights, and more.

This report originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.