Hewlett Packard Enterprise Secures $1 Billion AI Server Deal with Elon Musk’s X

Overview of the Deal: Hewlett Packard Enterprise Co HPE has landed a significant contract worth over $1 billion to provide servers specifically designed for artificial intelligence to Elon Musk’s social media platform, X.

Details of the Agreement: Bloomberg News reported on Friday that the deal was finalized late last year, according to sources familiar with the arrangement. These servers cater to the rising demand for AI applications among enterprises. Notable competitors, including Dell Technologies Inc. DELL and Super Micro Computer Inc. SMCI, also competed for this contract.

The Growing AI Server Market: The demand for AI servers has seen rapid growth, with businesses increasingly in search of hardware that can support advanced artificial intelligence tasks. Companies associated with Musk, such as Tesla Inc. TSLA and xAI, are becoming key customers in this hardware market.

Musk’s Vision for AI: Elon Musk has been vocal about his views on AI. He has predicted that AI could reach human-level capabilities by 2029 and remarked, “I certainly feel comfortable saying that it’s getting 10 times better per year which is, let’s say, four years from now that would mean 10,000 times better.” His AI venture, xAI, is making progress as well, with plans to integrate its Grok chatbot into Tesla vehicles soon. During a live stream on X, Musk stated, “Grok in Teslas is coming soon. You will be able to talk to your Tesla and ask for anything.”

Competitive Landscape: X is also facing challenges in the social media arena, particularly from competitors like Bluesky, which is reportedly approaching a $700 million valuation.

Stock Performance: On Friday, HPE stock experienced a slight increase, rising by 0.23%, based on data from Benzinga Pro.

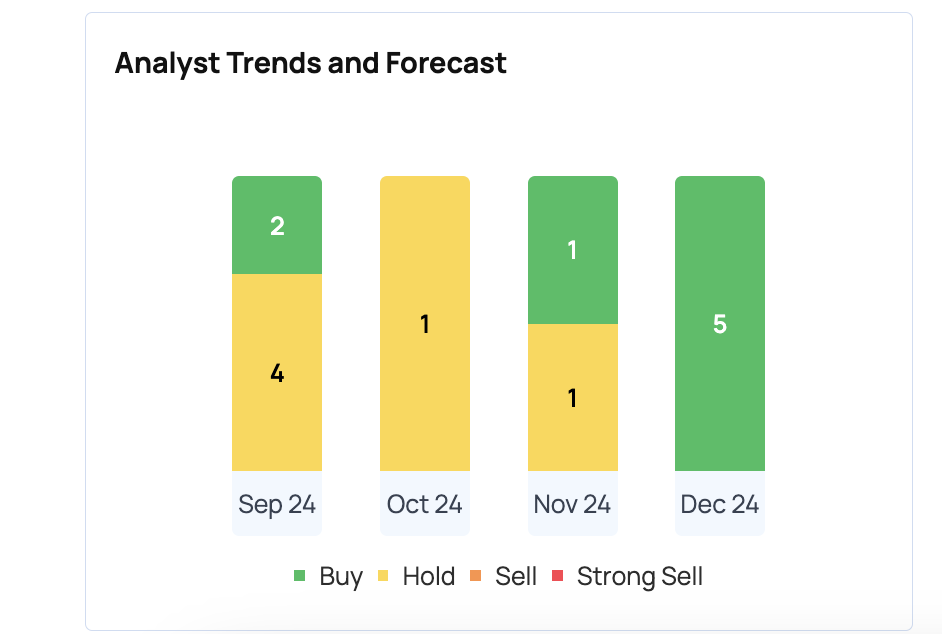

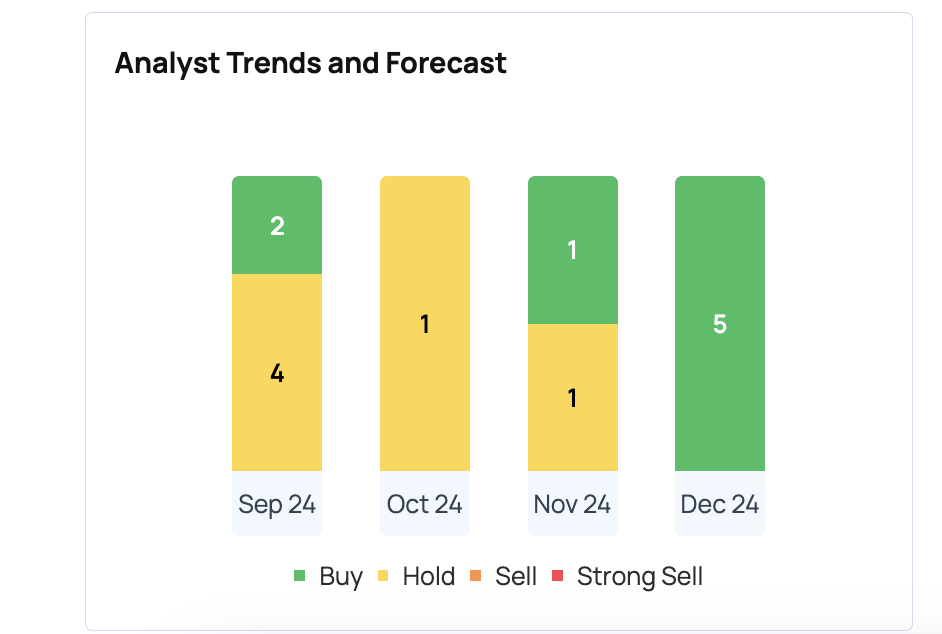

Recent analyst ratings from Deutsche Bank, Loop Capital, and Barclays were published on December 19, December 9, and December 6, respectively. With an average price target of $25.33 from these analysts, the ratings imply an upside potential of 14.01% for Hewlett Packard Enterprise Co.

For more updates, check out Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This article incorporates content produced with assistance from Benzinga Neuro and has been reviewed and published by Benzinga editors.

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs