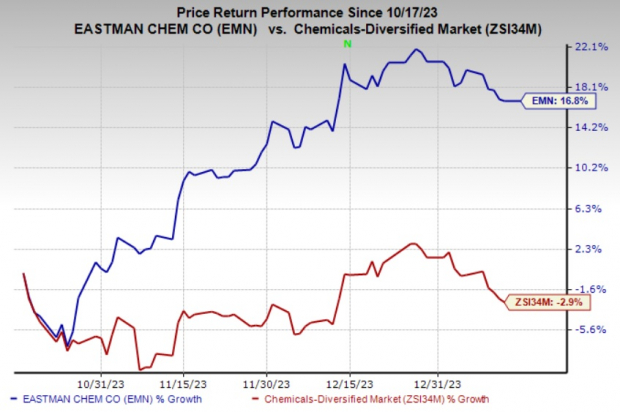

Eastman Chemical Company’s (EMN) shares have seen a remarkable upswing, registering a robust 16.8% surge over the past three months. This impressive performance has not only outshone its industry, which incurred a decline of 2.9% during the same period, but also surpassed the S&P 500’s 10.5% rise. Certainly, this calls for an in-depth examination into the driving forces behind this remarkable ascent.

Image Source: Zacks Investment Research

What’s Fueling EMN’s Growth?

One of the key factors propelling Eastman’s upward trajectory is its concerted effort in cost management. The company is anticipated to reap the rewards of lower operational costs stemming from its operational transformation program. Notably, in 2022, Eastman managed to counterbalance $1.3 billion due to inflation from amplified raw material, energy, and distribution costs by implementing strategic price hikes. Furthermore, it is expected to achieve a reduction of more than $200 million in manufacturing, supply chain, and non-manufacturing costs for 2023, net of inflation. Such pricing measures, alongside reduced raw material and energy costs, are likely to provide substantial support to the company’s bottom line.

Additionally, Eastman’s unwavering commitment towards leveraging its innovation-driven growth strategy to bolster new business revenues remains a notable contributor to its success. Its proficiency in specialty products bore fruit, with the generation of approximately $550 million in new business revenues in 2022. This, coupled with its innovation and market development initiatives, is slated to fortify the sales volumes.

Eastman Chemical also remains steadfast in its disciplined approach to capital allocation, with its operating cash flow witnessing a more than twofold surge year over year to $514 million in the third quarter of 2023. The company, in the same quarter, returned $94 million to shareholders through dividends and share repurchases, reflecting its commitment to delivering value to its investors. Further underscoring its robust cash flow generation, Eastman anticipates delivering $1.4 billion in operating cash flow in 2023. Most recently, the company marked its 14th consecutive year of dividend increase, a testament to the board’s confidence in its robust earnings and robust cash flow generation.

Eastman Chemical Company Price and Consensus

Source: Zacks.com

Stocks to Consider

While Eastman’s growth story is impressive, other top players to consider in the basic materials space include Cameco Corporation (CCJ), Carpenter Technology Corporation (CRS), and Cabot Corporation (CBT).

Notably, Cameco has a projected earnings growth rate of 184% for the current year, with the consensus estimate for its current-year earnings receiving an 18.3% upward revision over the past 60 days. On the other hand, Carpenter Technology’s current fiscal year earnings are pegged at $3.96, indicating a substantial year-over-year surge of 247.4%. Moreover, Cabot Corporation’s consensus estimate for the current fiscal year stands at $6.58, with a year-over-year rise of 22.3%. These growth expectations coupled with favorable Zacks Ranks make these stocks worth considering.

It’s also worth noting that Zacks Investment Research recently released its list of Top 10 Stocks for 2024, handpicked by the Director of Research, Sheraz Mian. This exclusive portfolio is backed by a stellar track record, having gained nearly +974.1% from its inception in 2012 through November 2023, nearly tripling the S&P 500’s +340.1% return. Are you ready to explore these high-potential stocks for 2024?

Discover the latest recommendations from Zacks Investment Research. Tap into the prolific research insights and maximize your investment portfolio today!

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.