AI Giants ARM Holdings and Super Micro Face Earnings Season Challenges

The 2025 Q1 earnings season continues to unfold, featuring various companies on the reporting docket this week. Notably, two significant players in the artificial intelligence sector, Super Micro Computer (SMCI) and ARM Holdings (ARM), will report their results. The AI enthusiasm has cooled in 2025, as many investors take profits, reevaluating their strategies in light of recent tariff developments and other economic factors.

What does the landscape look like for these companies as they approach their respective earnings releases? Here’s an analysis of evolving expectations.

ARM Growth to Remain Robust

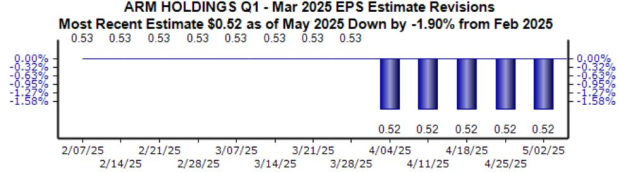

ARM specializes in designing and licensing high-performance, cost-effective, and energy-efficient CPU technology, essential for major semiconductor firms and OEMs. Analysts have slightly reduced their EPS expectations for the upcoming quarter, with the current Zacks Consensus estimate at $0.52, reflecting a 44% year-over-year growth.

Image Source: Zacks Investment Research

Sales are also projected to be strong, with expectations set at $1.2 billion, indicating a 33% increase from last year. The broader AI momentum has contributed significantly to this growth, as illustrated in the quarterly sales chart below.

Image Source: Zacks Investment Research

SMCI Expectations Plunge

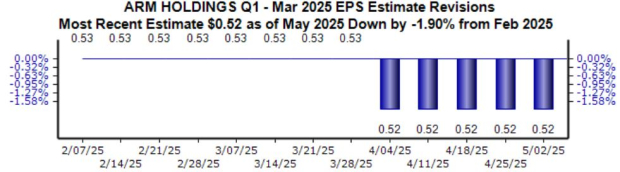

Super Micro Computer offers comprehensive IT solutions for AI, cloud, storage, and 5G/edge services, explaining the significant interest in its stock lately. So far in 2025, SMCI shares have outperformed, registering a 5% gain against a 3% decline in the S&P 500. However, quarterly reports have often prompted considerable volatility, and a similar outcome is anticipated this release.

Image Source: Zacks Investment Research

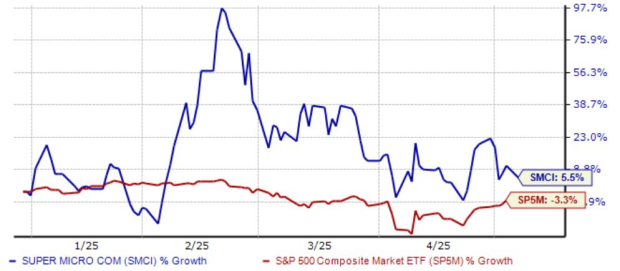

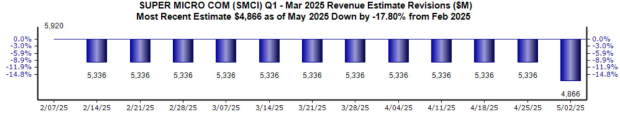

Currently, sentiment among analysts has turned negative for the upcoming earnings release, with the Zacks Consensus EPS estimate falling to $0.30, down over 50% since early February. Revenue predictions have also decreased, with a current estimate of $4.9 billion, an 18% drop during the same period.

Image Source: Zacks Investment Research

A table illustrating the recent top-line revisions is provided below.

Image Source: Zacks Investment Research

Despite the negative revisions, valuation multiples have become more attractive. Currently, shares trade at an 11.0X forward 12-month earnings multiple, compared to a five-year median of 14.1X, representing a 47% discount relative to the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

The 2025 Q1 earnings cycle features a packed lineup, with AI key players Super Micro Computer (SMCI) and ARM Holdings (ARM) scheduled to report.

Analysis indicates that ARM is heading into its release with a more favorable outlook than SMCI, which is seeing declines in both revenue and earnings expectations. However, forward guidance will be crucial in determining market reactions for both stocks, especially given the ongoing uncertainties from tariff discussions and other economic factors.