As the calendar turns from January to February, the upcoming week promises a deluge of earnings reports from some of the planet’s mightiest companies by market capitalization. Among the much-anticipated releases are updates from tech juggernauts Microsoft, Amazon, Meta Platforms, Apple, and Alphabet. In addition, there will be reports from diverse sectors such as coffee giant Starbucks, aerospace and defense giant Boeing, payment processor Mastercard, major pharmaceutical players Pfizer, AbbVie, Novartis, and Merck, as well as energy sector giants Chevron and Exxon Mobil. Furthermore, investors can expect insights into the automotive industry with updates from General Motors and the semiconductor sector, featuring stalwarts like Advanced Micro Devices and Qualcomm. The upcoming week’s earnings releases are poised to provide a comprehensive snapshot of the financial landscape across various key sectors.

Below is a rundown of the major quarterly updates anticipated in the week of January 29 to February 2.

Monday, January 29

SoFi Technologies (NASDAQ:SOFI)

SoFi Technologies, an online personal financing firm, is set to announce its Q4 earnings results on Monday before the market opens. The stock has experienced a 23% decline since the start of 2024. Meanwhile, it has received a Hold rating from both sell-side analysts and Seeking Alpha’s Quant rating system, which flags profitability as a chief concern.

Despite the stock’s pullback in recent weeks, JR Research, a SA Investing group leader, suggests that investors should closely monitor SoFi’s price action and improved fundamentals. With these as evidence, the analyst argued that there may not be a need for undue concern.

- Consensus EPS Estimates: Nil

- Consensus Revenue Estimates: $571.51M

- Earnings Insight: The company has exceeded revenue in 100% of the past 8 quarters, missing EPS only once in that time frame.

Also reporting: Cleveland-Cliffs, Nucor, Whirlpool, Philips, Super Micro Computer and more.

Tuesday, January 30

Alphabet (GOOG) (GOOGL)

Alphabet (GOOG) is scheduled to announce its Q4 results during Tuesday’s post-market session. The parent company of Google has displayed remarkable stock performance over the past year, boasting over 58% growth in the past twelve months. This has outpaced the S&P 500’s approximately 22% advance since January 2023.

Looking at the firm’s projected results, analysts anticipate a 50% bottom-line increase, fueled by AI enthusiasm and layover buzz.

- Consensus EPS Estimates: $1.60

- Consensus Revenue Estimates: $85.23B

- Earnings Insight: Google has topped EPS expectations in 4 of the past 8 quarters, beating revenue estimates in 5 of those reports.

Microsoft (MSFT)

Scheduled to detail its quarterly performance after the closing bell on Tuesday, Microsoft follows Alphabet in the earnings lineup. Microsoft has outperformed the broader market by an even wider margin than GOOG. Shares of the software giant have showcased over 68% growth in the past year.

While Seeking Alpha’s Quant Rating system maintains a cautious Hold outlook, Wall Street analysts continue to express optimism with a Strong Buy rating.

- Consensus EPS Estimates: $2.76

- Consensus Revenue Estimates: $61.1B

- Earnings Insight: Microsoft has outperformed EPS forecasts in 7 of the last 8 quarters and revenue in 6 of those quarters.

Also reporting: Advanced Micro, Pfizer, Starbucks, General Motors, UPS, Corning, Electronic Arts, Danaher, Cameco, Mondelez Int’l, Stryker, JetBlue Airways, Teradyne, Sysco, Match Group, Chubb, Juniper Networks, PulteGroup and more.

Wednesday, January 31

Boeing (BA)

Boeing is preparing to report Q4 results before the opening bell on Wednesday. The Virginia-based industrial and defense giant has seen a 23% drop in shares since the start of 2024, prompting a Hold rating from Seeking Alpha’s Quant Rating system due to valuation concerns. In contrast, Wall Street analysts maintain a Buy rating.

Market Anticipates Earnings Reports Amid Economic Fluctuations

Thursday, February 1

Meta Platforms (META)

As the goliath behemoths of industry ready their financial reports, a sense of both trepidation and optimism looms in the air. Meta Platforms, formerly known as Facebook, after a sterling performance in Q3, has projected Q4 revenue within the range of $36.5B to $40B. Although concerns surrounding a weak outlook for advertising revenue have cast a shadow, the company’s cost-cutting measures and a resurgence in ad income have catapulted the stock’s performance, resulting in a significant 177% gain over the past year.

- Consensus EPS Estimates: $4.99

- Consensus Revenue Estimates: $39.09B

- Earnings Insight: Meta has surpassed EPS expectations in 4 of the past 8 quarters and exceeded revenue estimates in 6 of those instances.

Amazon (AMZN)

The e-commerce and cloud giant Amazon, renowned for its disruptive impact on traditional retail, is set to unveil its Q4 earnings after the market closes on Thursday. Despite a consensus Strong Buy rating from Wall Street analysts, the company’s status, as assessed by the Seeking Alpha Quant Ratings system, is Hold. Over the past year, Amazon shares have witnessed a staggering 62% increment in value.

SA contributor Bradley Guichard, taking a bullish stance on the stock, contends that Amazon is historically undervalued, currently trading 17% below its all-time high. Guichard opines that the current price does not fully capture the company’s potential.

- Consensus EPS Estimates: $0.79

- Consensus Revenue Estimates: $166.25B

- Earnings Insight: Amazon has surpassed revenue and EPS expectations in 5 of the previous 8 quarters.

Apple (AAPL)

The California-based tech giant Apple is poised to release its Q1 earnings post-market on Thursday. With AAPL shares having surged over 35% in the past year, maintaining a stable market value of $3 trillion, the stock has experienced a sharp ascent in the first half of 2023 followed by a plateau in recent months.

Amidst mixed projections, analysts foresee a rise in earnings per share year over year, while revenue is expected to remain nearly stagnant. Despite Wall Street’s Buy rating, the Seeking Alpha Quant Rating system raises concerns about growth and valuation, assigning a Hold rating.

In China, Apple has emerged as the leading phone seller, securing a 17.3% market share in 2023 according to IDC. Although iPhone shipments experienced a marginal decline of 2.1% in Q4, Apple managed to outperform Vivo for the entire year.

Anticipated sales pressures in 2024 are attributed to intensified competition, limited product upgrades impacting high-end market share, and reduced iPhone appeal. Despite these headwinds, Apple sustained demand through discounts and promotions offered via third-party distribution channels.

SA author Geoffrey Seiler highlights Apple’s significant success over the past decade and five years. However, he underscores potential risks for the company, particularly in its high-margin revenue streams—the app store and search default revenue.

While not predicting an imminent loss of these revenue sources, Seiler expresses concerns about the stock’s valuation. He deems it unattractive given the potential risks the company is facing.

- Consensus EPS Estimates: $2.10

- Consensus Revenue Estimates: $118.26B

- Earnings Insight: Apple has surpassed EPS estimates in 7 of the past 8 quarters but missed revenue expectations in 3 of those reports.

Also Reporting

Altria (MO), Merck (MRK), Enterprise Products (EPD), Barrick (GOLD), Honeywell (HON), Peloton (PTON), U.S. Steel (X), Sirius XM (SIRI), Sanofi (SNY), Royal Caribbean (RCL), Clorox (CLX), Cardinal Health (CAH), Atlassian (TEAM), First Majestic Silver (AG), Illinois Tool (ITW), Canadian Natural Resources (CNQ) and more.

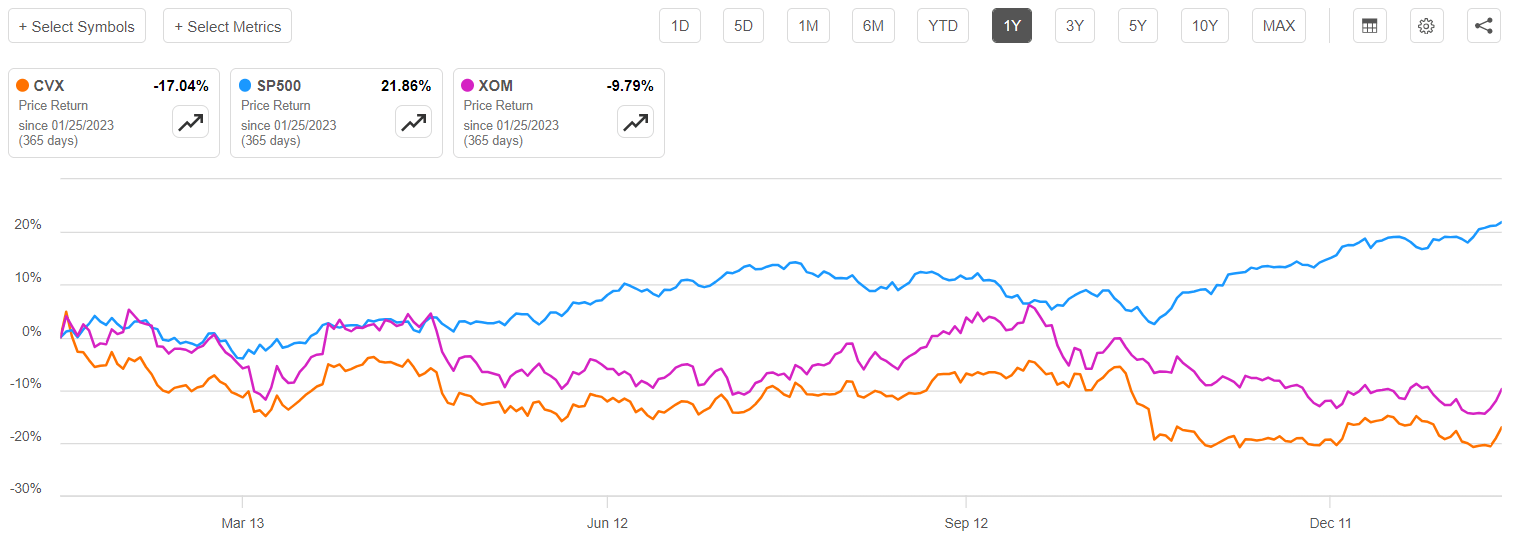

Friday, February 2

Oil giants Chevron (CVX) and Exxon Mobil (XOM) are set to unveil their Q4 earnings before the market opens on Friday. Despite trailing the broader market index, Seeking Alpha’s Quant Rating system maintains a cautious stance with a Hold rating for both stocks. In contrast, Wall Street analysts uphold an optimistic outlook, assigning a Buy rating to both.

Amidst prevailing market conditions and escalating crude oil prices, analysts anticipate a year-over-year decline in earnings per share and revenue for both CVX and XOM.

Last week, TD Cowen downgraded Chevron to Market Perform along with a reduced price target of $150, citing execution concerns. Conversely, TD Cowen upgraded Exxon Mobil to Outperform, setting a $115 price target, spotlighting the stock’s decline and unchanged valuation.

SA Investing Group leader Danil Sereda maintains a bullish stance on Exxon Mobil, citing the anticipated growth in the integrated oil and gas industry due to supply-side measures and a resurgence in crude oil consumption. He emphasizes XOM’s allure with organic growth opportunities, the impending acquisition of Pioneer Natural Resources, and the potential for cash returns and dividend growth.

Also reporting: Bristol-Myers (BMY), Enbridge (ENB), Regeneron Pharma (REGN), Brookfield Renewable Partners (BEP), The Cigna Group (CI), Grainger (GWW) and more.