EF Hutton Launches Coverage of Invivyd: Promising Outlook Ahead

Analyst Prediction Indicates Potential 869.56% Growth

On October 30, 2024, EF Hutton began tracking Invivyd (NasdaqGM:IVVD) with a Buy rating. The firm’s analysis reveals an optimistic forecast for the company’s stock, projecting an average one-year price target of $8.82 per share. This forecast shows a remarkable increase of 869.56% compared to the recent closing price of $0.91 per share.

The price predictions from analysts vary significantly, ranging from a low of $1.11 to a high of $15.75. This variability reflects differing perspectives on Invivyd’s future performance.

Fund Sentiment Reveals Growing Interest

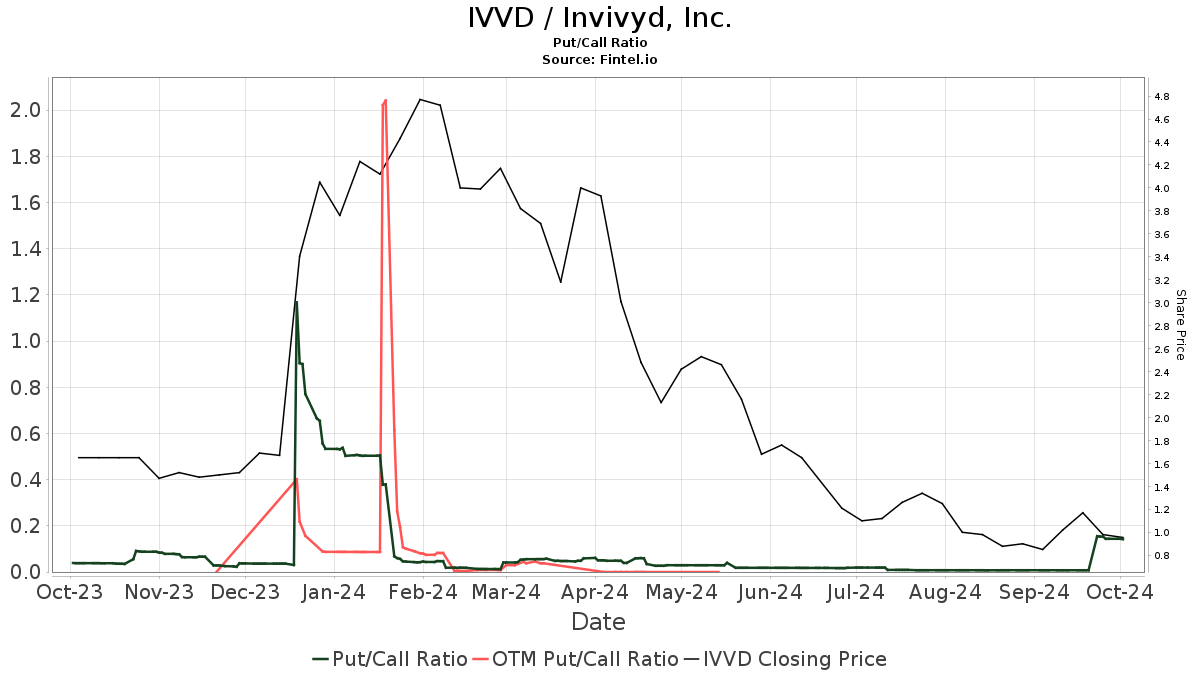

There are currently 142 funds or institutions invested in Invivyd, marking a 15.45% increase with 19 new owners added in the last quarter. The average portfolio allocation for these funds is now 0.11%, reflecting an increase of 65.16%. Institutional ownership rose by 4.76%, totaling 76,538K shares over the past three months. Notably, the put/call ratio for IVVD stands at 0.12, suggesting a generally bullish sentiment among investors.

Investment Holdings Overview

Maverick Capital remains a significant stakeholder, holding 11,766K shares, which accounts for 9.85% of the company, unchanged over the last quarter. Similarly, Deep Track Capital maintains its position with 10,954K shares, representing 9.17% ownership. M28 Capital Management also holds steady with 9,248K shares at 7.74%, as does Slate Path Capital with a 3.13% stake, or 3,735K shares.

683 Capital Management has updated its holdings, now owning 3,625K shares, which is a 4.14% increase from its last report of 3,475K shares. However, this firm decreased its portfolio allocation in Invivyd by 73.31% over the last quarter.

Company Insight

*(Provided by the company.)*

Invivyd is a clinical-stage biopharmaceutical company committed to developing antibody-based treatments for infectious diseases, particularly those with pandemic potential. Their antibodies are enhanced through advanced engineering techniques to ensure effectiveness, affordability, and manufacturability. Among their notable products is ADG20, a SARS-CoV-2 antibody designed for broad neutralization. The company has secured production capacity with third-party manufacturers to support clinical trials and future commercial efforts, pending regulatory approval.

Fintel offers some of the most complete investment research tools available for individual investors, traders, financial advisors, and small hedge funds. Their data encompasses a wide array of metrics, including fundamentals, analyst insights, ownership details, and more, supported by data-driven stock recommendations.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.