Eagle Materials Inc. EXP reported tepid fourth-quarter fiscal 2024 (ended Mar 31, 2024) results, wherein earnings and revenues missed the Zacks Consensus Estimate. On a year-over-year basis, the bottom declined, but the top line increased.

The company’s results reflect higher gross sales price and sales volume in the Heavy Materials segment. Adverse weather and increased maintenance costs impacted the Cement and Concrete and Aggregates.

Following the announcement, the company’s shares dropped 5.7% during trading hours on May 21.

EXP expects solid fundamentals in fiscal 2025 markets. Large-scale infrastructure spending and domestic manufacturing projects should boost cement demand. Stabilizing mortgage rates and a housing supply shortage are anticipated to increase residential construction activity. EXP is well-positioned to capitalize on these trends due to its geographical footprint across the U.S. heartland and the Sun Belt.

Inside the Headlines

Eagle Materials reported earnings of $2.24 per share, missing the Zacks Consensus Estimate of earnings of $2.72 by 17.7%. Also, the metric declined 20% from the year-ago quarter’s earnings level of $2.79.

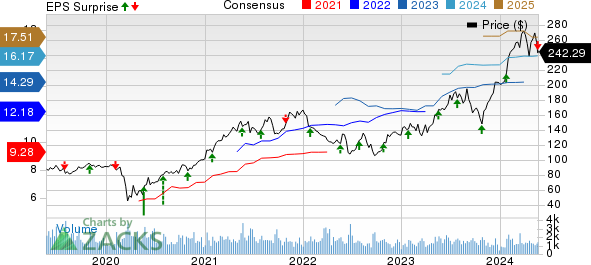

Eagle Materials Inc Price, Consensus and EPS Surprise

Eagle Materials Inc price-consensus-eps-surprise-chart | Eagle Materials Inc Quote

Quarterly revenues of $467.7 million missed the consensus mark of $478.6 million by 0.4%. However, the metric inched up 1% from the year-ago period’s value of $470.1 million.

Segmental Discussion

Heavy Materials (including cement, concrete and aggregates): This segment reported fiscal fourth-quarter revenues of $238.1 million, which increased 5.4% from $225.9 million reported a year ago. However, the segment’s operating profit decreased 24.3% year over year to 36.3 million.

Within the Heavy Materials umbrella, Cement’s revenues (excluding Joint Venture and intersegment revenue) rose 9.6% to $189.4 million from the year-ago quarter’s value of $172.8 million. The sales volume of Cement increased 2% year over year to 1,323 metric tons from 1,296 metric tons. Also, the average net sales price per ton moved up 5% to $154.59 year over year.

Concrete and Aggregates’ revenues decreased 8.3% year over year to $48.7 million from $53.1 million. The sales volume of Concrete declined 19% to 273 metric cubic yards, while the same for Aggregates grew 22% to 702 metric tons on a year-over-year basis. The average net sales price for Cement (per cubic yard) and Aggregates (per ton) were $148.60 and $11.53, up 9% and down 12%, respectively, from the year-ago period’s tally.

Light Materials (including gypsum wallboard and recycled paperboard): This segment’s revenues were $238.6 million, down 2.3% year over year from $244.2 million. The segment’s operating profit declined 7.2% year over year to 92.2 million.

Under the Light Materials’ umbrella, the quarterly revenues of Gypsum Wallboard were $210.2 million, down 4.2% from $219.5 million reported in the year-ago quarter. The sales volume dwindled 1% to 747 million square feet, and the average net sales price per thousand square feet declined 3% to $232.62 on a year-over-year basis.

Recycled Paperboard’s revenues grew 14.6% year over year to $28.4 million from $24.7 million. The sales volume also reflected an uptrend of 8% to 86 metric tons from 80 metric tons reported in the year-ago quarter. On the other hand, the average net sales price per ton increased 3% to $567.55 from $550.52 reported in the prior year.

Operating Highlights

The gross profit of Eagle Materials fell 11.6% year over year to $119.7 million. The gross margin was 25.1%, which deceased 370 bps year over year from 28.8%. Adjusted EBITDA of $154.4 million decreased 10% year over year.

Fiscal 2024 Highlights

Adjusted EPS was $13.61, up 9% from the fiscal 2023 levels. Revenues of $2.3 billion increased 5% from the fiscal 2023 tally. Adjusted EBITDA of $834.4 million rose 7% year over year.

Liquidity and Cash Flow

As of Mar 31, 2024, Eagle Materials had cash and cash equivalents of $34.9 million compared with $15.2 million at the fiscal 2023-end. Long-term debt was $71 million, up from $66.5 million as of the fiscal 2023-end.

Zacks Rank & Recent Construction Releases

Eagle Materials currently sports a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

UFP Industries, Inc. UFPI reported mixed results for the first quarter of 2024. Earnings beat the Zacks Consensus Estimate, but net sales missed the same. The top and the bottom line declined on a year-over-year basis. Lower pricing and organic unit sales hurt the company’s quarterly results.

UFPI’s adjusted EBITDA of $180.8 million declined 10.5% year over year. Adjusted EBITDA margin also contracted 10 bps from the prior year to 11%.

Boise Cascade Company BCC reported solid first-quarter 2024 results, with earnings and sales topping the Zacks Consensus Estimate and increasing year over year. The uptrend in the company’s results was attributable to the seasonal tailwinds and strength in new single-family housing starts, resulting in sales volume growth. These factors led to increased contributions from BCC’s two reportable segments.

BCC remains optimistic about the increasing trajectory of single-family housing starts, given the low supply of existing single-family homes, as this metric is the key driver of its sales. Also, it aims to effectively allocate its capital and ensure shareholder value, along with fostering its growth.

Owens Corning OC reported impressive results in first-quarter 2024, with earnings and net sales surpassing the Zacks Consensus Estimate. Earnings increased on a year-over-year basis despite a net sales decline. Sales declined due to lower sales volumes in the Insulation and Composites segments.

For the second quarter of 2024, Owens Corning expects net sales to be in line with the second quarter of 2023 while generating approximately 20% EBIT margins.

Free – 5 Dividend Stocks to Fund Your Retirement

Zacks Investment Research has released a Special Report to help you prepare for retirement with 5 diverse stocks that pay whopping dividends. They cut across property management, upscale outlets, financial institutions, and a couple of strong energy producers.

5 Dividend Stocks to Include in Your Retirement Strategy is packed with unconventional wisdom and insights you won’t get from your neighborhood financial planner.

Download Now – Today It’s FREE >>

UFP Industries, Inc. (UFPI) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.