Next week’s slate of earnings reports won’t be the most numerous, but it is certainly the most significant. Five of the ‘Magnificent Seven’ stocks are set to share some of the most valuable economic data in the world, with the two largest American energy companies also taking the stage.

So far, the earnings season has painted a generally upbeat picture, with the majority of stocks besting both earnings and revenue estimates.

Impending Tech Reports

According to the Zacks Earnings Trend Report by research head Sheraz Mian, the total Q4 earnings for the Technology sector are expected to be up +18.7% from the same period last year on +6.8% higher revenues. The impact of the strong Tech sector contribution on Q4 earnings for the rest of the index is remarkable.

The ‘Big 7 Tech Players’ – Amazon (AMZN), Alphabet (GOOGL), Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) – are scheduled to start reporting Q4 results in the next few days. Total Q4 earnings for the group are projected to be up +38.3% from the same period last year on +12.5% higher revenues, following a substantial 2023 Q3 growth.

These figures are stunning, considering the significant portion these mega-cap tech stocks occupy within the S&P 500. The remarkable sales and earnings growth they are posting is simply undeniable.

Earnings from Microsoft (MSFT) and Alphabet (GOOGL) are expected after the market closes on Tuesday, while Apple (AAPL), Amazon (AMZN), and Meta Platforms (META) are due to report on Thursday.

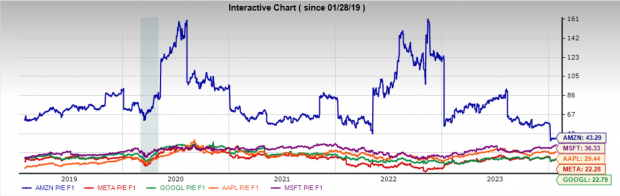

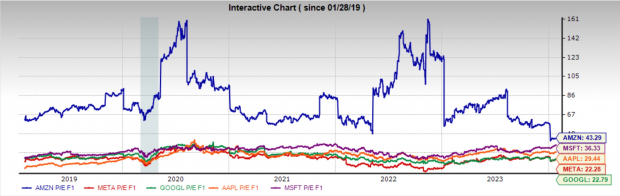

It’s worth noting the valuations of the five tech stocks set to report next week. None of them have outlandish valuations, with a couple being quite appealing. Amazon and Microsoft lead in forward earnings multiples, while Meta Platforms and Alphabet are at the opposite end of the spectrum, with Apple falling in the middle.

Image Source: Zacks Investment Research

Based on valuations, Meta Platforms and Alphabet appear quite appealing, while Microsoft and Apple may need to work off their premium multiples before becoming as attractive. Amazon also appears attractive based on its high earnings growth expectations.

It’s also interesting to note that Microsoft, Amazon, and Meta Platforms hold a Zacks Rank #2 (Buy), while Apple and Alphabet have a Zacks Rank #3 (Hold) rating.

Energy Sector Prospects

Conversely, the earnings expectations for energy stocks are diametrically opposed to the tech sector. The sectors anticipated to experience the most significant earnings declines in Q4 include Autos, Basic Materials, Medical, Energy, and Transportation.

Energy stocks have faced challenges over the past year, primarily due to the stabilizing of oil prices. Following the onset of the Ukraine-Russia conflict and the easing of inflation, the price of crude oil has markedly decreased from the highs of $130 to $78, with sporadic spikes up to $95.

Despite the expected year-over-year earnings decline, this sector continues to hold appeal and is worth considering for potential investments.

On Friday, US oil majors Exxon Mobil (XOM) and Chevron (CVX) will report earnings before the market opens.

The Case for Investing in Energy Stocks

The Numbers

When considering the historical valuation of energy stocks, it’s hard to ignore their attractiveness. Both Exxon Mobil and Chevron are currently trading at approximately 10 times forward earnings, a considerable drop from their three-year highs near 30 times. What’s more, they are both below their 10-year medians, standing at around 17.7 times.

The Appeal

Chevron and Exxon Mobil also boast hefty dividends of 4% and 3.7% respectively, combined with structural tailwinds. These tailwinds include a widespread underinvestment in oil and gas infrastructure, which is likely to keep oil supply low for the foreseeable future.

Holding Steady

Both Exxon Mobil and Chevron currently have a Zacks Rank #3 (Hold) rating.

Image Source: Zacks Investment Research

Final Thoughts

The energy and technology sectors offer two very different outlooks regarding earnings, yet both may be appealing based on valuations. Since they are critical industries in the country, it would be prudent for discerning investors to hold a mix of stocks from both sectors.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.