Innovative Partnership Boosts Home Energy Solutions

Envision a symphony of energy efficiency as Eaton Corporation plc collaborates with Tesla Inc. to revolutionize home energy storage and solar installations. By combining Tesla’s Powerwall with Eaton’s cutting-edge AbleEdge smart breakers, this partnership is set to empower homeowners with intelligent load management capabilities. Picture a dance between renewable energy sources and dynamic energy load management, allowing users to optimize energy consumption and increase backup power during grid outages.

As the energy landscape shifts towards renewables, homeowners seek independence from the traditional power grid. Eaton and Tesla stand at the forefront of this transition, ushering homeowners and installers towards a new era of energy management by embracing renewables and intelligent load handling technologies.

Eaton’s Home Energy Revolution

Eaton’s Everything as a Grid philosophy paves the way for homes to become bi-directional energy hubs, producing and sharing renewable energy. Long gone are the days when power flowed unidirectionally from a central grid; today, homeowners can actively participate in the energy ecosystem by generating their own electricity and contributing to grid stability.

With the rise of electrification across various sectors, Eaton focuses on developing flexible energy systems that efficiently manage power consumption. Bidirectional energy flow benefits both consumers and the grid by lowering energy costs and promoting sustainable energy practices.

Expansion Initiatives and Financial Outlook

Eaton’s global footprint expands through strategic acquisitions and joint ventures. Recent acquisitions have bolstered the company’s presence in both Electrical Americas and Electrical Global segments, propelling growth and diversification.

Buoyed by a strong performance and an array of new offerings, Eaton anticipates adjusted earnings per share (EPS) to surge to $10.65-$10.75 in 2024, reflecting a 17% increase from the previous year. The company has also revised its organic sales guidance upwards, indicating a positive trajectory for its financial performance.

Market Performance and Investor Insights

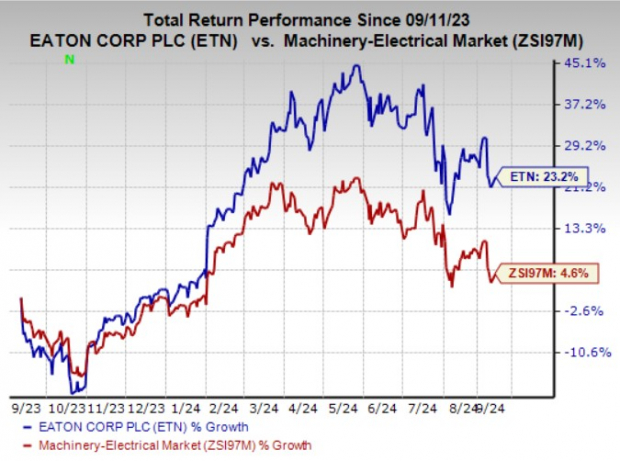

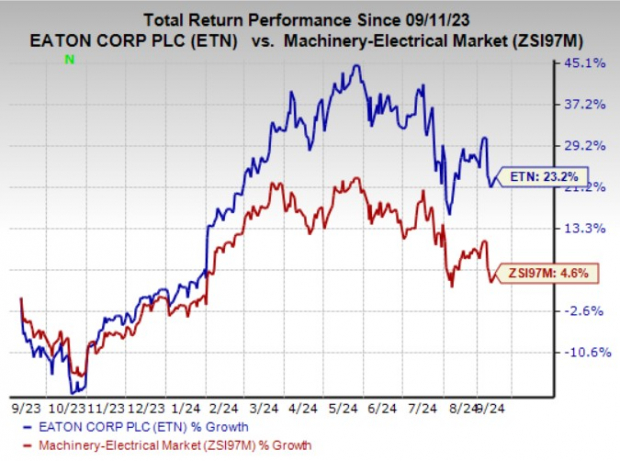

Eaton’s shares have outshined the industry, witnessing a remarkable 23.2% surge in the past year compared to the industry’s 4.6% growth. This stellar performance underscores investor confidence in Eaton’s strategic initiatives and market positioning.

Image Source: Zacks Investment Research

Zacks Ranking and Investment Opportunities

Presently holding a Zacks Rank #2 (Buy), Eaton exemplifies a robust investment option in the evolving energy landscape. Evidently, Eaton’s strategic approach and collaborations position it favorably for sustainable growth in the energy efficiency sector.

Discover Potential Investment Opportunities

Want to explore investment prospects in companies poised for significant growth? Zacks Investment Research offers insights into stocks set to soar, presenting investors with the opportunity to capitalize on emerging trends and untapped market potential.

Don’t miss out on these potential home runs! Explore top investment picks here.