The Public Offering

Edgewise Therapeutics EWTX is all in. The company just revealed plans for a secondary issue, releasing approximately 21.8 million shares of its common stock to the public at $11.00 per share, targeting a gross haul of about $240 million. This effort is bolstered by participation from venture capital and investment management entities such as RA Capital Management, TCGX, Venrock Healthcare Capital Partners, Cormorant Asset Management, and Frazier Life Sciences.

Investor Interest

The justified speculation didn’t go unnoticed. Share prices of EWTX surged by 34.6% on Jan 19. The move could be in response to the issuance at $11.00 per share, a premium of 13.5% compared to the share price as of Jan 18. The reassuring participation of existing investors is likely to relieve existing shareholder base dilution.

Financial Strides

The voluminous new issuance is expected to wrap by Jan 23, 2024. The motive behind this cash influx holds water. The company seeks to cultivate and refine EDG-5506, its leading pipeline candidate running through a variety of muscular dystrophy indications. These include studies for Becker muscular dystrophy (BMD), Duchenne muscular dystrophy (DMD), Limb-Girdle muscular dystrophy (LGMD), and McArdle Disease. The pipeline doesn’t end there; EWTX is also enlisting participants for early-stage investigation of EDG-7500 tailored for hypertrophic cardiomyopathy (HCM).

Impressive Vision

Edgewise, currently without a marketable product, is hanging its hopes entirely on the success of its pipeline candidates. The new stock offering will certainly help bolster the company’s financial standing. Announced earlier this month, the preliminary cash balance stood at $318.4 million as of December 2023.

Market Position and Future Prospects

With the increased cash influx, Edgewise can hasten its pipeline development, wrap-up the GRAND CANYON study, and proceed towards regulatory filing for EDG-5506 in BMD. The enlarged financial reservoir will also extend Edgewise’s existing cash runway, a major step in heightening its potential market impact. Such vigorous strides reflect the company’s unmistakable commitment. And with its pronounced reliance on the pipeline, one must reckon the importance of this milestone.

Market Overview and Promise

Edgewise’s stock has outperformed the industry’s fall by racking up a 23.1% rise year to date, a significantly notable feat. And we can’t discount the steady progress, which anchors the belief in the company’s upcoming horizons. Such a rally is proof of the stock’s buoyancy, fortifying a firm stance as EWTX continues to surge, riding the wave of investor appetites.

Evaluating the Potential

Despite these gains, Edgewise carries a Zacks Rank #3 (Hold) at present. A broader look at the healthcare sector props up alternative picks including CytomX Therapeutics CTMX, Novo Nordisk NVO, and Sarepta Therapeutics SRPT, each carrying their own prospects in the industry. These options are backed by their respective ranks. This is an opportunity for investors to take a keen-eyed approach, surveying the potential amidst a sea of evolving choices.

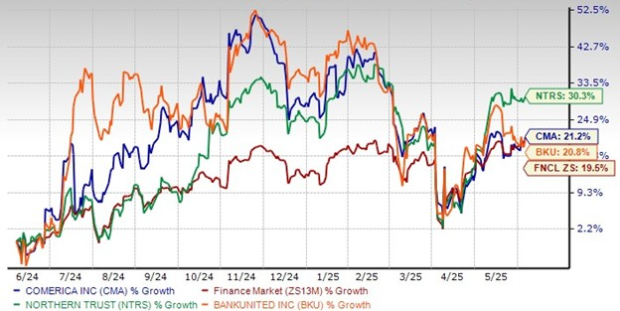

Market Competitors

Considering the fluctuating estimates and share movements in the past year, the market nevers fails to offer insight. Amidst the flux, there are boundless fluctuations, showcasing the intricate minting market seedbed. These insights shed light on the dynamism of the market and the constant push and pull in the medical sector, highlighting the potential pathways to profit and also underscoring the risk inherent in such ventures.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.