Eli Lilly’s Bold Moves: $15 Billion Share Buyback and Dividend Increase LLY has recently announced a significant $15 billion share buyback plan along with a 15% increase in its dividend, stirring interest among investors.

As the Indianapolis-based pharmaceutical company celebrates the success of its blockbuster drugs, Mounjaro and Zepbound, its stock trends are showing mixed signals in the market.

Stock Trends: The Battle Between Buyers and Sellers

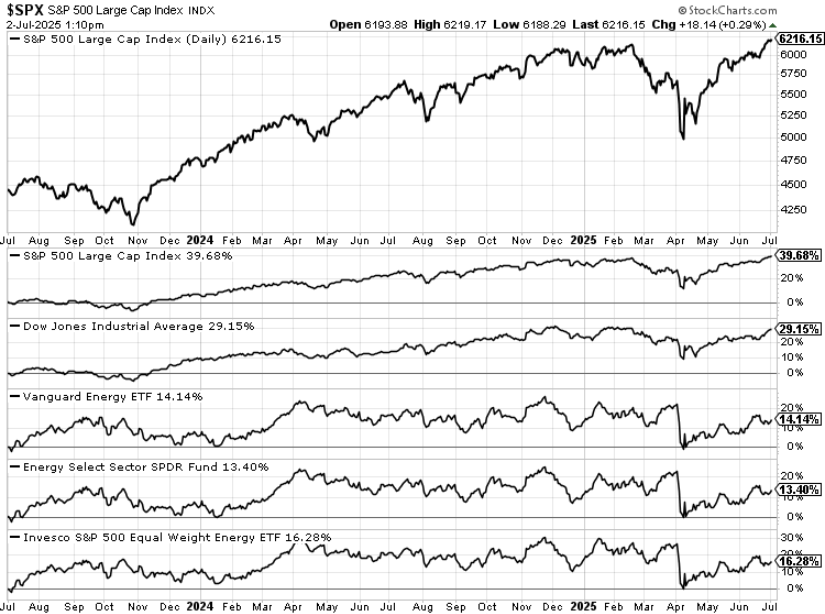

Chart created using Benzinga Pro

Context: Eli Lilly Shares Surge Over 35% This Year as the drugmaker announces its substantial buyback and dividend increase.

The stock currently stands at $800.13, reflecting a nuanced situation with its technical analysis:

- Bearish Indicators Predominate: The stock is trading below important moving averages: the eight-day SMA at $811.79, the 50-day SMA at $841.23, and the 200-day SMA at $838.29. These trends are raising concerns, especially with the 50-day and 200-day SMAs nearing a Death Cross. Additionally, a negative MACD reading of 5.12 suggests potential downside momentum.

- A Hint of Bullishness: The 20-day SMA at $784.85 does indicate some short-term bullishness, providing potential support for the stock in the near future.

- Momentum Indicators Raise Questions: With an RSI of 47.31, LLY stock is in neutral territory, indicating it could either decline further or rebound.

Strong Fundamentals Meet Market Doubts

Even with some cautious signals from the stock chart, Eli Lilly’s financial health remains robust. The company’s rapid growth is largely fueled by increasing demand for its diabetes and obesity treatments. CFO Lucas Montarce highlighted the firm’s focus on growth through new product launches, enhancing manufacturing capacity, and ongoing research and development efforts.

Investors reacted positively to the buyback and dividend announcements, leading to a rise in after-hours trading on Monday. However, the technical outlook suggests that maintaining this upward momentum could be a challenge in the short term.

As the market observes these developments, all eyes will be on whether Eli Lilly’s buyback initiative can give the stock the lift it needs.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs