Shaking up the investor landscape, the esteemed Eltek (NasdaqCM:ELTK) has seen its average one-year price target surge to an impressive 15.30 / share—an uplifting 15.38% uptick from the earlier estimate of 13.26 calculated on January 16, 2024.

Home to an array of analyst input, the range of price forecasts for the company spans from a modest 12.12 to a striking 18.90 / share. Impressively, this new average price target paints a delightful picture of growth, showcasing a 12.17% upsurge from the most recent closing price of 13.64 / share.

The Investor Sentiment Odyssey

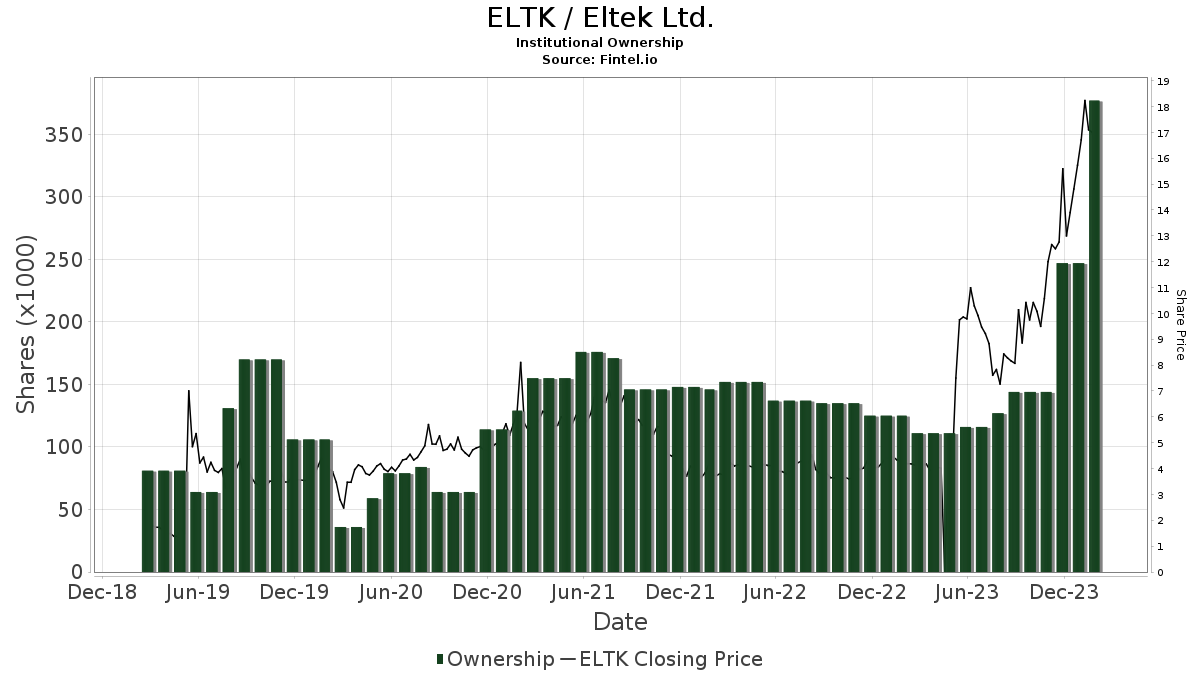

Intriguing movements in the investor universe reveal 15 funds or institutions currently holding positions in Eltek. This indicates a remarkable 50.00% surge in ownership compared to the previous quarter. The pooled weight of all funds backing ELTK sits at 0.02%, marking a robust 49.40% uptick. Notably, institutional stakes have seen a 62.81% surge in shareholdings over the past three months, totaling a substantial 402K shares.

Insider Insights into Shareholder Play

Delving into individual shareholder moves, Renaissance Technologies, holding 96K shares, exhibits 1.43% ownership of Eltek; a slight decline from the previous 108K shares, marking a decrease of 12.75%. Nonetheless, the firm has amped up its stake in ELTK by an impressive 18.64% over the quarter.

Further in the playing field, Navellier & Associates command 82K shares, illustrating 1.22% ownership of the company—an impressive 51.54% rise from the prior 40K shares they held. Their portfolio allocation has skyrocketed by a staggering 165.95% in the recent quarter.

GWM Advisors holding 46K shares, equivalent to a 0.69% stake, has witnessed a commendable upswing in their ownership—a hefty 43.87% increase from the previous 26K shares. Their portfolio allocation skyrocketed by an incredible 190.48% over the past quarter.

Marshall Wace, Llp adds to the shareholder mix with 40K shares, boasting a 0.60% stake in the company. Quadrature Capital, offering 27K shares, wraps up the lineup with a 0.40% ownership.

Peeking Behind the Eltek Curtain

Eltek, Israel’s premier manufacturer of printed circuit boards—the essential circuitry in most electronic devices—pioneers in the intricate high-end of PCB production, focusing on HDI, multilayered, and flex-rigid boards. Known for its cutting-edge circuitry solutions, Eltek caters to the tech-savvy demands of modern electronic applications, emphasizing sophistication and compactness in product design.

Ranging far and wide, Fintel emerges as a treasure trove of investment research accessible to individual investors, traders, financial advisors, and small hedge funds.

Encompassing global fundamentals, analyst insights, ownership particulars, fund sentiment, options trends, insider dealings, options flow, atypical options exchanges, and more, Fintel’s exclusive stock recommendations harness the power of advanced, validated quantitative models for bolstered returns.

Click here to delve deeper. As featured on Fintel.

Remember, the thoughts and opinions presented here reflect those of the author, not Nasdaq, Inc.