Tesla Faces Challenges Amid Ambitious Profit Projections

Tesla (NASDAQ: TSLA) has been a standout performer over the past 15 years, boasting a remarkable 17,430% increase since its initial public offering. However, the stock has seen a significant decline, down 42% from its all-time highs at the end of 2024, marking one of the most considerable retracements in its history.

To address this downturn, CEO Elon Musk proposes a bold goal: a potential 1,000% increase in Tesla’s profits over the next five years. With such ambitious projections, the question arises: Is Tesla a buy-the-dip opportunity? Let’s explore the current landscape for this electric vehicle and technology leader.

Electric Vehicle Growth Slows

Once a trailblazer in the electric vehicle (EV) market, Tesla achieved multiple valuations of $1 trillion. The company evolved from an understated automotive player to a significant vendor, delivering over 1 million vehicles annually worldwide.

Nonetheless, recent numbers indicate a slowdown in growth. In 2024, Tesla delivered 1.79 million vehicles, a slight decrease from 1.81 million in 2023, marking the end of its impressive year-over-year growth streak. To manage excess inventory, management has begun cutting prices, leading to a decline in gross margins, which fell to 17.9%—the lowest level in five years.

Although some investors view this slowdown as insignificant, a closer analysis suggests otherwise. In the United States, EV sales increased by 15% year over year in the fourth quarter, yet Tesla’s market share continues to diminish.

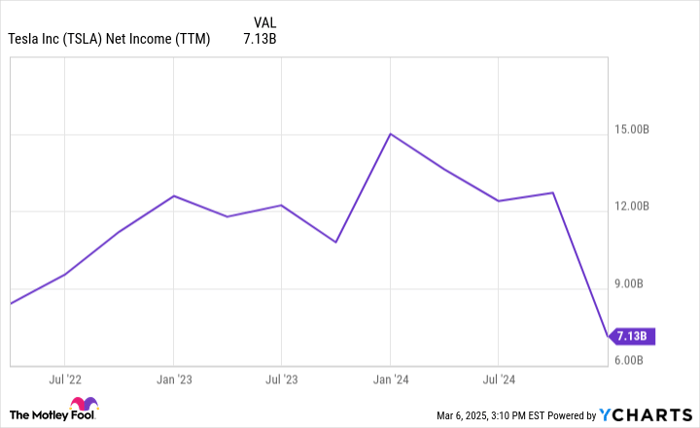

Globally, particularly in China, competition is intensifying. Rivals like BYD are capturing substantial market share from Tesla, delivering vehicles at lower price points. This competitive pressure contributes to Tesla’s stock decline, with net income decreasing from a peak of $15 billion to $7 billion in less than two years.

Exploring New Ventures: AI, Robotaxis, and Humanoid Robots

While Tesla faces challenges in the EV segment, Musk posits that future value may derive from emerging technologies like artificial intelligence (AI), humanoid robots, and robotaxis.

These innovations hold potential for opening new markets, although tangible progress has yet to materialize. The company’s promises regarding self-driving robotaxis have been recurrent, but management has yet to deliver a market-ready product.

The prototype humanoid robot, dubbed Optimus, demonstrated promise, but its performance at its 2024 debut was human-controlled. In the competitive AI landscape, Musk seems to invest considerable resources into the xAI Grok language tool rather than Tesla-specific projects.

Despite management’s forward-looking vision, skepticism remains. Numerous past promises have left little aside from minor EV updates. A compelling vision does not guarantee realization; business outcomes are inherently uncertain.

TSLA Net Income (TTM), data by YCharts; TTM = trailing 12 months.

Can Tesla Achieve a 10x Profit Increase in Five Years?

Musk’s ambitious projections suggest a potential 1,000% profit increase within five years. However, achieving this goal appears questionable given Tesla’s eroding market share in the EV sector and a lack of new product launches.

Even if Tesla manages to boost profits from $7 billion to $70 billion, the stock may not represent an attractive investment, particularly for those focused on fundamentals. At present, Tesla’s market cap stands at $875 billion. A scenario where net income reaches $70 billion would lead to a price-to-earnings (P/E) ratio of 12.5, notably higher than General Motors‘ P/E of 7.5. This suggests Tesla would maintain a premium valuation, diminishing its appeal for value-focused investors.

As such, despite Musk’s optimistic profit projections, the stock may not be a prudent choice at this time.

Considering Strategic Investment Options

Have you ever felt you missed out on investing in top-performing stocks? Consider this: Our analysts occasionally issue a “Double Down” Stock alert for companies poised for significant growth. If you’re concerned about missing opportunities again, now might be an ideal time to act.

- Nvidia: A $1,000 investment made when we doubled down in 2009 would now be worth $292,207!*

- Apple: A $1,000 investment from 2008 has grown to $45,326!*

- Netflix: A $1,000 investment from 2004 has surged to $480,568!*

Currently, we are offering “Double Down” alerts for three remarkable companies, and the window for investment may close swiftly.

Continue »

*Stock Advisor returns as of March 3, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends BYD Company and General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.