White House Easter Egg Roll Highlights Economic Realities for Investors

As investors, we must engage with economic and stock market conditions as they actually are…

Hello, Reader.

Today marked the White House’s annual Easter Egg Roll, the first of President Donald Trump’s second administration. Thousands gathered on the South Lawn for the event, but instead of traditional plastic eggs, around 30,000 real eggs were displayed, highlighting a curious choice given the rising costs of this food staple.

In March, the price of a dozen eggs soared to a record-high of $6.23. The latest Consumer Price Index (CPI) data, released on April 10, shows that egg prices surged 5.9% since last month and a staggering 60.4% compared to the same time last year.

Despite these figures, Trump commented on social media this morning that food costs—including eggs—are “trending so nicely downward,” echoing similar sentiments he shared last week about “groceries (even eggs!) being down.”

However, grocery prices have consistently increased during Trump’s presidency, a trend likely to continue due to his administration’s extensive tariffs.

This scenario is reminiscent of former Defense Secretary Donald Rumsfeld’s statement during the Iraq War in 2004: “You go to war with the army you have, not the army you might want or wish to have at a later time.”

In the same vein, investors must navigate the realities of economic and stock market conditions as they truly are, rather than how we, or Trump, might wish them to be—eggs included.

For instance, we may hope that the three major U.S. stock market indexes didn’t open in the red today. However, that’s not the current situation.

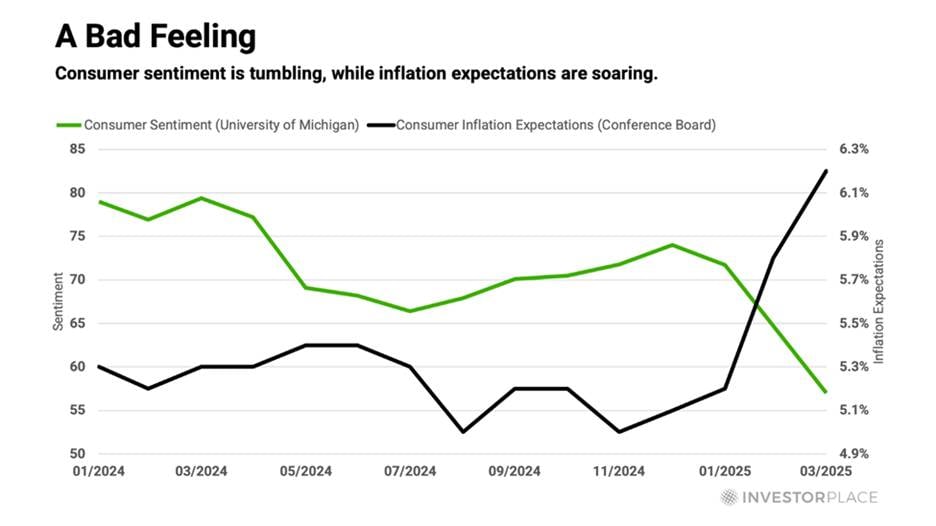

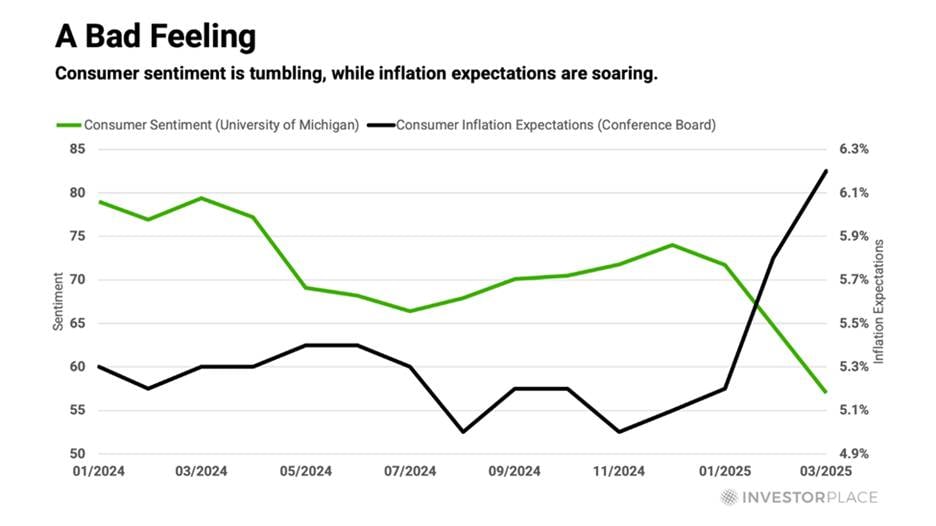

On the economic front, we may wish that tariffs had never been enforced or that the ongoing trade war was a thing of the past. Similarly, we might hope for a decline in inflation expectations and a more positive consumer sentiment than we currently have.

But that’s not the economy we have.

Consequently, investors must accept both the good and the bad, while seeking to identify stocks that represent the best risk-reward potential.

Such promising stocks often reside in the stock market’s shadows, where they receive minimal attention. While you won’t find a high-flyer or market “darling” in these areas, you might discover the next high-flyer just waiting to be unearthed.

Companies in these less visible sectors tend to have below-average valuations, even as they exhibit above-average growth prospects. Such discounted pricing creates prime entry points when market conditions are favorable, and lower valuations can offer some safeguard against recent market turmoil.

Last week, I shared a low-valued, “unpopular” tech stock here—a recommendation from my Fry’s Investment report service, and it’s one I still consider worthy of attention.

If you missed that analysis, take a look at the Smart Money roundup below, and see what else we examined here this past week…

Smart Money Roundup

Nvidia Moves to Manufacture in the U.S.—This Overlooked Company Is Already Doing It

Despite Nvidia Corp.’s (NVDA) dominant position in the AI market, its high valuation warrants caution. While investors may be intrigued by the company’s $500 billion U.S. manufacturing announcement, in Wednesday’s report, I clarify how its “American-made” plans may not be as promising as they appear. Read on to uncover a U.S. tech company that deserves your focus instead.

What Kind of Easter Egg Hunt Are You In?

The Journey of Netflix: From Rejection to Streaming Dominance

In Part 1 of Senior Market Analyst Brian Hunt’s analysis, he outlines how Netflix Inc.’s (NFLX) rejection by Blockbuster for a $50 million deal paved the way for its evolution into a $129 billion streaming giant. Hunt utilizes an Easter egg hunt metaphor to explain stock picking, noting that a $5,000 investment in Netflix back in 2002 could have grown to $2.87 million by selecting the right opportunities.

Finding Opportunity in a Crowded Market

In Part 2 of the series, Hunt prompts readers to think about the conditions for Easter egg hunts. Would you prefer searching in a park filled with 1,000 people or a more exclusive area with just 10 others? This analogy extends to investing, with Hunt encouraging investors to seek out less crowded and often overlooked sectors in the market for better outcomes.

Looking Forward: Trends Shaping the Market

In the coming week, I’ll delve into broader market trends that are influencing my investment strategies, especially given the current volatility. Key megatrends, such as artificial intelligence (AI), remain critical points of interest.

AI stands as one of the significant investment narratives of this era, possibly of our lifetimes. I found it fascinating that our partners at TradeSmith have developed an AI algorithm capable of forecasting prices one month ahead.

Access to such AI-driven predictive insights, once a privilege reserved for top Wall Street firms, now offers regular investors a powerful tool, especially during turbulent market conditions.

To further this knowledge, TradeSmith CEO Keith Kaplan hosted The AI Predictive Power Event last week. This initiative aims to equip everyday investors with tools to thrive amid market chaos.

Click here to watch the replay now.

Best regards,

Eric Fry